What About Mutual Funds at Primerica

Post on: 29 Май, 2015 No Comment

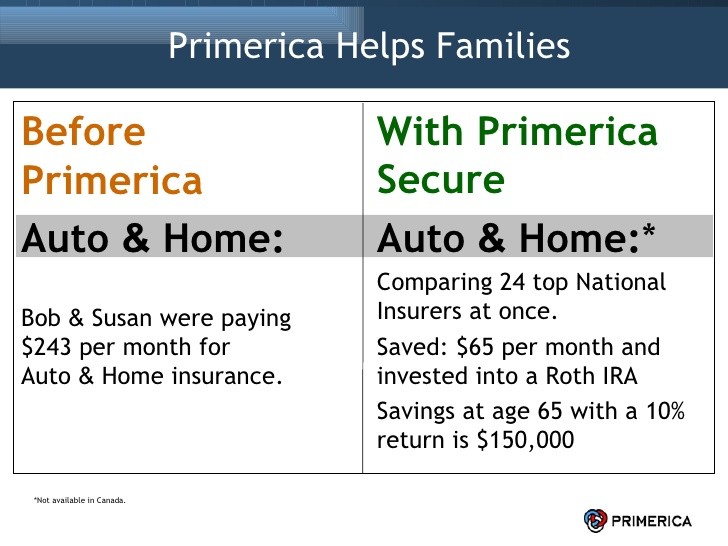

To be honest, I am not really interested in their term life insurance product as they are similar to any other insurance company. They might have been one of the very first companies to sell term insurance back in the day but these days are over. Every insurance agent I have met in my life (working for several different companies) told me the same thing: we are there for our client and we will offer them the insurance product to cover their needs. So, guided with the light of one of the numerous commentators on my Primerica analysis . I decided to look into their mutual funds.

Therefore, my post is more focused on the Primerica Concert series offering diversified portfolios according to your investment profile .

According to Morning Star, they rate the aggressive growth . the growth and the moderate growth with a 5 stars score. The three of them offer double digit returns over 5 years (and over 3 years for the aggressive and growth portfolio). However, those funds are not for soft hearted as they all show negative double digit returns at one point in time as well. So if you like trashing with your investment as you were at a Marilyn Manson concert, you might enjoy the ride J Nonetheless, they are qualified in the 1 st quartile most of the time and their Morning Star rate is quite good.

The Primerica Concert series seems to be an all-inclusive option for investors. These portfolios offer a great asset allocation between fixed income, cash, Canadian equities, American equities and International equities. On the other side, they are a bit too much concentrated in Canadian stocks to be considered a fully diversified fund. For example, the aggressive portfolio has a concentration of 46% in the Canadian market. So this diversification will help smoother the volatility but is not optimal.

Another thing caught my attention when I was digging further; the performance over 10 years. When I attempted to a Primerica meeting. they were mentioning double digit returns to make the financial projection. I guess they were referring to their Concert series. However, their 10 years performances are showing returns of 6% for the three categories of funds. So would you really like ending some years at -20% knowing that you will end-up with a small 6% overall returns? I have to mention that their MER’s of 2.5% are pretty high and certainly don’t help to show some good long term results!

In the end, I think that the Concert Series are still good mutual fund. They obviously outperform their category with a high percentage in Canadian equity. On the other side, their long term stats and MER’s don’t make me a huge fan of them either.

If you liked this article, you might want to sign up for my FULL RSS FEED . Then, you would get my daily post in your email and can read it at any time. To subscribe, please click HERE .