What A Stronger Dollar Means For Stocks

Post on: 15 Октябрь, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

(Bloomberg/Bloomberg via Getty Images)

The U.S. dollar has been on the up and up, climbing to four-year highs and gaining traction against the euro, pound and yen. Great news, right? Well, it does mean cheaper overseas vacations but for the stock market, it’s more of a mixed bag.

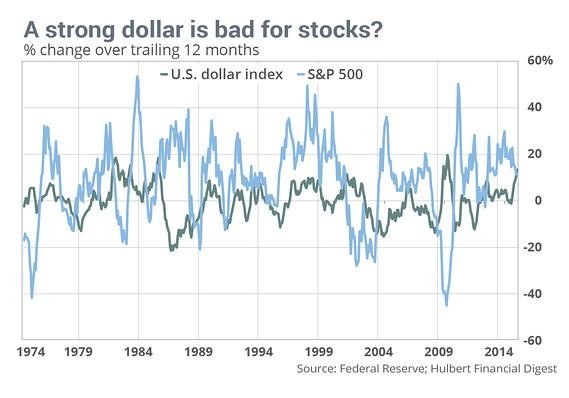

At large, it doesn’t mean all that much. A recent report from Barclays Barclays finds that S&P 500 returns are virtually unaffected by what the dollar does. Historically, stocks haven’t sunk on a weak dollar or soared on a strong one. So index investors on the buy-and-hold track have nothing to be particularly excited or fearful about.

There are certain industries and companies that could suffer as the buck gains momentum though.

For instance, take energy and materials companies, like gas behemoth Chevron Chevron or consumer packager Sonoco. Their cost of doing business is heavily reliant on the price of commodities. But a strong dollar is bad for commodities – it makes them more expensive. For this reason, energy and materials companies traditionally underperform in times of a strong dollar, notes Barclays, as increasingly expensive commodities cut into profits.

Analysts at Mizuho Securities offered a similar view in a note Tuesday, recommending an underweight position in energy stocks via the Energy Sector SPDR exchange-traded fund.

Big, multinational companies like Coca-Cola Coca-Cola and Philip Morris could also suffer from missed earnings estimates going into the third quarter. Why? They have to translate their heap of foreign earnings into stronger dollars. This unfavorable currency conversion can be the difference between a good earnings report or a disappointing one.

According to Mizuho, analysts have actually been “fairly aggressive” about lowering expectations. Just since the end of July, analysts have lowered third quarter forecasts for international companies by 1.5 percentage points. The sharpest cuts have been for energy, consumer staple and technology stocks, which tend to have particularly high international exposure.

Healthcare and utility companies, on the other hand, have outperformed in times of a strong dollar. Accordingly, analysts have raised earnings expectations for them going into the third quarter.

While adjusted expectations could mute an immediate negative impact on stocks, notes Mizuho, there’s concern that earnings guidance for future quarters and the full year will be lowered too, in anticipation of the continued strength of the dollar. A decline in earnings would be a contrast to the strong performance streak that corporate America has enjoyed as of late, and which has helped support an aging bull market.

Companies also have to worry about the strength of their sales abroad. For one, a stronger dollar means American exports look more expensive and consumers may flock to foreign companies offering lower-priced goods, dampening sales for US-based companies. Secondly, a stronger dollar is partly due to sluggishness abroad. Europe, for instance, is battling deflation and will soon make a foray into quantitative easing. Japan is struggling too, with a growth rate under 1% and the biggest debt burden in the world. This type of economic climate threatens to erode sales revenue abroad as consumers spend less.

The dollar, already up 8% against other major currencies in the last three months, could continue its ascent. “U.S. dollar index bull markets tend to be prolonged affairs lasting for years with an average gain of 30%,” notes Mizuho. Barclay’s predicts that over the next year, the value of one euro will fall to $1.10, compared to $1.27 currently and $1.35 as of July.