Weiss Ratings

Post on: 9 Июль, 2015 No Comment

Undervalued Global Bank Stocks

by Gene Kirsch, Senior Banking Analyst | May 22, 2012

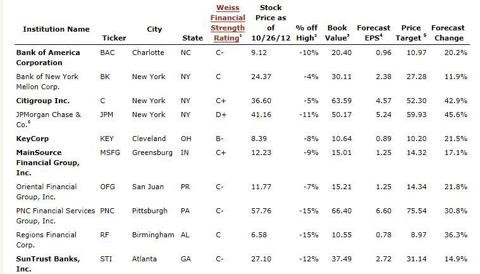

While the last Weiss Ratings undervalued portfolio focused on domestic banks, this portfolio will focus on global banks including those in the U.S. that meet the undervalued criteria we established. As of April, the domestic portfolio was up over 17%. We’re going to try to beat those returns by including both international and domestic banks that do business globally in our undervalued bank stock portfolio.

The basis of this analysis of global banks will be Weiss’ new global bank ratings (GBR) set to be released in early June. These include ratings for the largest 200 publicly traded banks worldwide.

As you’ll undoubtedly remember, domestic bank stocks were annihilated in 2011, especially the large money-center banks like Bank of America (BAC) (down 58%), Citigroup (C) (down 44%) and Wells Fargo (WFC) (down 41%). Global bank stocks have not fared much better with some of the largest banks in the world suffering losses—Deutsche Bank (DBK.DE) based in Germany (down 24%, Euros); Mitsubishi UFJ Financial Group (8306.JP) based in Japan (down 23%, Yen); HSBC Holdings, PLC (HSBA) based in the United Kingdom (down 19%, British Pounds) and BNP Paribas SA (BNP.PA) (down 34%, Euros). So, if you’re looking for good investment deals in the global bank sector, this might be the time.

For reference, we’ll look at one of the most useful European financial indexes, iShares MSCI Europe Financials Index (EUFN), a weighted exchange-traded fund (ETF) designed to measure the combined equity market performance of the developed countries of Europe. It also mirrors the performance of the MSCI Europe Financial Index. The EUFN lost almost 27% of its value in 2011, although year to date it is up 9.2%. Some of its largest holdings include the above-mentioned global banks, HSBC Holdings PLC, Deutsche Bank and BNP Paribas SA. Also included were Barclays PLC (BARC) based in the United Kingdom (down 33%, British Pounds) and Banco Santander SA (SAN.MC, Euros) based in Spain (down 20%).

Other useful global bank indexes for comparison include the Bloomberg World Bank Index (BWBANK), a much broader banking capitalization-weighted index of the leading bank stocks in the world. The BWBANK Index lost 13% of its value in 2011. And the MSCI World Bank Index (MXWO0BK), a free-float weighted equity index that was developed with a base value of 100 as of December 31, 1998 (includes developed markets only), lost 14% if its value in 2011.

After the carnage, there were good values to be found domestically and there are some to be found globally as well. First, let’s consider the macroeconomic climate. On a global basis, there are several diverging economies based on key metrics of Gross Domestic Product (GDP), unemployment, inflation and interest rates. The table below shows these metrics sorted by the top 10 largest economies in the world 1.