Weekly Options Iron Condor

Post on: 8 Июль, 2015 No Comment

Weekly options iron condor trade is a type of options trade strategy that combines a put credit spread with a call credit spread. This is a popular strategy for monthly index options or with non-trending stock as you dont want to enter iron condors on volatile stocks.

Weekly options credit spread trade is the most common 2-legged option trade strategy and usually is made as a bet on a specific direction of the stock. With a iron condor youre goal is for the stock or index to stay in a range so that you can collect to premiums from the 2 credits.

For example, if XYZ stock has been bouncing around in a range then you could sell at bear call credit spread near resistance of the range and sell a bull put credit spread near support of the range. The combination of the two credit spreads creates an Iron Condor trade.

The benefit of using weekly options with Iron Condor strategy is the fast time decay of weekly options.

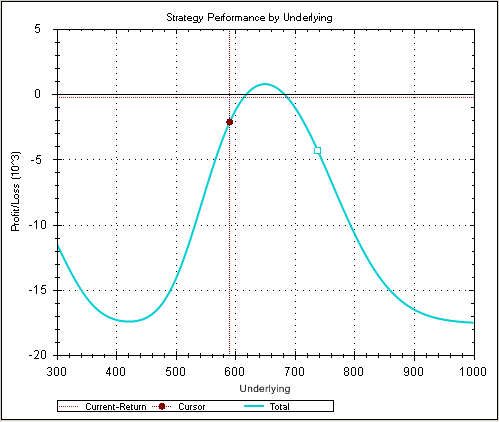

From the chart below you can see chart a typical Iron Condor chart. The red line is representative of max profit at expiration. The curved white line represents the current profit/loss relative to the white horizontal zero line. The curved white line moves up each day as the out of the money sold options decay in price each day.

The profit tent is the range between the two red corners in the chart so if the stock can stay within that range then the trade will turn out profitable.

The two price points where the red lines cross the horizontal white line are the breakeven points that if the stock moves beyond those two points will start becoming unprofitable.

Weekly Options Iron Condor Chart

You can see why you wouldnt want to enter a volatile stock with a weekly options iron condor because the stock can quickly move out of the profitable range and with the short time to expiration that weeklys have you dont have the ability to adjust the trade.

Weekly Options Iron Condor Risks

The risks with an iron condor strategy is that the stock can move out of the desired range and cause a need to adjust the trade with the hope that the stock will move back into the profit range.

The risk with weekly options is that since they have a short time to expiration which makes it hard to find strike prices much beyond the current market price that have decent time value priced in. This therefore causes you to have use a narrow range for weekly options iron condor.