Weekly Mortgage Rates Rise Most in 38 Years (BBT)

Post on: 3 Июль, 2015 No Comment

If you’re reading this, then you’re likely not surprised by the fact that mortgage rates rose this week. But what is surprising is just how much they shot up.

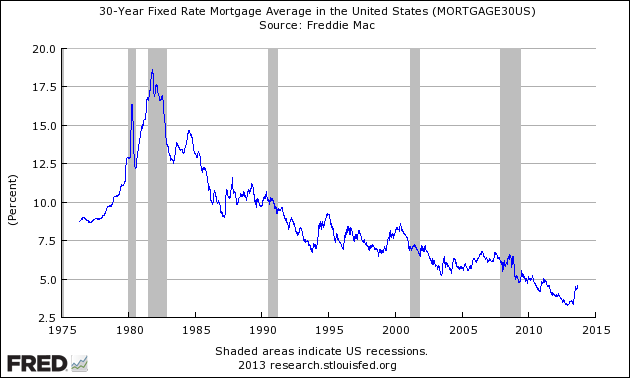

Take a look at the following chart. As you can see, the average rate on a 30-year fixed-rate mortgage increased this week to 4.46%. Is that a big jump? Sure. But it’s important to keep in context. The corresponding average rate since 1976 is 8.65%, or nearly double today’s figure. In other words, this week’s rate in and of itself is, historically speaking, really nothing to write home about.

But what is worthy of writing home about is the sheer magnitude of the one-week increase. You can see this in the chart below, which illustrates the weekly rises and falls in mortgage rates since the beginning of 2013. Over the past seven days, the average cost of a home loan has skyrocketed by 13.5%. And even this comparison does it no justice. It just so turns out, in fact, that this jump was the largest such weekly leap in the past 38 years — and perhaps even more, but that’s where Freddie Mac’s data begins.

We all know the explanation for the move: Investors are freaking out that the Federal Reserve will soon begin to reduce its easy-money policy known as QE3. This would decrease the amount of liquidity being injected into the bond market each month, which would drive down the cost of the underlying securities, and thereby push interest rates higher.

For banks like Wells Fargo ( NYSE: WFC ). BB&T ( NYSE: BBT ). and U.S. Bancorp ( NYSE: USB ). all of which look to the mortgage market for a significant chunk of non-interest revenue, this could mean a number of different things. On the positive side, it’ll incentivize them to underwrite more purchase-money mortgages, which would help to sustain the housing recovery. It’ll also push up net interest margins as well as the value of their mortgage servicing rights — assuming they’re hedged accordingly.

But on the negative side, this dramatic increase in rates will bring refinancing activity to a screeching halt. And, as I’ve discussed on numerous occasions, this will reduce the juicy profits that these lenders have been recording related to both refinancing applications and on the sales of the mortgages themselves to Fannie Mae and Freddie Mac.

At the end of the day, how will these all balance out? That remains to be seen and is highly institution-specific. But at the very least, jumps like these are likely to fuel volatility in bank stocks over the foreseeable future.

Many investors are terrified about investing in big banking stocks after the crash, but the sector has one notable stand-out. In a sea of mismanaged and dangerous peers, it rises above as The Only Big Bank Built to Last . You can uncover the top pick that Warren Buffett loves in The Motley Fool’s new report. It’s free, so click here to access it now .

John Maxfield has no position in any stocks mentioned. The Motley Fool recommends Wells Fargo. The Motley Fool owns shares of Wells Fargo. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .