Week Ahead Has Bubble Burst For Momentum Stocks

Post on: 20 Апрель, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

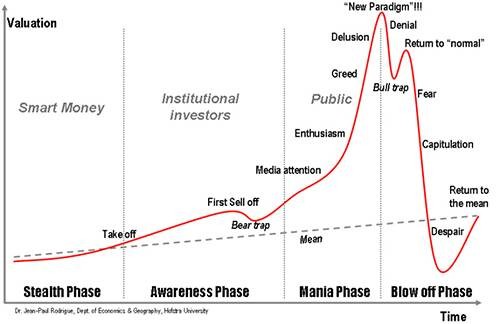

As many overvalued technology, internet and biotech shares continue to fall, investors head into a week heavy with potentially market-moving news from global policy makers, economic indicators and companies.

Despite falling last Friday, the S&P 500 and Dow Jones 30 indexes remain near record highs. However, the technology-heavy Nasdaq is now down about 5 percent from its year high set early in March as many stocks including Facebook. Netflix Netflix and TripAdvisor suffer substantial falls.

This coming week, traders and investors must navigate a busy flow of market news. So far, the damage has been limited mainly among so-called “momentum” stocks, but the wrong word or nuance from a policy maker or CEO could trigger a wider sell off.

The International Monetary Fund and World Bank start their Spring meetings on Friday in Washington and the G-20 finance ministers and central bankers also meeting to discuss the world economy.

Indeed, leading figures from the IMF IMF will make big announcements throughout the week.

For example, on Tuesday, the IMF will release its World Economic Outlook report in advance of the Friday meetings, and on Wednesday the IMF will make public its Global Financial Stability Report.

Also on Tuesday, the earnings season “unofficially” gets under way when aluminum giant Alcoa reveals its numbers, to be followed by Bed, Bath & Beyond on Wednesday, Family Dollar Stores on Thursday, and banks JPMorgan Chase and Wells Fargo on Friday.

First-quarter earnings from S&P 500 companies are expected to have increased about only 1.2 percent from a year ago, Thomson Reuters data showed — that is down drastically from earlier estimates of a 6.5 percent increase. They key as always for investors will be guidance from companies on their future prospects.

“The market is trying to find a base and get more of a fix on what the stocks are worth,” Pioneer Investment Management fund manager John Carey told Bloomberg. “There may be some nervousness going into first-quarter earnings and whether that will justify these prices we’re seeing.”

Tuesday is also the day when hotel chain La Quinta brings its initial public offering (IPO) of stock to market, to be followed by the IPO of auto lender Ally Bank expected on Wednesday.

Also on Wednesday, the U.S. Federal Reserve is due to release the minutes of its March 18-19 meeting at which the Federal Open Market Committee (FOMC) officially ended the link between benchmark interest rates and unemployment levels, saying it would in future look at a wide range of information.

These minutes are often the most sensitive market news of any week. Investors examine the language of Fed policy makers for any hint or nuance about the direction of future interest rates — and react accordingly.

Thursday brings news on China’s exports, a press briefing by IMF managing director Christine Lagarde, a monthly U.S. budget statement and U.S. weekly initial jobless claims.

Friday will bring a preliminary read on the influential University of Michigan U.S. Consumer Confidence report, and updates on U.S. producer prices.

This week’s other economic news will include updates on U.S. consumer credit on Monday, U.S. job openings and labor turnover on Tuesday and U.S. wholesale inventories on Wednesday.

All in all, the week ahead is the type where anything could happen — and quite often does.