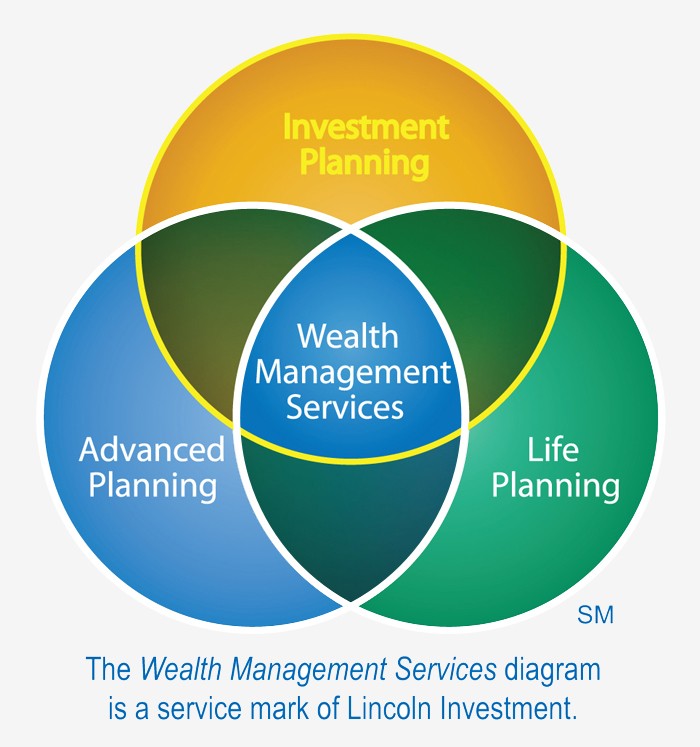

Wealth Management Services Financial Planning

Post on: 22 Июль, 2015 No Comment

We offer complete wealth management services in Atlanta to all of our clients. These services include everything from monitoring investments and creating performance reports, to protecting and preserving your wealth. It is our belief that you come to us for complete financial services, so we strive to meet that objective.

Annuities

Restricted and Controlled Stock

Hedging Strategies

Retirement Planning

Atlanta Financial Advisors offer a complete line of retirement planning tools and services. We offer everything from traditional Individual Retirement Accounts (IRA’s) to roll over accounts. Each retirement goal is different, and we can accommodate and meet any need.

Our financial consultants, along with your personal legal counsel, can help you establish a personal trust with your wealth. Trusts protect your wealth in a way that ensures you remain in control of your money, while it still has the ability to grow in a protected account.

Investment Consulting Services

Our investment consulting services include:

-Portfolio assessment and investment policy statement

-Asset allocation review and policy statement

-Asset allocation with manager recommendations

-Ongoing monitoring and performance reporting

Separately Managed Accounts

Using due diligence, we review your asset allocations, recommend and help you choose investment managers that will meet your needs. We also will use our “Separately Managed Accounts” method to independently review the actions of your investment manager to ensure that they are performing in a manner for which they were hired.

Alternative Investments

Our Alternative Investments Division provides clients with non-traditional investment opportunities. These opportunities are used to enhance or compliment their standard investment portfolio. Use of these investments will strictly be based on preference of the client, and the amount of risk they wish to undertake with any portion of their portfolio.

We strive to provide unbiased advice to our clients on traditional and non-traditional investment methods. This unbiased information allows our clients to reach their financial goals. We offer several types of investment opportunities including, but not limited to:

Equity and Fixed Income Securities .

These securities will help the client create a well-balanced portfolio. These securities are chosen based on risk and preference of the client. Our professional team strives to provide the clients with up-to-date and relevant information about this type of investment so that the right choices can be made for the portfolio.

For the more seasoned investor, options often provide a portfolio a way to earn money, while staying very flexible. If you are interested, your financial adviser can recommend different option platforms that are available.

Exchange Traded Fund (ETF’s) .

ETF’s were created to provide the investor with significant exposure to a specific area of the market. Discuss with your adviser what, if any ETF’s would be right for your portfolio.

The Atlanta Financial Advisors team has access to many different mutual funds. Through careful consideration and use of objectivity, the financial adviser will recommend which mutual funds would be best to fit your needs.

We work in conjunction with many different insurance companies so that we may provide a broad range of insurance products to our clients. Any insurance product that are recommended will only be based on meeting your financial objectives.

An annuity can be a great alternative investment tool. These products serve different purposes and your financial adviser will make individual recommendations.

Restricted and Controlled Stock .

Our advisers are prepared to help you meet all the legal requirements of purchasing and selling restricted and controlled stocks.

When a majority of your wealth is concentrated on employer stock and stock options, our financial services can help you diversify your portfolio in a manner that will not conflict with black-outs and at a cost and pace that is consistent with the client’s preferences.

When a client has a large portion of their portfolio invested into a single stock, selling that stock may not be possible or practical. Our financial advisers can help you steadily diversify your portfolio without interfering with this stock.