We Are Moving Into A Time Of Extreme Danger For The Global Economy Investing Video Audio Jay

Post on: 17 Июнь, 2015 No Comment

If you do not believe that we are heading directly toward another major financial crisis, you need to read this article. So many of the exact same patterns that preceded the great financial collapse of 2008 are happening again right before our very eyes. History literally appears to be repeating, but most Americans seem absolutely oblivious to what is going on. The mainstream media and our politicians are promising them that everything is going to be okay somehow, and that seems to be good enough for most people. But the signs that another massive financial crisis is on the horizon are everywhere. All you have to do is open up your eyes and look at them.

Bill Gross, considered by many to be the number one authority on government bonds on the entire planet, made headlines all over the world on Tuesday when he released his January Investment Outlook . I don’t know if we have ever seen Gross be more negative about a new year than he is about 2015. For example, just consider this statement …

“When the year is done, there will be minus signs in front of returns for many asset classes. The good times are over.”

And so that is why – at some future date – at some future Ides of March or May or November 2015, asset returns in many categories may turn negative. What to consider in such a strange new world? High-quality assets with stable cash flows. Those would include Treasury and high-quality corporate bonds, as well as equities of lightly levered corporations with attractive dividends and diversified revenues both operationally and geographically. With moments of liquidity having already been experienced in recent months, 2015 may see a continuing round of musical chairs as riskier asset categories become less and less desirable.

Debt supercycles in the process of reversal are not favorable events for future investment returns. Father Time in 2015 is not the babe with a top hat in our opening cartoon. He is the grumpy old codger looking forward to his almost inevitable “Ides” sometime during the next 12 months. Be cautious and content with low positive returns in 2015. The time for risk taking has passed.

So why are Gross and so many other financial experts being so “negative” right now?

It is because they can see what is happening.

They can see the same patterns that we saw in early 2008 unfolding again right in front of us. I wanted to put these patterns in a single article so that they will be easy to share with people. The following are 10 key events that preceded the last financial crisis that are happening again right now…

#1 A really bad start to the year for the stock market . During the first three trading days of 2015, the S&P 500 was down a total of 2.73 percent . There are only two times in history when it has declined by more than three percent during the first three trading days of a year. Those years were 2000 and 2008. and in both years we witnessed enormous stock market declines.

#2 Very choppy financial market behavior . This is something that I discussed yesterday . In general, calm markets tend to go up. When markets get choppy, they tend to go down. For example, the chart that I have posted below shows how the Dow Jones Industrial Average behaved from the beginning of 2006 to the end of 2008. As you can see, the Dow was very calm as it rose throughout 2006 and most of 2007, but it got very choppy as 2008 played out…

As I also mentioned yesterday. it is important not to get fooled if stocks soar on a particular day. The three largest single day stock market gains in history were right in the middle of the financial crisis of 2008 . When you start to see big ups and big downs in the market, that is a sign of big trouble ahead. That is why it is so alarming that global financial markets have begun to become quite choppy in recent weeks.

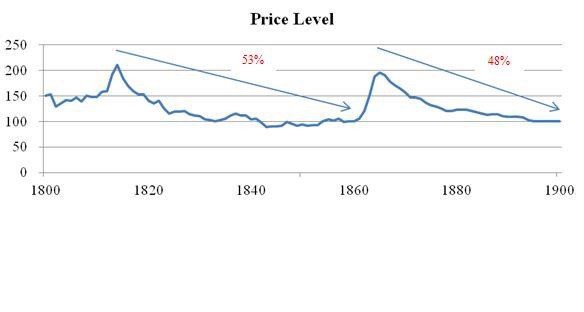

#3 A substantial decline for 10 year bond yields . When investors get scared, there tends to be a “flight to safety” as investors move their money to safer investments. We saw this happen in 2008, and that is happening again right now.