Warren Buffett Still Buying Stocks Sees Good Value

Post on: 20 Апрель, 2015 No Comment

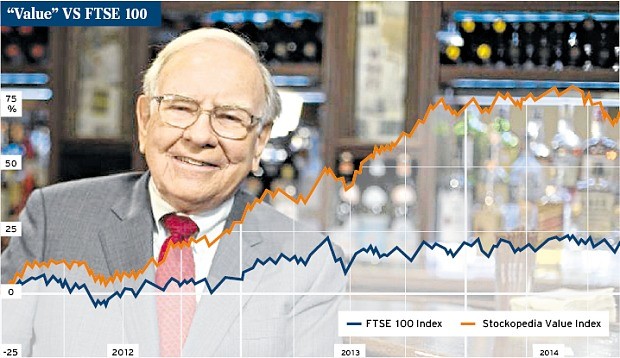

Warren Buffett still sees good value in stocks, even as the Dow Jones Industrial Average approaches an all-time high.

On CNBC’s Squawk Box. Buffett said Berkshire Hathaway is still buying stocks, even though prices have increased.

Anything I bought at $80 I don’t like as well at $100. But if you’re asking me if stocks are cheaper than other forms of investment, in my view the answer is yes. We’re buying stocks now. But not because we expect them to go up. We’re buying them because we think we’re getting good value for them.

He said stocks are not as cheap as they were four years ago but you get more for your money compared to other investments. He added, The dumbest investment, in my view, is a long-term government bond.

Buffett revealed that a potential acquisition had been mentioned to him and he will be exploring the idea, no deal is imminent. That’s always a low probability. Whether it’s a five percent or ten percent, who knows? But I get excited when I hear about possibilities. Asked what sector the company is in, he replied with a laugh that it is in business.

Buffett praised Berkshire’s new portfolio managers, Todd Combs and Ted Weschler, and announced publicly for the first time that they’ll soon be getting an additional $1 billion to work with. He joked they are making his decisions look bad by comparison. The new money will increase the size of their portfolios to $6 billion from $5 billion.

Lacy O'Toole | CNBC

Warren Buffett speaks to Becky Quick on CNBC's Squawk Box on Mar. 4, 2013.

Buffett said it’s quite unlikely he’ll hire another portfolio manager, in part because he’s so happy with Combs and Weschler. We hit the jackpot with these two.

Buffett isn’t too worried that the automatic government spending cuts known as the sequester will slow down the U.S. economy too much.

We’re continuing to see a slow recovery, he said. It hasn’t taken off, but it hasn’t stopped either.

Buffett said that while the sequester will reduce the government’s stimulus of the economy by cutting back on the deficit the remaining spending is still providing the economy a lot of juice.

(The economy's) not galloping at all, but we are making progress bit by bit. Everybody would love to see it faster. But it's not going into reverse and I do not think the sequester will cause it to go into reverse. -Warren Buffett, Berkshire Hathaway Chairman & CEO

It’s not galloping at all, but we are making progress bit by bit. Everybody would love to see it faster. But it’s not going into reverse and I do not think the sequester will cause it to go into reverse.

Buffett remains confident, however, that Washington’s red ink will be reduced. We’re going to bring down spending. We’re going to bring up revenues. We may get there in fits and starts. And everybody may scream each time we do it. But the deficit is going to come down. It needs to come down.

Buffett has enormous respect for Federal Reserve Chairman Ben Bernanke, but thinks it will be interesting to see what happens when the Fed begins to unwind its efforts to keep interest rates very low. He said that rates near zero have pushed stocks higher than they would have gone otherwise and the global markets are on a hair trigger, looking for any sign the central bank may start raising rates.

The results of higher rates, he said, will be very noticeable in the markets. While stocks will be hurt by higher rates, Buffett said other investments will also be affected and he still thinks equities are the best thing to buy now.

Will the Fed’s action affect Berkshire’s decisions? No, said Buffett, pointing out that in all the years he’s worked with partner Charlie Munger, they’ve never had a conversation about macroeconomics when deciding whether or not to buy a company.

For him, price is the main consideration because it takes care of the future.

Buffett joked that while he got a business he likes, and a partner he likes (3G Capital), in the $23 billion acquisition of H.J. Heinz. he barely liked the price and wouldn’t have made the deal if 3G founder Jorge Paulo Lemann wasn’t involved. We get terrific management, he said, with 3G running Heinz. It’s a long-term deal, said Buffett. We hope to own Heinz 100 years from now.

Asked if he would buy another consumer products company, Buffett replied there’s nothing on my plate right now but if something comes along, and it looks like we can make a deal, and the price is right, we’re ready to go.

Buffett said unusual options activity the day before the Heinz deal was announced was clearly insider trading and he’s confident the SEC will nail that guy. He noted that while Berkshire works very hard to keep upcoming deals secret, there were several investment banks and others involved in the negotiations, making a leak more likely.

Among other topics covered during the three hours:

- Buffett’s advice to Apple CEO Tim Cook: Ignore pressure to return to cash to shareholders and run the business in such a manner as to create the most value over the next five to ten years.

- Buffett said Berkshire plans to hold its Bank of America warrants through the end of their 9-year lifetime.

- Buffett repeated his belief that big-city newspapers have a far worse business model than local community papers. When asked if he has any interest in buying the Chicago Tribune or L.A. Times from the privately-held Tribune Company, he responded, No thanks.

- In his annual letter to shareholders released Friday, Buffett said he was looking for someone who is bearish on Berkshire to ask questions during May’s annual meeting. Today he revealed that Doug Kass will be taking on that role.