Warren Buffett s New Toy Teased by Motley Fool

Post on: 16 Март, 2015 No Comment

Sniffing out the OPEC’s Worst Nightmare solution to Energy Tech’s Unsung Hero — Your Inside Scoop on the #1 Investment No-Brainer of the Century.”

Welcome! If you are new to Stock Gumshoe, grab a free membership here and join us to get our free newsletter alerts with new teaser answers and debunkings. Thanks!

The Motley Foolies are running an ad this week that teases us about a stock Warren Buffett has been buying his new toy is something in the oil services business, and theyre calling it a no brainer.

Like many of their recent ads, this ones signed by someone other than the Gardner brothers who run the Stock Advisor newsletter being pitched it happens to be Bryan White this time around, hes one of their analysts, and hes saying that he expects this stock to skyrocket as soon as June 5 as a Congressional committee reviews the Safeguards Act of 2013.

So, naturally, a bit of urgency after all, without urgency you could take a few minutes to check with your friendly neighborhood Stock Gumshoe and do your own research but heck, if theyre saying it could skyrocket by tomorrow do you have time to wait?

Dont worry, well get you an answer before then. And Ill throw in a little hint up front for you: its a $30 billion company, and usually with stocks that large youve got a bit of time to think things over before they skyrocket depending, of course, on what your definition of skyrocket is.

So without further ado, heres how the ad is introduced:

Dont Outsmart Yourself on This One

President Obama is powerless to stop it.

Exxon, Shell, and BP are digging deep into their pockets for it. (In fact, theyre required by law to cough up $41,000 an hour.) And oil-drunk dictators from Russia, to Saudi Arabia, to Venezuela are hopping mad about it.

It looks like an octopus wearing a Mardi Gras crown. It sounds like 1,000 Harley Davidsons revving up at a green light. And it feels like the no-brainer investing opportunity of the century.

So thats Warren Buffetts new toy how about some more details from the ad?

- If a company rents out its high-tech tools for $41,000 an hour and demand is so hot that the line to get them is three years long

- If Warren Buffett’s investment company Berkshire Hathaway has already bought 2.19 million shares of its stock this spring without breathing a word about it to anyone in public

- If its positioned front and center at the intersection of the two biggest energy mega-trends to come along in a century helping to make the United States a net exporter of oil by the end of 2013 and completely energy independent within a decade

- If Obama is waving the white flag on trying to stop it because hes happy enough that its forcing Big Oil companies like Exxon, Shell, and BP to clean up their environmental act

- If its making Venezuelan dictator Hugo Chavez spin in his grave and hanging other anti-democratic dirtbags like Vladimir Putin & the Saudi Arabian royal family out to dry for good

Then Im investing!

Irregulars Quick Take

Paid members get a quick summary of the stocks teased and our thoughts here. Join as a Stock Gumshoe Irregular today (already a member? log in at top right)

Well, if youre at all savvy in the ways of the SEC and their filings and have a few minutes to kill, thats enough to feed your own personal Thinkolator, should you have one lying around in the garage you can just check Berkshires quarterly 13F filings to see what Warren Buffetts company has been buying and selling over time and youll see which stock they added 2.19 million shares of in the last quarter (these are always dated reports they come out 45 days after the quarter end, and unless the manager is a really major holder and therefore an insider they dont have to report changes more frequently).

Should I let the cat out of the bag so early on here? OK, fine this is National Oilwell Varco (NOV).

And yes, Berkshire Hathaways position in NOV increased by 2,189,500 shares in the first quarter of this year thats not one of Berkshires larger stock positions, so the likelihood is that the decisions on this are probably being initiated by one of the other investment managers that Berkshire brought on in recent years and not by Mr. Buffett himself (he tends to focus on the large multi-billion-dollar deals and investments and on the massive foundational holdings of the company) though since the two managers, Todd Coombs and Ted Weschler, have recently been generating better returns than Warrens stock picks perhaps thats not a bad thing (that underperformance of Buffett is not surprising, of course, particularly in the short term the new guys are managing far less money and dont have old legacy positions with embedded gains).

Berkshires position in NOV was apparently initiated back in the second quarter last year, at prices averaging about $70 a share, which is where the stock is now and I havent checked what prices they might have paid in the first quarter of this year as they increased the position, but the stock price ranged from about $66-74 during that quarter so the average cost for Berkshire is probably still near the current $70 price.

National Oilwell Varco is a pretty ubiquitous company in oil services, particularly in their core niche of high-tech equipment for drilling and completion operations. Reportedly 90% of the drilling rigs in operation now have some kind of NOV equipment on them, and though they do sell and lease rigs and provide a variety of oilfield services, their biggest profit driver is the high-tech equipment thats used on all kinds of rigs.

And while international demand for rigs and equipment is apparently still growing in many regions where shale or horizontal drilling is just starting up (like Russia, where theres a recent story about NOV angling for sales ), NOV, like most of the drilling services and equipment companies, has seen tighter competition and slack demand for rigs in the United States and Canada over the last year or two as capacity was ramped up in many areas in anticipation of the continuing the shale boom but the natural gas-focused projects have in some cases been delayed or halted due to low prices.

So NOV has still been able to grow revenue year over year, but their earnings and earnings per share fell sequentially in this last quarter and are also down a bit year-over-year, which brought a miss on the last quarterly report and has helped to keep a lid on the stock price (though some of the underperformance was from what they call one time issues).

Which means its not a hot growth name or a big investor darling at the moment, but it has been a Motley Fool pick for years and has a strong market position, and its currently pretty inexpensive with a forward PE thats slightly less than giant industry leader Schlumberger (SLB) and about the same as Halliburton (HAL) none of those biggies has been growing earnings rapidly recently, but NOV has at least been growing sales a bit faster. Most of the larger oil services stocks have migrated to trading at a forward PE of between 10-12 or thereabouts, even firms that are struggling a bit more like Weatherford International (WFT), so the soft North American market has everyone somewhat worried about growth.

NOV pays a small dividend that tallies up at about 1.5% right now even after they announced a doubling of the dividend this past quarter, but they have been a consistent dividend raiser over the last several years and could easily pay out far more if they wished thats less than a 20% earnings payout.

Their balance sheet is excellent, with only a small debt position and a pretty low price/book ratio of 1.5, though a lot of that is from the big goodwill slug associated with the many smaller drilling technology companies theyve acquired over the years. They tend to put their cash flow back into acquisitions, and they probably pay their executives too much and dont have enough insider ownership for my preferences, but the Berkshire Hathaway position increase and their generally decent value right now is a nice notch in their favor, along with the strong market position and the likelihood that more high-tech drilling equipment will be required for the worlds oil explorers and producers in the years ahead.

Will the latest Congressional hearings about drilling technology cause these shares to spike this week? Well, thats not so easy to predict but Id be shocked if the stock moved aggressively based on whatever this new regulation or chatter about it might be.

The Safeguards act proposed in Congress is real, though thats another of the idiotic acronyms that our elected officials seem to love so much the full name is the Secure All Facilities to Effectively Guard the United States Against and Respond to Dangerous Spills Act of 2013, and it seems to largely be about just that, tightening up the laws about preventing and dealing with oil spills. Not surprisingly, it was introduced by Bill Young, a Representative from Florida, where concern about oil spills is high it has no cosponsors and the places Ive checked indicate that it has no more than a 1% chance of being passed into law. The bill has been referred to committees and subcommittees, but I havent seen a hearing scheduled there is a hearing on Thursday of a bill that wants to expand offshore energy exploration and production on the Outer Continental Shelf, though I dont suppose one subcommittee hearing is suddenly going to move the ball on that extremely contentious issue.

Though frankly, whether this bill is passed or not, it would be surprising if any extension of offshore drilling werent accompanied by requirements for higher-tech equipment for stronger or more redundant safety and blowout/spill prevention, and I think its clear that offshore drillers in particular are focused on ordering newer or more upgraded rigs to make sure the equipment is as safe and low-liability as they can get no one wants to be responsible for a major spill, or to be dragged through court and through the headlines over it for years as BP and Transocean and Cameron were for the Deepwater Horizon explosion and blowout.

Will that drive NOVs earnings sharply higher in the near term? Well, that I dont know they do have equipment on thousands of offshore rigs, though they dont own the rigs, and there are a lot of big and expensive rigs being built over the next few years that will feature NOV equipment (they can get hundreds of millions of dollars of equipment onto each one of the latest generation of deepwater rigs). On the flip side, the other competitors in the industry havent exactly been caught napping Cameron has a joint venture deal with Schlumberger called OneSubsea that is pushing technology and services, and they seem to be growing as a competitor in bidding for big rig technology packages with manufacturers, so I dont know if that will hamper their ability to win business. I have no idea what their technological advantage is in any of their specific equipment offerings.

The target price of the average analyst for NOV is about $84, and the fair value cited by the Morningstar analyst is $85 (they called NOVs Pete Miller their CEO of the Year last year, too, so they think management is excellent though they cut their fair value from $98 after the last quarters weakness), so theres certainly potential upside if those folks are right. Its a strong company in a competitive business thats driven to large degree by enthusiasm for oil and gas drilling you can see what happened with the decreasing rig count in the US and Canada over the last year or so bringing earnings down for them and most of their competitors, so there are challenges from competing firms and competing technology advances, but my impression is that the biggest reasonable downside to fear for NOV is probably further weakness in gas or, in the worst case, simultaneously falling oil and gas prices that substantially decrease investment by oil companies.

The last time I wrote about this stock as a teaser pick was more than two years ago, and at the time it carried more of a premium valuation and a share price about $10 above where it now stands Im more comfortable with it now that its lost some of that premium valuation, but with most oil services stocks pretty cheap now you cant say that its a real obvious bargain then again, the cheapest stocks usually are a lot hairier than NOV, and theres something to be said for Warren Buffetts oft-quoted maxim that hed rather buy a great company at a good price than a good company at a great price. (OK, the actual quote, from his 1989 letter, is Its far better to buy a wonderful company at a fair price than a fair company at a wonderful price.)

Thats all I can tell you about National Oilwell Varco and the Motley Fools tease of this stock I dont own it, it looks like a reasonable buy for the sector but Im not going to buy it immediately, and your opinions and decisions, of course, are what matters for your money so what do you think about this one? Is it really the Number 1 Investment No-Brainer of the Century? Let us know with a comment below.

I confess to being an addict.

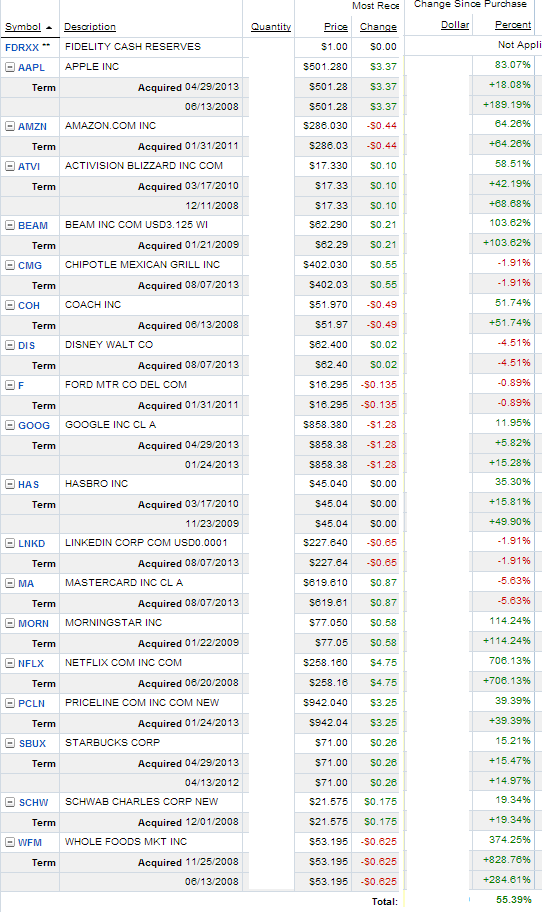

I check my net worth, my spending and saving progress, and my portfolio (combined from several different brokerage accounts) using Personal Capital at least once a week, sometimes every day. after all, it’s free and brilliantly organized.

Personal Capital has great tools for tracking spending (they can cut your spending by 15%), but what I love most is their automated financial dashboard — it will look at all your assets and debts, tally up your asset allocation, project where you’ll be at retirement, and suggest ways to manage risk or improve returns. It’s free, I think their free tools are great, and I think it’s worth checking out — you can do so here.