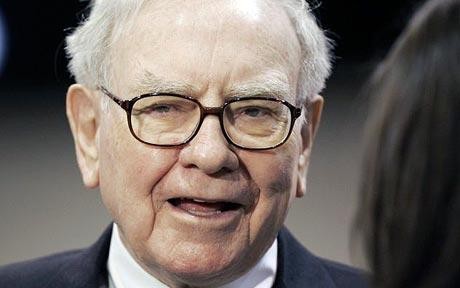

Warren Buffett is buying this stock now

Post on: 20 Апрель, 2015 No Comment

MattDoiron

Insider Monkey provides high-quality evidence-based articles to inform individual investors about the intricacies of investing.

According to a filing with the SEC, Warren Buffett ‘s holding company Berkshire Hathaway BRK.A, +1.10% has continued to buy shares of DaVita DVA, +0.37% a $12 billion market cap provider of kidney dialysis services at hospitals and dialysis centers. Adding over 600,000 shares of the stock in early July, Berkshire reported close to 16 million shares of the stock as of July 3. As a result, Buffett’s stake in the company is worth about $1.8 billion at current prices.

We track quarterly 13F filings from hundreds of hedge funds and other notable investors such as Berkshire as part of our work researching investment strategies (we have found, for example, that the most popular small cap stocks among hedge funds earn an average excess return of 18 percentage points per year ). According to our database, Berkshire owned about 15 million shares as of the end of March. In light of the famous Warren Buffett quote. our favorite holding period is forever, DaVita may just be a forever stock due to the inherent stability of the health-care sector and the long-term bullishness present in the dialysis space.

In the first quarter of 2013, DaVita’s net patient service revenues increased by 12% versus a year earlier, with overall revenue growing to a greater degree due to the company’s merger with Health Care Partners, now a subsidiary of the business. DaVita wrote a $300 million loss contingency reserve during the quarter, which caused its pretax income to be much lower than its levels a year ago; if we add back that reserve, however, we get a 39% increase in income before taxes.

Because of the recent acquisition and the contingency reserve, trailing EPS numbers aren’t that relevant to daVita’s valuation and we can’t really use the Q1 numbers as a guide to future performance either. Wall Street analysts are predicting that earnings per share for this year will come in at $7.51- making for a current-year P/E multiple of 15- and then experience only weak growth in the next year. That is a decent valuation, although the company would probably need to grow its earnings at a somewhat faster rate going forward than the sell-side is projecting in order to be a buy at these prices. In addition to Berkshire’s interest, we can see that at the end of Q1 2013 billionaire Stephen Mandel’s Lone Pine Capital had about 2 million shares of DaVita in its portfolio (see Mandel’s stock picks). D.E. Shaw, a hedge fund managed by billionaire David Shaw. disclosed ownership of 1.8 million shares. Alan Fournier. Jeffrey Gates. Julian Robertson. and George Soros are among DaVita shareholders.

The closest peer for DaVita is Fresenius Medical Care FMS, +1.19% Its sales rose by 6% in its last quarterly report compared with the first quarter of 2012, a lower growth rate than what DaVita saw in its core business leaving aside the merger. Fresenius is actually valued at a small premium to DaVita on a forward earnings basis, at a valuation multiple of 16 times expected earnings for 2014. As a result we think that we’d be less interested in doing further research on this company. We can also compare DaVita to specialized health services companies including MEDNAX MD, +2.85% HEALTHSOUTH HLS, +1.22% and Acadia Healthcare ACHC, +2.49% The first two of these companies carry forward P/Es of 15, pricing them about in line with DaVita, and each experienced double-digit growth rates on the bottom line in their most recent quarter compared with the same period in the previous year. Markets aren’t actually pricing in much growth at them, either, and so it could be worthwhile to look into whether or not this much earnings growth might be sustainable. Acadia is expected to substantially improve its business over the next year and a half, but the forward earnings multiple is still above 20 and 13% of the float is held short as many market players are bearish.

We think DaVita is a more interesting target than Fresenius, and we suppose that investors should put at least some weight on Buffett’s interest in the company as well- though the valuation is high enough that we would be cautious in evaluating the business before buying. MEDNAX and HEALTHSOUTH could be prospects as well.

Insider Monkey’s small-cap strategy returned 46.3% between September 2012 and June 2013 versus 16.2% for the S&P 500 index. Try it now by clicking the link above.