Warren Buffett and Benjamin Graham on Diversification

Post on: 16 Март, 2015 No Comment

- Warren Buffett has often opposed diversification as an investment strategy, which is a central concept taught in traditional B-schools.

- Benjamin Graham, Buffett’s Guru, on the other hand viewed Diversification as a central concept to achieve market beating portfolio returns.

- Are the two at a conflict? A deeper look reveals interesting conclusions.

Warren Buffett’s Take On Diversification

Warren Buffett of Berkshire Hathaway (BRK.A). once said, “Diversification is protection against ignorance, it makes little sense for those who know what they’re doing.” This one line summarizes his view on diversification. While it is a clear practice in the world of investments, diversification as a concept has failed to impress the greatest investor of our times. Conventional wisdom or business school textbooks state diversification helps to cut risk by reducing dependence on the fluctuations of one single company. So why is Mr. Buffett against diversification or not fully convinced by conventional investing wisdom?

In his 1978 letter to Berkshire shareholders the Oracle of Omaha wrote

“We try to avoid buying a little of this or that when we are only lukewarm about the business or its price. When we are convinced as to attractiveness, we believe in buying worthwhile amounts”.

Warren Buffett’s approach also seems to be starkly in contrast to that of Benjamin Graham, his mentor. Benjamin Graham preferred to invest solely on the basis of Quantitative analysis and believed in buying a large number of stocks with specific characteristics (like low PE ratio stocks, net-net stocks).

Benjamin Graham On Diversification

Benjamin Graham compared investing with the insurance underwriting business, as can be inferred from the following paragraph quoted from page 518 of ‘The Intelligent Investor’:

“There is a close logical connection between the concept of a safety margin and the principle of diversification. One is correlative with the other. Even with a margin in the investor’s favor, an individual security may work out badly. For the margin guarantees only that he has a better chance for profit than for loss-not that loss is impossible. But as the number of such commitments is increased the more certain does it become that the aggregate of the profits will exceed the aggregate of the losses. That is the simple basis of the insurance-underwriting business.”

“Diversification is an established tenet of conservative investment. By accepting it so universally, investors are really demonstrating their acceptance of the margin-of-safety principle, to which diversification is the companion.”

While margin-of-safety is a central concept of investment, diversification increases the success rate of the overall investment as the number of stocks invested in increases. This is also what probability teaches us. The larger the pool of investments, the closer will be the result to the average, which in this case is a market beating return due to the presence of a margin of safety.

Comparing The Two Views On Diversification

Warren Buffett and Benjamin Graham seemed to be at a conflict on the topic of diversification. However, it would be interesting to note Warren Buffett from a recent post on Fortune ;

“The goal of a nonprofessional should not be to pick winners – neither he nor his helpers can do that – but should rather be to own a cross-section of businesses that in aggregate are bound to do well. A low cost S&P 500 index fund will achieve this goal.”

This might seem in contradiction to Warren Buffett’s historical stance on diversification, but a deeper look helps to understand this better. Investing in an indexed fund and diversification is something Warren Buffett suggests for a nonprofessional investor. And there is a clear reason.

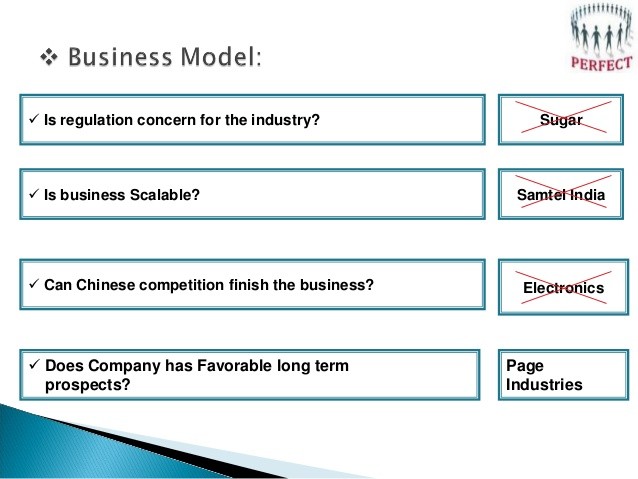

According to a post on basehitinvesting.com. Warren Buffett’s investment strategy differs from Ben Graham in one major way: While Graham focused on the numbers, Buffett differentiated himself using a combination of Qualitative and Quantitative analysis. Qualitative analysis consisted of visiting companies, talking to the management, and considering the actual prospects of the business.

However, for a non-professional investor to do Qualitative analysis would be extremely time consuming and hence Warren Buffett suggests use of diversification by the nonprofessional investor. The key is to differentiate between a professional and non-professional investor. A professional investor has a higher chance of knowing what he is doing due to resources at his/her command and hence should focus on investing in their best ideas. This would lead to a better returns than that of a diversified strategy.

Conclusion

In conclusion, we can say that Buffett despised Diversification as a professional investor but he suggests use of diversification by a non-professional investor. His approach and take on Diversification can be best summarized in the following lines. Most individual investors and investment professionals invest in equities to gain the market return and not the specific return of individual stocks. Warren Buffett, on the other hand, seeks to gain market beating returns by investing in specific highly attractive stocks. Most individuals are not able to stomach the costs or the risks of a Warren Buffet approach. The costs or the risks equate to the certainty of under-performing, at times often significantly, the market over the short term. It is no surprise that the Oracle’s favorite holding period is ‘FOREVER’.

Disclaimer: We do not hold any stake in the aforesaid stocks. Please read our detailed disclaimer .