Wall Street Sinks as Investors Retreat From Emerging Markets

Post on: 31 Март, 2015 No Comment

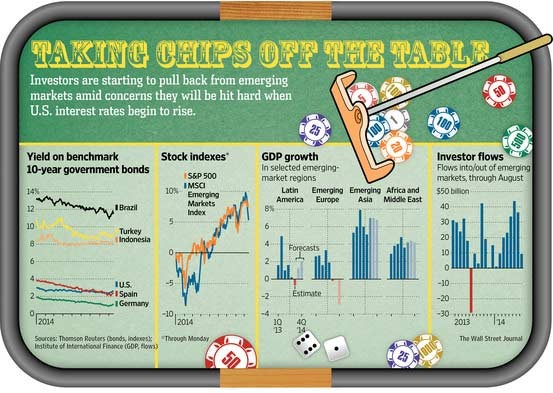

Stocks fell in the United States on Friday after a selloff in emerging market assets, as expectations grew that the Federal Reserve would trim its market-friendly stimulus measures further next week.

The Dow Jones industrial average fell 0.17 percent, the Standard & Poor’s 500-stock index lost 0.34 percent and the Nasdaq Composite dropped 0.55 percent.

With many market participants expecting the Fed to continue to wind down its stimulus measures by an additional $10 billion a month next week, investors are looking to less risky assets such as United States bonds, expecting that interest rates will begin to rise.

A rout in emerging market assets spread to developed countries in Europe on worries over Fed policy, slowing growth in China as political problems grew in Turkey, Argentina and Ukraine.

The Turkish lira hit a record low and the South African rand hit a five-year low against the dollar. United States-listed shares of Banco Bilbao Vizcaya Argentaria fell 4.2 percent a day after the country’s peso currency had its steepest daily decline in 12 years.

Argentina’s government said Friday that it would loosen strict foreign exchange controls after abandoning earlier this week its long-standing policy of supporting the peso currency by intervening in the foreign exchange market. That resulted in the currency’s steepest plunge since the 2002 financial crisis.

The S.&P. 500 is down 0.6 percent for the week, putting it on pace for back-to-back weekly losses for the first time since September.

Nine companies in the S.&P. 500 were scheduled to report earnings on Friday. Procter & Gamble was up about 4 percent after the opening bell after the world’s largest household products maker reported a lower quarterly profit but left its 2014 sales growth forecast unchanged.

Microsoft gained 3 percent after the world’s largest software company posted a bigger-than-expected quarterly profit.

Honeywell International posted a higher fourth-quarter profit as sales increased across major segments of the diversified manufacturer. Its shares were up 0.5 percent at the opening bell.

European shares slipped to a one-week low, with stocks exposed to emerging markets hit by a rout in Latin American currencies and banks losing ground on concerns about their earnings outlook.

Asian shares slumped to a four and a half month low, extending the previous day’s weakness, amid worries over Chinese economic growth and the decline in emerging market currencies.