Volatility squeeze

Post on: 16 Июль, 2015 No Comment

Understanding How Finding Volatility Squeezes Stocks Experience Can Result in Bigger Profits _

You will find a lot of methods used to succeed in the stock market. Some traders invest hours on reading and learning market trends and patterns, and some others simply select a stock on a whim. Generally, the more profitable investors are the ones who’ve educated themselves and have absolutely paid very close attention towards the over all market. One specific characteristic of a pattern, a lot of traders are really aware of would be the volatility squeeze.

A Easy Explanation Of Market Volatility

For beginners lets talk about the idea of volatility and just what it means in respect to securities. Volatility in the marketplace determines how certain or uncertain the change in the current market can be. In the event the market has higher volatility it implies that there is a likelihood that the worth of the stock will possibly rise very high or fall extremely low. This could mean a higher risk for a profit or loss for the investor. Once the volatility of a stock is extremely low this means there is less risk for a loss, as well as the price of the stock is likely to remain very steady.

Bollinger Bands Vs Keltner Channels?

Bollinger Bands are some of the most beneficial tools to know in the stock market business. It’s an very complicated and technical technique employed by a lot of skilled investors. These bands are utilized to determine just how volatile the market currently is. The bands encircle an average line which establishes the possible prices for stocks. The movement of the average line dictates the width and shape of the Bollinger Bands. Learning the approach for these particular bandsis going to be useful.

Keltner Channels are somewhat equivalent to Bollinger Bands simply because they also include an average line which measures the predicted price value of the current stock. The outside lines in which surround the average are influenced by the movement of the average line. Normally the one big distinction between the Keltner Channels and also the Bollinger Bands is the shape of either. Bollinger Bands normally change their shape and distance from the average line, and Keltner Channels keep a fixed distance from the average line.

What exactly is the Squeeze?

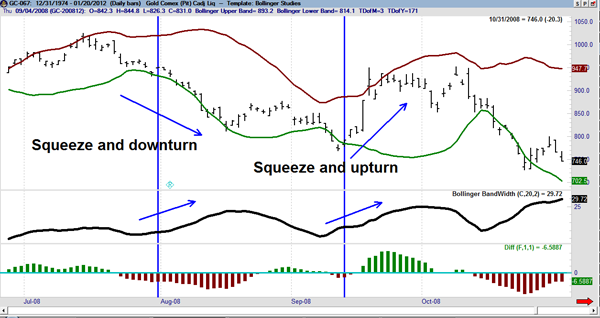

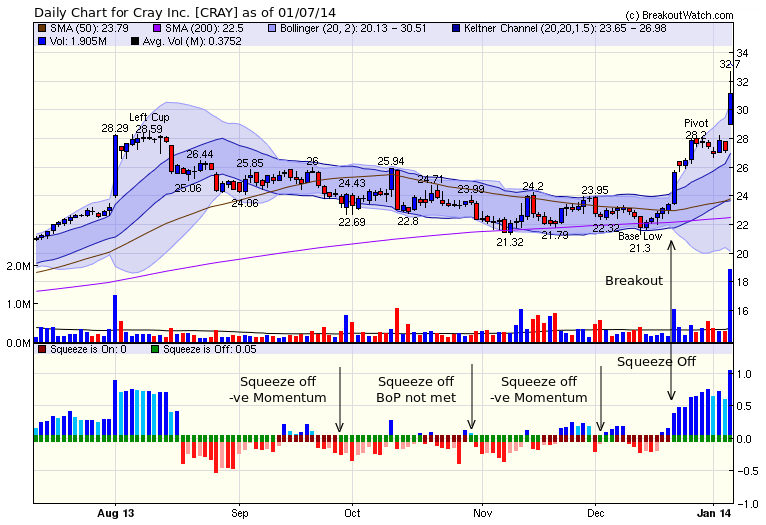

The squeeze purely requires evaluating the behavior between Bollinger Bands and Keltner Channels. Market specialists refer to the market being in a squeeze once an instance of the Bollinger Band is situated inside of the Keltner Channels. A look at any graph combining the 2 will probably show the Bollinger Band dip inside the Keltner Channel. This can be a clear signal of incredibly low volatility in the marketplace. Traders pay very close focus to this sign simply because they recognize that this won’t last very long. This can be a clear indication that a volatility breakout of the market will probably soon return, and investors must be ready to make a move.

Although the behavior of the current market cannot be predicted at 100% accuracy, patterns such as these offer key predictions for investors. Investors must concentrate on discovering volatility squeezes stocks have to offer. Knowing volatility squeezes in the market can bring about higher opportunities for earning capital.