Volatility Spikes Again My Playbook

Post on: 16 Март, 2015 No Comment

Summary

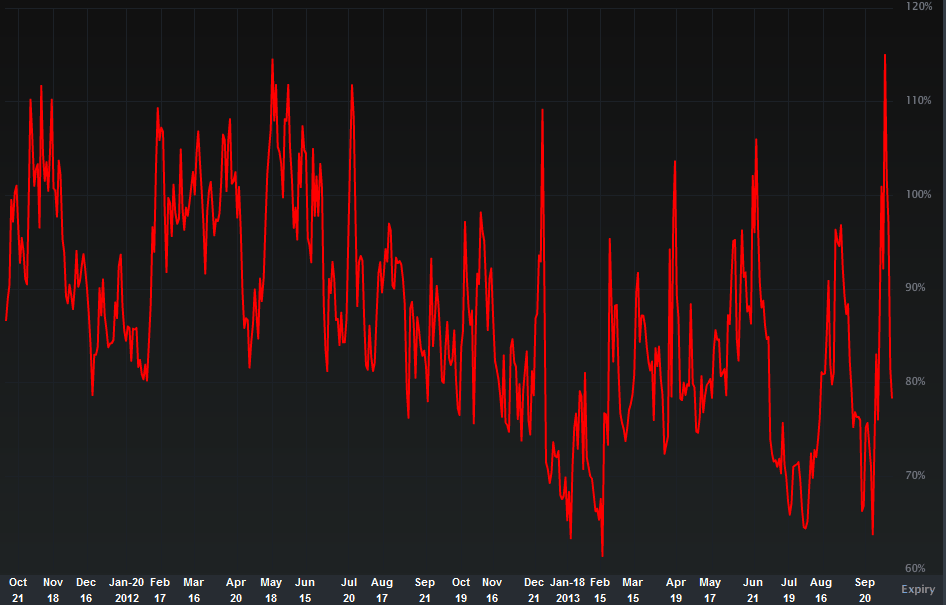

- Volatility as measured by the VXX has spiked once more.

- Is this time really different?

- My outlook and playbook for volatility going forward.

About three weeks ago, I wrote an article detailing why I was closing out my long position in volatility at the time, via the VIX ETF (NYSEARCA:VXX ). Those of you that follow me know I’ve been in and out of volatility positions for the last few months, and in my most recent article, I said I wanted to wait for a spike I could short instead of trying to get long again once things settled down. Well, as it turns out, we got our spike beginning late in December and continuing at least through Monday. In this article, I’ll take a look at the move in volatility and see if this move is good enough to take a position or if I will continue to wait it out for a better opportunity.

To begin, the VIX spiked hard in the last few trading days with the move coming after Christmas from 14 to 20. The VIX usually is very quiet this time of year so the spike caught me off guard. Many commenters on my previous VIX articles stated they would hold their long volatility positions through the new year and unfortunately, that strategy meant big losses. This underlines the importance of taking profits when you can when you’re trading volatility; VXX or other VIX-based ETFs move very quickly and in large magnitudes so when the trade goes your way, don’t be afraid to give up some potential gains to take your profits and live to fight another day.

Part of the reason why I’ve shorted the VIX in the past couple of months is because the reasons for the volatility spikes were ones I didn’t think were sustainable like the Ebola breakout and oil plunging lower. Now, it’s not that I don’t think those are real issues — because they are — I’m simply saying I didn’t think those issues were enough to cause sustained volatility in the stock market. Fortunately for me, they weren’t and the trades worked out very well. So what is it this time?

We know oil is still in bad shape. In fact, WTI Crude went below $50 for the first time since the crisis on Monday and continues lower as I write this. Oil has been absolutely crushed in recent months on fears of a slowing global economy and that has spooked investors despite the fact that lower oil is an enormous stimulus to consumers.

Asian stocks have been hammered recently on global growth fears as well. And then there is the Euro zone. Not only has growth been terrible in the Euro zone but we’ve also got fears that terrible growth will lead to deflation. The ECB has vowed to fight deflation (as it should) but we’ve seen years and years of central bank stimulus fail to ignite inflation so I believe investors doubt the ECB’s ability to do so. We also have fears once more that Greece will exit the Euro zone and cause a host of other small nations to do the same, throwing the region into turmoil. The Greeks have an election later this month that will set the course for the country to stick it out or leave the Euro and that will be very closely watched by investors.

In other words, I think this time is different. I’m not worried about oil or Asia but I am worried about the Euro zone. If Greece does in fact leave the Euro, it could have massive repercussions throughout Europe, and of course, here at home. If the Euro begins to break apart, it could cause economic chaos and a deep recession like the financial crisis. Our crisis caused Europe to follow suit and this time, with Europe being the source, we would not be immune either.

This all leads me to my volatility outlook in terms of trading the VXX. We can see the spike has caused VXX to trade up from $28 to $33 in just a few days, a moderately sized spike but one that is certainly worthy of notice.

However, given the situation in Europe, I hesitate to get short right now. The move up has been nice but not enough that I feel the risk/reward setup is strong enough to get short. I think the Euro zone situation is far grimmer (potentially) than the reasons the previous spikes in volatility occurred and thus, I will need a bigger move up before I’m willing to short.

So, my outlook is to wait for a bigger spike in VXX as these things tend to have one enormous move up before they are exhausted. If Monday was that move then so be it; I will have missed my opportunity. But given the potential blowup in Europe right now, I need more margin of safety before taking the plunge. If I see the VIX in the high 20s or more and VXX moves up towards the high $30s, I’ll be looking to take a position. Be careful out there.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.