Volatility Index (VIX) Predicted the Current Stock Market Decline Investing Daily

Post on: 30 Апрель, 2015 No Comment

By Jim Fink on February 24, 2011

The VIX is a good measure of fear priced into the S&P options market.

As the stock market closed last Friday (Feb. 18 th ), investors were happy and content. The Dow Jones Industrial Average had ended yet another winning day, up more than 73 points. The Wall Street Journal trumpeted the fact that the Dow had just hit a new 2 and year high its highest close since June 2008. Just two days earlier, the S&P 500 had hit 1333.58, which constituted an exact double of the March 2009 devil low of 666.79. Two traders who were quoted in the financial press summed up the feelings of many investors with the following statements:

- This is a market that just has momentum and it wants to go higher.

- Theres no reason to think it will sell-off now. For the time being enjoy the ride.

No reason for a selloff? Au contraire, mes amis. A huge red flag had been literally staring investors in the face since mid-January. The red flag in question: the Chicago Board Options Exchanges (CBOE) Volatility Index (Chicago Options: ^VIX), which had fallen below 16% on January 14th. As super-trader Elliott Gue of Stocks on the Run describes in this articles opening quotation, the VIX is a mathematical calculation derived from the prices of options on the S&P 500 index. Specifically, it measures the annualized implied volatility of S&P 500 options that on average expire in 30 days.

The concept of implied volatility is described more fully in our free options report. as well as Understanding Stock Option Valuation . but essentially it measures the degree to which option traders expect an underlying stock or index to move over the next 12 months. An implied volatility of 20% means that the price of a stock or an index is expected to trade within a range 20% above and 20% below the current market price. The more volatile an underlyings price is expected to be, the more expensive the related options sell for because options become very profitable with larger moves in the underlying.

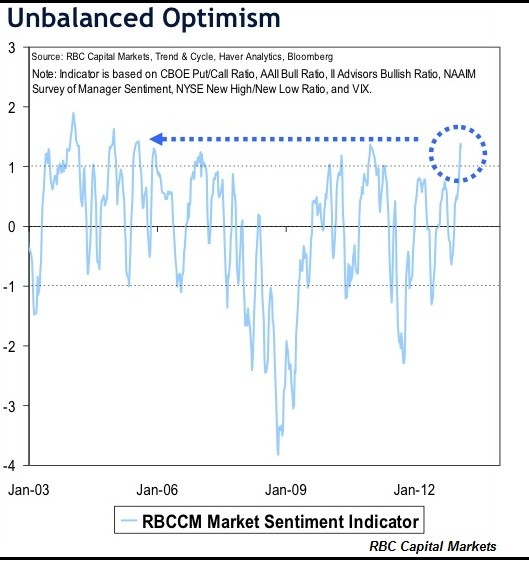

By measuring the prices of S&P 500 options, therefore, the CBOE can reverse engineer and determine traders expectations for future price volatility. It is these trader expectations that the VIX measures and, consequently, the VIX is really a sentiment index. Investor sentiment is usually used as a contrary indicator because investors get apathetic or greedy at market tops and fearful at market bottoms. Whenever investors are all trading in one direction, nobody is left to continue that trend and the market is ripe for reversal.

Investor sentiment only works as a contrary indicator at extremes . At other times, investor sentiment can actually be an indicator of momentum that should be respected and followed. So the key to using investor sentiment successfully as a contrary indicator is to know the historical range of the indicator and only act on it in a contrary fashion when the indicator is at the top or bottom of its historical range.

For the VIX, its average value since 1990 has been 20.7, so an extreme low reading would have to be a number significantly below this level. In the recent past, an extreme low level has corresponded with a number below 16, which is more than 22% below its average reading of 20.7:

On the chart above, there are three obvious low points around the 16% level: (1) mid-May 2008; (2) mid-April 2010; and (3) mid-January 2011. All three of these low points in the VIX have occurred near tops in the stock market.

Date When VIX First Closed Below 16