Volatility how to use it a tool to make profits in markets

Post on: 9 Июнь, 2015 No Comment

What is volatility ? Volatility is a measure of spread of share price range. Or in simpler words volatile stocks are those stocks that move in higher price band. These are also called high beta stocks. Please note that here we are not calculating beta value.

Why Stock Suddenly Becomes Volatile?

There are many reasons for stocks to be very volatile. Some of them are:

- Rumor about merger/Acquisition.

- Quarterly/Annual result coming soon.

- Government policy change is expected. For example rise in interest rate will affect home loan companies.

- Launch of new product/service.

- International price pressure on product/service offered by company.

- Some accident in the company. Exact loss is difficult to predict, and many more..

How To Take Advantage Of Volatility. (Novice traders should avoid it.)

1. For Intraday traders.

A stock as a result of some important news moves violently either up or down depending on the news impact. An example of positive news on stocks.

- Generally first or second day, smart or informed traders enter and take long positions.

- Seeing huge movement, novice/uninformed traders enter and make price move further from its fair value.

Price goes up.

Typical trend to note here to take advantage of this price movement.

- Volume should reduce with every passing day.

- In candle stick, wick should be longer than body.

2. For swing traders with higher duration

Many stock apart from moving with high daily price fluctuation gives fluctuation on weekly/monthly period. These are the stocks that can be traded for good 5-15 % profit in relatively shorter period.

For such stocks, its best to identify whether stock is in sideways market. To identify such stock one can refer to almost flattish 50/100 day moving average. When ever the price is below this moving average and towards lower range one can buy and exit when it moves above moving average and towards upper range.

To identify such stock refer to

Also note that Volatility may proceed a major price movement.

Warning: In general, it is best to avoid share that are highly volatile. Only professional traders may try to take advantage of this.

If you feel confident to play such stocks then we strongly suggest to play with small capital and with a strict Stop loss. Other wise one wrong move can wipe out good portion of your capital.

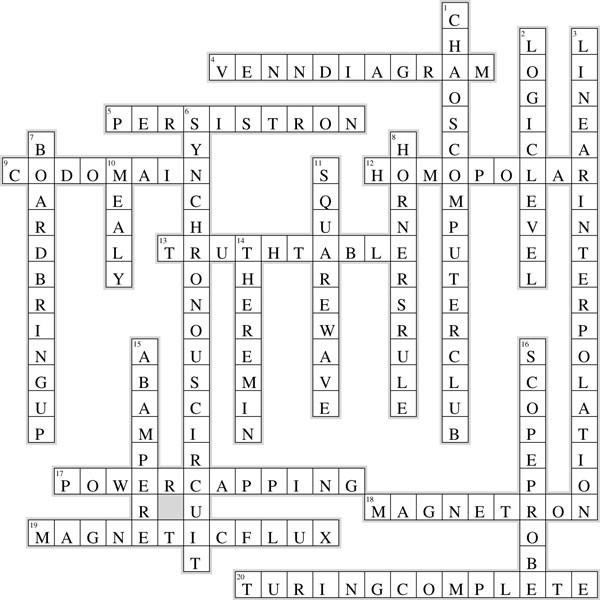

Stock Screening Based On Volatility: