Vix Cboe Volatility Index Definition Investopedia 2015

Post on: 16 Март, 2015 No Comment

3A%2F%2Fwww.schaeffersresearch.com%2F?w=250 /% We’re on the cusp of another overbought VIX, approximately the umptillionth overbought VIX since the start of 2014. I define it as a close 20% above its 10-day simple moving average. It tends to be a decent contrarian tell … at least, it has been good

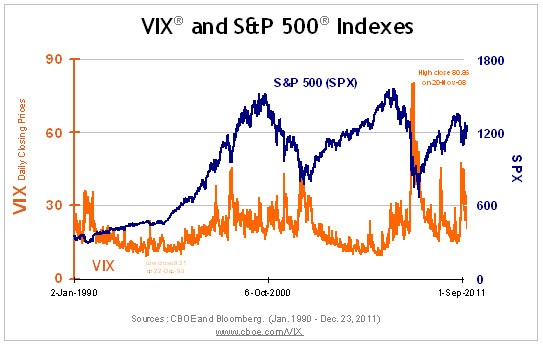

3A%2F%2Fwww.businessinsider.com%2F?w=250 /% The first chart features an overlay of the index and the CBOE Volatility Index (VIX) since 2007. Today the VIX rose to 29.34, a gain of 20.6% over the previous close. As the chart above illustrates, the correlation between the S&P 500 and the VIX is

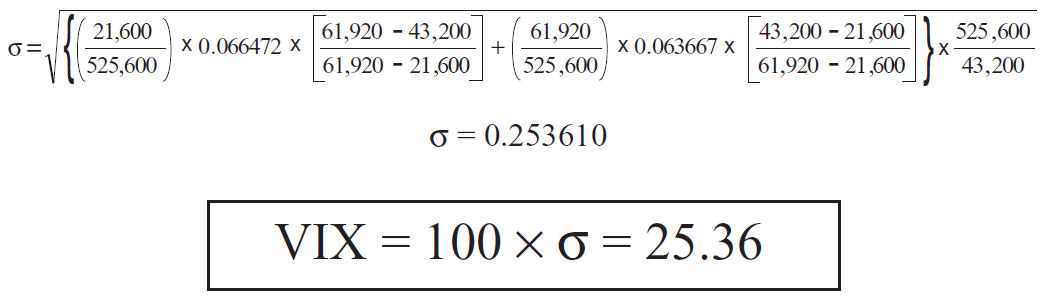

3A%2F%2Fwww.marketintelligencecenter.com%2F?w=250 /% But for starters, let’s define what the term, or in this case, the asset class of volatility means. According to Investopedia, The Chicago Board Options Exchange (CBOE) Volatility Index shows the market’s expectation of 30-day volatility. It is

3A%2F%2Fseekingalpha.com%2F?w=250 /% But for starters, let’s define what the term, or in this case, the asset class of volatility means. According to Investopedia, The Chicago Board Options Exchange (NASDAQ:CBOE) Volatility Index shows the market’s expectation of 30-day volatility.

3A%2F%2Fwww.marketwatch.com%2F?w=250 /% The reason we can expect February to have a lot of volatility is simple: January did, too. In fact, the CBOE’s Volatility Index VIX, -7.23% jumped After all, almost by definition, market bottoms — whether they be of corrections or major bear

3A%2F%2Fetfdailynews.com%2F?w=250 /% John Nyaradi: The VIX, as defined by Investopedia.com, is “the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market’s expectation of 30-day volatility.” The VIX is a continuous minute-by-minute snapshot of the expected

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% [The Five Top-Performing ETFs of the Year] XIV is an exchange traded note that provides the inverse, or opposite, of the daily performance of an index of futures contracts based on the CBOE Volatility Index, or VIX. The ETN charges a fee of 1.35% and has a

3A%2F%2Fwww.gurufocus.com%2F?w=250 /% The same held true for what we define index of global small-cap stocks, excluding the United States. The Russell Global ex-U.S. Large Cap Index is an index of global large-cap stocks, excluding the United States. The CBOE Volatility Index (VIX

3A%2F%2Feconintersect.com%2F?w=250 /% Note 2: For anyone needing a VIX refresher, Investopedia provides a handy overview: VIX: The ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market’s expectation of 30-day volatility. It is constructed using