Vince Foster For Interest Rates Mortgages Are The Tail Wagging The Dog

Post on: 4 Август, 2015 No Comment

Stay Connected

The positive spin on Fridays miserable employment report was a classic mistaking of economic and market cause and effect. Its amazing how price can change participants attitudes. Because stocks exploded higher, the conclusion was that this reaction was a positive interpretation of the employment situation. You heard comments implying the headline number was irrelevant and that the market was focusing on the positive drop in the unemployment rate.

Lets examine the details. The January gain in non-farm payrolls was reported at 113,000 jobs, far below the consensus estimate of 180,000 and substantially less than the whisper number of 225,000. The even weaker December 2013 gain of 74,000 jobs that most wrote off as an anomaly when first reported was revised only to 75,000. To put these numbers in perspective, January 2013 growth was 197,000 and the average growth in monthly payrolls since January 2010 has been 160,000. Economists estimate the economy needs at least 150,000 jobs per month just to accommodate new workers who enter the labor force, so these gains are hardly inspiring.

Perhaps the most important data point for the market is the growth in average hourly earnings because of the influence on spending and inflation. The year-over-year growth in average hourly earnings rose 1.9%, better than the 1.8% estimate. Decembers number was revised from 1.8% to 1.9%, in line with the measly post-crisis average of 2.0%. The weak earnings growth post-crisis has taken its toll on consumption, which is trending near historic lows; and while we saw a year-end uptick, this came at the expense of savings, which dropped to 3.9% — the lowest level of the recovery.

Average Hourly Earnings Vs. Personal Consumption Over Savings Rate

Because consumption represents 65% of GDP, wage growth is essential to the overall economic growth rate. Savings can subsidize consumption to a point, but its not sustainable over time. The savings rate as a percent of disposable income bottomed at 2% before the financial crisis burst the consumption bubble, so this can be seen as a limit for spending growth.

Once consumers have exhausted their savings to sustain spending, the growth rate will equal wage growth. We have been seeing this trend of converging consumption growth and wage growth since 2011, and should expect it to resume as savings drop. A consumption growth rate of 2.0% would be crippling to the recovery, and in the context of the Feds 2.0% inflation objective, would put real growth in recessionary territory.

In the context of spending and inflation, this jobs data was on balance bullish for fixed income, but even more bullish for mortgage-backed securities (MBSs). Fewer job gains and lower purchasing power produce less homebuyers and thus less supply of collateral for mortgage securities. This has been playing out in the market for mortgage originations.

According to Bank of America-Merrill Lynch (NYSE:BAC ), Agency MBS gross issuance dropped to

$68 billion in Jan. from

$75 billion in Dec. led by FNMA. FNMA purchase issuance fell 24% m/m in Jan, refi issuance dropped 19%. This decline in originations was corroborated in January prepayment data that was released on Thursday (Feb. 6) after the close. MBS prepayments have already slowed to a standstill since last years spike in interest rates removed incentives for many homeowners to refinance. Yet despite a near 50bps drop in mortgage rates in January, Fannie Mae 30-year prepays speeds slowed by another 19%, to the lowest rate since 2008, while Fannie 15-year prepays slowed by 13%.

Friday, in a report from Fannie Mae, analyst Li-Ning Huang explained why many borrowers have been unable to take advantage of this refinancing cycle opportunity. Borrowers expectations of their future financial situation, stress over debt-paying ability, and unsuccessful past refi attempts are among factors that have kept

40%-50% of borrowers from refinancing, she wrote.

Friday after the close I received a brief comment on the days activity from one of the Streets larger MBS market makers. The remarks aptly summarized the mortgage credit demand reality:

Looks like we are entering the first refi wave where nobody refis. 800MM in origination spread over three coupons? That doesnt even lick the envelope. 2014 has gone bipolar. Lower yields are bringing slower speeds and no supply.

Does this level of activity sound like a product of a robust jobs market?

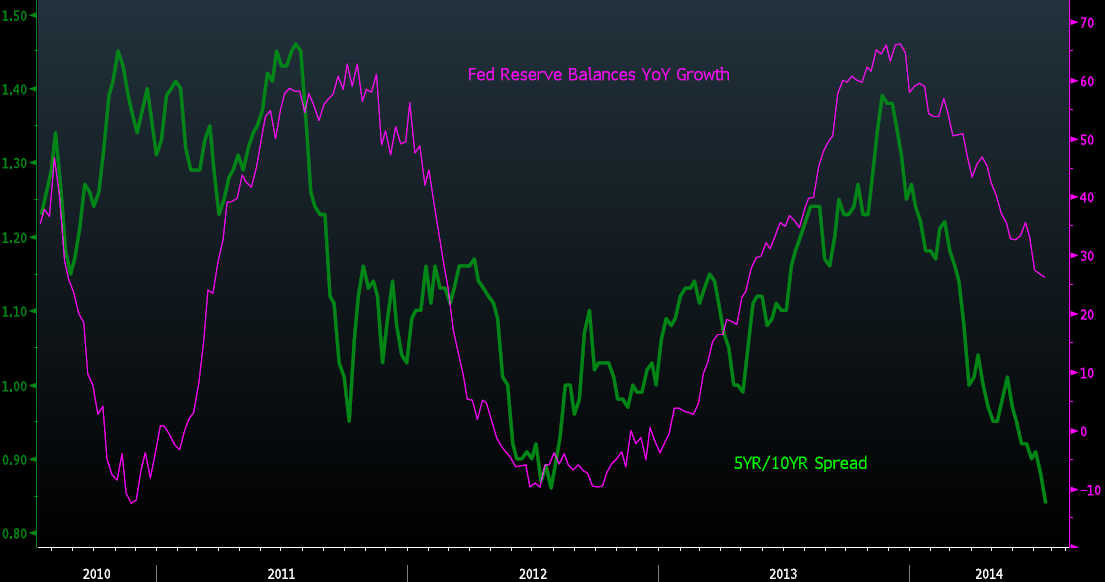

In the interest rate complex, mortgages are the tail wagging the dog. Mortgages represent the single largest form of consumer credit demand, and nominal interest rates are a function of nominal spending, which is highly sensitive to changes in the price of credit. Absent mortgage credit demand, there is little pressure on the cost of credit, thus its hard to see MBS yields rise in the context of a shrinking supply of mortgage loans.

MBA Mortgage Applications Vs. Mortgage Credit Growth

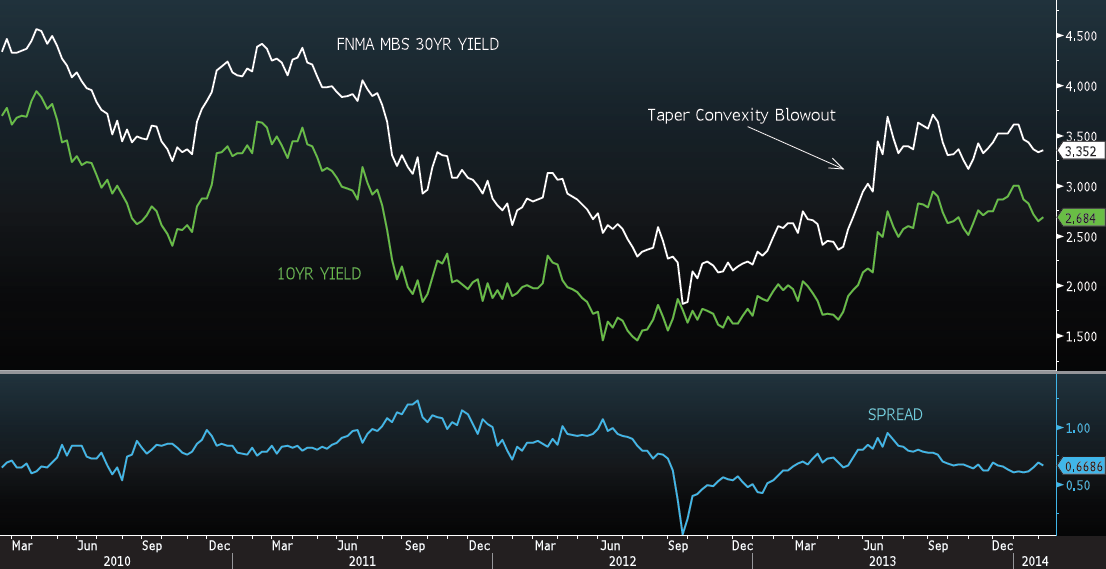

Mortgage rates are also responsible for nominal interest rates because of the interplay between Treasuries and MBS price convexity. Because mortgage-backed securites are callable by the homeowners option to prepay, MBS duration exhibits negative convexity in relation to movements in interest rates. This essentially means that MBS duration shortens as interest rates fall and extends as interest rates rise.

Going into the December 2013 FOMC meeting that was to announce the commencement of tapering, I posited that it was already discounted by the market. I predicated this presumption based on analysis from Credit Suisses convexity maven Harley Bassman; the analysis concluded that the negative convexity risk embedded in MBSs had largely been removed from the market. On December 10 in Bond Market Trading Is Already Discounting Fed Tapering I stated the following:

The sensitivity of MBSs to volatility is the single most important governor of bond market interest rates, and the reason is the negative convexity. If this negative convexity has been removed, then we are looking at a much different bond market composition with much less exposure to interest rate volatility. If this negative convexity has been removed, then the duration extension risk MBSs carry has also been removed, which means the securities will not be responsible for pushing interest rates higher.

This development removes a major interest rate risk factor in the long end of the curve. As Bassman states, long-term interest rates are now only subject to fundamentals. Treasury yields should now only be subject to discounts of growth and inflation. Mortgage rates are now only subject to the demand for housing credit. With longer term treasuries in between the run rate of personal consumption and nominal GDP, and current coupon MBS presenting a 70bps spread with virtually no extension risk, they now offer investors a very compelling fixed income option.

The huge drop in January prepays now makes this removal of negative convexity even more pronounced, and interest rates should continue to be at the mercy of mortgage credit demand. However, if mortgage credit demand doesnt even pick up when interest rates fall, should we expect the cost of this credit to rise? Furthermore, if demand for the largest segment of consumer credit is weak amid current interest rates, then should we expect Treasury yields that discount aggregate consumption growth to also rise? Yet there is an overwhelming consensus that interest rates are due to start rising as the Fed removes QE and is poised to hike interest rates.

Say what you want about the drop in the unemployment rate, but the lack of demand for mortgage credit as interest rates fall speaks more to the conditions in the job market and meager wage growth. Thus its difficult to imagine an increase in market rates in an environment where credit demand is weak and wage growth is below the Feds own inflation target.

At the beginning of the year when Business Insider asked me for my best idea for the next decadem, I responded simply, mortgages :

You are getting paid a premium for risk (extension and prepayment) that has largely been removed. And if we are entering a rising-rate environment, you get to reinvest amortizing principal in higher coupons. Rates would have to fall significantly to accelerate prepayments. Plus supply will be shrinking, acting as a natural cap on yields. Banks still have tepid loan demand and rising deposits. Buying Fed-induced market pukes has been very profitable.

Fannie Mae 30-Year MBS Yield

Its only been a month, but the conditions behind my rationale are already starting to play out. MBS market participants substantially reduced exposure due to Fed tapering, and in the process, pushed yields to levels that substantially reduced credit demand. As the Fed transitions ownership of new origination to economic buyers, the market will seek equilibrium interest rates where MBS demand can find mortgage credit supply. Evidence suggests this rate is at best in line and at worst much lower. Mortgages arent cheap, but neither is anything else. And with higher yields cutting off supply, they may be near fair value, thus keeping the overall level of interest rates low.