Vertical Option Spreads 4 Advantages of Trading Vertical Spreads

Post on: 13 Апрель, 2015 No Comment

In a market such as this, it is imperative that investors be prepared for the downside. You need to make sure youre protected and also have a plan for going on the offensive to make money from that downside.

But, between the amount of money you have invested in your portfolio and the cost of protecting it, many of you do not have enough capital remaining in your account to then take advantage of the downside using the strategy of simple stock replacement via purchasing puts. Keep in mind that you can start to reconstruct your portfolio using the stock replacement strategy, which allows you to keep your same-size position, decrease your risk and increase your cash position. For those of you who have embraced this concept, cash will not be an issue.

For those of you who just have to own stocks, then cash will be a problem. And the stock replacement puts, which would have allowed you to make money on the downside, could very well be too expensive.

Obviously, it is never too late to reconstruct your portfolio and do it the right way. However, for those of you who just cant do it for whatever reason, thus leaving you without enough cash for stock replacement, you will need another way to take advantage of the downside.

The Benefits of Vertical Spreads

When asked what my favorite options strategy is, or what the best strategy is to use, I always say that my favorite strategy is the right one for the specific occasion.

While I would never willingly admit to having a favorite strategy, due to the fact that, depending on the situation, there are many different strategies that could be the right one at that time, I would have to say that the vertical spread is a viable strategy more often than any of the others in most situations.

That is because the vertical spread is probably the most versatile of all of the option strategies :

- It is extremely cost-effective.

- It features a limited-risk scenario.

- It can be used to play direction.

- It can be used to collect premium.

While I cannot properly teach the vertical spread in the depth required in a brief article, I can show you why you should seek to learn more about this strategy.

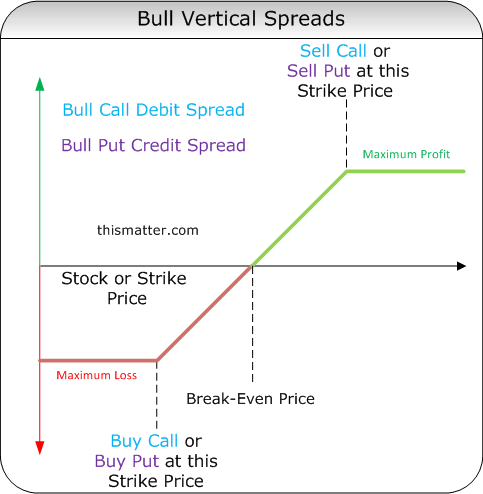

First, we need to know what a vertical spread is and how it is constructed. A vertical spread can be constructed in two different ways.

Vertical spreads involve the simultaneous purchase of one option and the sale of another in the same month in a 1-to-1 ratio. It will consist of all calls or all puts.

An example (but not a recommendation) of a vertical spread may be purchasing an IBM Dec 120 Call while selling an IBM Dec 125 Call at the same time. Another example would be purchasing an IBM Jan 125 Put while selling an IBM Jan 120 Put.

Now that you understand the construction, lets take a look at the advantages of the vertical spread.

The Cost Advantage

The first advantage, and the most important one in this example, is the cost-efficiency.

Lets say that we believe IBM is going to trade down and we would like to take advantage of that opportunity. We could short the stock. but then we would have to come up with the margin requirement which is 50% of the price of the stock or, in this case, about $63 per share.

If your portfolio is reasonably allocated, there wont be much cash available in your account, and probably not enough cash to cover the margin to short enough shares to matter even if IBM goes down.

Instead, you could decide to buy a short stock-replacement put. The ideal put will in this example would be the Jan 135 Put, which would cost you about $10 per share per contract. (An option contract represents 100 shares, so $10 per share times 100 would cost you $1,000.)

This strategy could also be too expensive for some traders. If it is, here is where the cost-efficiency of the vertical spread comes in.

Say you were to buy that IBM Jan 120-125 Put spread, as described earlier. You purchased the Jan 125 Put and sold the Jan 120 Put in a 1-to-1 ratio. You would have paid approximately $3.40 for the Jan 125 Put and you would have sold the Jan 120 Put for around $1.80.

Your total cost would be $1.60 ($3.40 paid out minus $1.80 collected), times 100 (amount of shares per contract) times the amount of spreads you choose to buy.

In this case, if you were to buy 10 spreads (buying 10 Jan 125 Puts and selling 10 Jan 120 Puts), your total cost would be $1,600 a lot less than the margin requirement needed to short the stock.

If IBM closes below $120 on January expiration, the spread will be worth $5 (the difference between the two option strike prices, or $125 minus $120).

You paid $1.60 for a spread that is now worth $5. You have made $3.40 on your $1.60 investment with the stock trading down around $6. From a cash standpoint, this is a good alternative to shorting the stock.

Limited Risk

The second advantage is the limited-risk scenario. When buying the vertical spread, the buyer can only lose what they have spent.

In our example, you spent a total of $1,600, $1.60 per share per spread. So, the most you can lose is that $1,600 with the opportunity to make $3,400.

If you had shorted the stock, you would have unlimited risk if the stock went up. The limited-risk scenario is very important, because the last thing you need is an open-ended risk in addition to the risk you already have.

The pure put purchase, i.e. the short stock-replacement put, would have a limited-risk scenario also. But the difference in the amount of risk is still considerably more than in the vertical spread almost 10 times more, in fact!

Play Direction While Collecting Premium

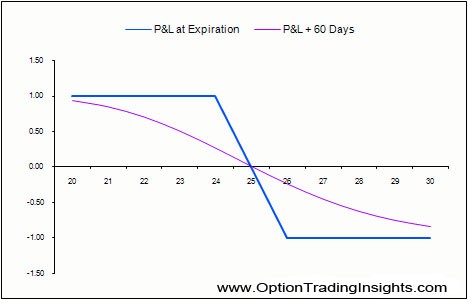

Finally, the vertical spread can be purposely constructed in such a way so that it is not only a directional strategy, but also a premium-collector strategy. If the option you sell has a theta that is higher than the theta in the option you buy, then your spread will benefit with the passage of time. (Theta tells us how much our options price will lose in one day. Learn more about the option Greeks here. )

This leads to an increased probability of being successful.

Now, the spread will not only benefit from the stock moving in your direction, but also if time simply passes by with the stock staying still.

For example, say instead of buying the Jan 120-125 Put spread for $1.60, we chose to buy the Jan 125-130 Put spread.

In this case, we would buy the Jan 130 Put for about $6.20 and sell the Jan 125 Puts for $3.40 for a total cost of $2.80 with the stock trading at $125.70.

If the stock were to finish right at $125.70 at January expiration totally unchanged then the spread would be worth $4.30. This would leave you with a profit of $1.50 ($4.30 minus $2.80) without the stock even moving! This profit is brought to you courtesy of time decay.

Vertical Spreads Offer a World of Opportunities

As you can see, the vertical spread is a powerful strategy that can really help investors, not only in this specific scenario in the current market, but also in many other situations.

There are several other advantages that the vertical spread offers investors. There is also much more to the mechanics and selection process of the vertical spread, not to mention finding an opportunity where the vertical spread is a viable option.

In order to be in a position to take advantage of all the vertical spread has to offer, you need to first be educated in option theory and in the workings of the vertical spread itself.

When educated in how to use the vertical spread properly, increased profits and decreased risk are within the scope of all investors.

For more on vertical spreads, see:

4 Ways to Make Your Fortune in Chinas Second Surge

If you had gotten in on Chinas first big surge between 2004 and 2007, you could have multiplied your wealth nearly 1,000 times. Now history is offering you a second chance to make your fortune. Get the four most profitable sectors in China today and the best China stocks to buy now in this new special report. Download your FREE copy here.