Venture Capital The medtech

Post on: 16 Март, 2015 No Comment

Medical device companies are having a much harder time raising early-stage venture capital than biotech and pharma, according to a recent Silicon Valley Bank report.

On the Series A side of things, biotech is a pretty stable area right now, but devices have some significant issues in trying to find ventures to support Series A company creation, said Jonathon Norris, the author of Trends in Healthcare: Investments and Exits .

Indeed, the playing field is far from level between the two sectors, Norris said, for a number of reasons. Medical devices lack the corporate support thats commonly seen now in biotech. The medical device tax looms and is scary to investors who think the tax will come from the equity they put in not an attractive way for investors to pay for companies, Norris said.

Luckily for medical devices, and Norris said this is anecdotal, individual angels are filling the innovation gap, banding together to fund early-stage devices with early-stage capital. And its not just $100,000 in seed funding angels are beginning to invest millions into medtech startups to get them to a valuable inflection point. Also, medical device venture dollars are more focused on later-stage companies that are closer to FDA approval, so as to get a quicker exit.

Advertisement

Wall Street just treats medical device and biopharma differently, Norris said, but there are reasons beyond those hes suggested and a decent amount of dissent.

But this is just one takeaway from a report that surveyed the healthcare goings-on among venture, M&A and IPO activity in 2013. Here are a few key findings:

- Venture fundraising stabilized at $3.5 billion to $4 billion a reasonable level, Norris said, but a bit lower than the previous cycle which fell between $5 billion and $8 billion.

- That said, last year venture fundraising was a bit higher at $6.7 billion than Norris expected, largely because of the robust IPO market. In their prep to go public, many biotechs raised large mezzanine rounds, thus upping the overall venture funding in the healthcare sector. As the IPO market cools off, as it is doing now, that dollar amount will come down a bit, Norris said.

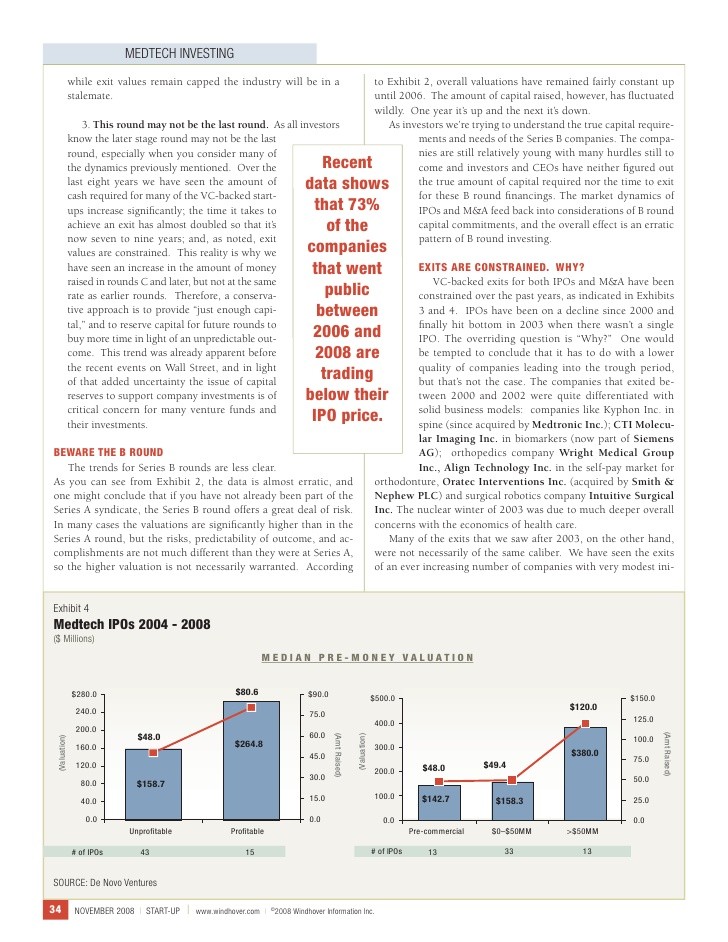

- Healthcare IPOS triple, leading to potential IPO/big edit returns of $12.5 billion. In 2013, there were 27 biopharma and device M&A exits, compared to 35 in 2012. And the deal values declined from $8.9 billion in 2012 to $7.1 billion in 2013. But this was buttressed by the huge increase in IPO activity 37 venture-backed IPOs versus just 12 in 2012. Norris developed an algorithm that analyzed each M&A and IPO deal, and came to a conservative estimate excluding IPO proceeds that the returns could be in excess of $12.5 billion from last years biotech/medtech activity. Neat infographic:

- Corporate venture activity in biopharma bolsters healthy financing ecosystem. On the biotech side, theres cause for a lot of optimism, because youre seeing corporate venture become so active in early-stage investment, Norris said. Five years ago, corporate venture outfits were more involved in later-stage companies, but theyre honing in more keenly on biotech startups these days, and are very active in Series A deals. While corporates arent necessarily putting in as much capital as traditional venture investors, theyre there, Norris said, part of the financing syndicate. This is one of the reasons biotech has been consistently able to create a steady number of new companies each year, he said.

Were starting to see some anecdotal work between corporate ventures, incubators and venture investors to start new companies, Norris said. These havent necessarily been made public yet, but its important and good to see these one-off deals in the U.S. but also outside the U.S.

One example of this might be the Avalon Ventures/GlaxoSmithKline deal that is starting up and incubating 10 new biotechs; this model does, anecdotally, seem to be picking up some steam.

The report also predicted that:

- Healthcare fundraising will see continued stability.

- Venture investment into companies will slowly drop, then level off.

- Series A investments in biopharma will remain level.

- Investment will lag in Series A device, but corporate venture signals more active role.

- As the IPO market cools in second half of 2014, M&A activity will pick up.

- Acquirers will show continued strong interest in oncology and diagnostics.