Vanguard Index Funds vs Vanguard ETFs

Post on: 11 Май, 2015 No Comment

Recent Posts:

Vanguard Index Funds vs Vanguard ETFs

If you ever wondered whether you should buy a Vanguard index mutual fund or the ETF version well, the answer can be found in just a couple small numbers.

Namely, expense ratios and minimum initial investment amounts.

For each index, Vanguard runs just one pool of assets, then applies a different pricing structure to each share class. Therefore, in general and for many indexers most peoples decision between Vanguard index funds vs ETFs is to go with the one with lowest expense ratio.

This same rationale applies to almost any comparison of like index investments. After all, the performance for the cheapest one will edge out that of the more expensive one over time.

Of course, part of the reason Vanguard is the largest mutual fund company in the world is because it has consistently led competitors by gradually reducing the expense ratios and minimum purchase amounts on its mutual fund share classes, which include Investor, Admiral, Signal, Institutional and Institutional Plus shares.

For example, the Admiral shares of Vanguard mutual funds once had a minimum initial investment amount of $100,000. This eventually was reduced to $50,000 and more recently down to $10,000, which is within reach for a large number of investors. The Signal shares, only available to advisors, are set to be phased out, which is a recent move by Vanguard to remove confusion and make their Admiral shares available to more investors.

With Vanguards current pricing structure, Vanguard index funds might be a better choice than their ETFs.

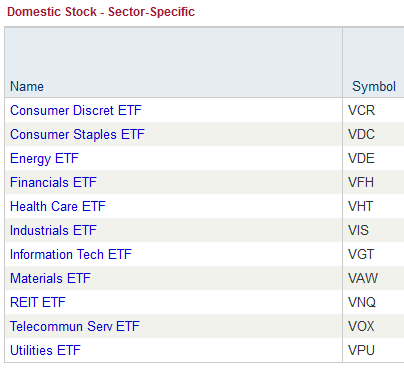

To illustrate, lets compare a few of the most popular Vanguard index funds with their respective ETF counterparts.

Vanguard Index Funds vs. Vanguard ETFs

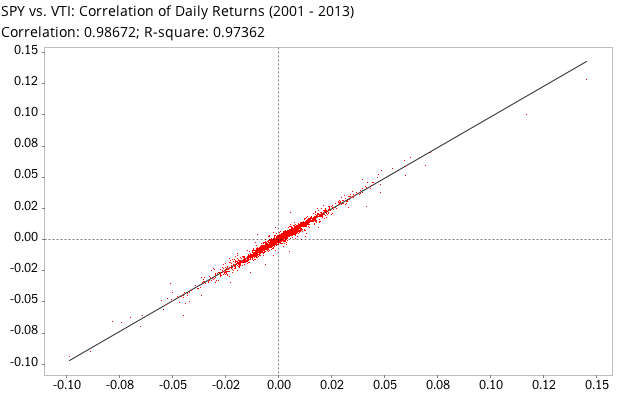

Vanguard Total Stock Market Index Admiral Shares (VTSAX ) have an expense ratio of 0.05% and a minimum initial investment of $10,000. The Vanguard Total Stock Market ETF (VTI ) has the same 0.05% expense ratio, but no minimum initial purchase price.

However, once you factor in commissions on ETF trades of VTI, the VTSAX mutual fund version actually wins the price battle and is the best choice for investors who dont care to trade intraday (mutual fund trades settle at the end-of-day net asset value).

Vanguard Total Stock Market Index Signal Shares (VTSSX ), which are now closed to all investors and set to be phased out, have the same 0.05% expense ratio. Meanwhile, the Investor share class, Vanguard Total Stock Market Index (VTSMX ), has a higher expense ratio of 0.17%, though they do have a minimum initial investment of just $3,000.

The same story can be told across Vanguards entire selection of index funds and ETFs.

Vanguard Total Bond Market Index Admiral Shares (VBTLX ) have an expense ratio of 0.08% and an initial purchase of $10,000. Vanguard Total Bond Market Index ETF (BND ) has no initial purchase minimum but the same expense ratio of 0.08%. If you cant put up the initial ten grand, you can buy the Vanguard Total Bond Market Index Investor Shares (VBMFX ) for $3000 but at a higher expense ratio of 0.20%.

When It Makes Sense to Buy a Vanguard ETF Rather Than the Index Fund

To repeat a previous point, one outstanding feature of ETFs is their ability to trade intraday like a stock, whereas mutual funds can only trade at the end of the day. When looking to take advantage of price movements (or in anticipation of a price movement), ETFs can be advantageous.

For example, like with stocks, a ETF investor can place a stop-loss order that will trigger the sale of the respective ETF at a pre-determined price. This can be quite useful in a rapidly declining price environment.

To boil everything down, there are only two basic reasons to buy Vanguard ETFs instead of the comparable Vanguard index funds:

- If you want the ability to place minute-by-minute, intraday trades

- If you cant afford the Admiral share minimum initial purchase.

Otherwise, the clear winner in the Vanguard index funds vs Vanguard ETFs competition is the index funds if you can get the Admiral shares.

As of this writing, Kent Thune did not hold a position in any of the aforementioned securities. Under no circumstances does this information represent a recommendation to buy or sell securities.

investorplace.com/2014/09/vanguard-index-funds-vs-etfs/.