Vanguard Important information about leveraged and inverse ETFs and ETNs

Post on: 21 Апрель, 2015 No Comment

Exchange-traded funds

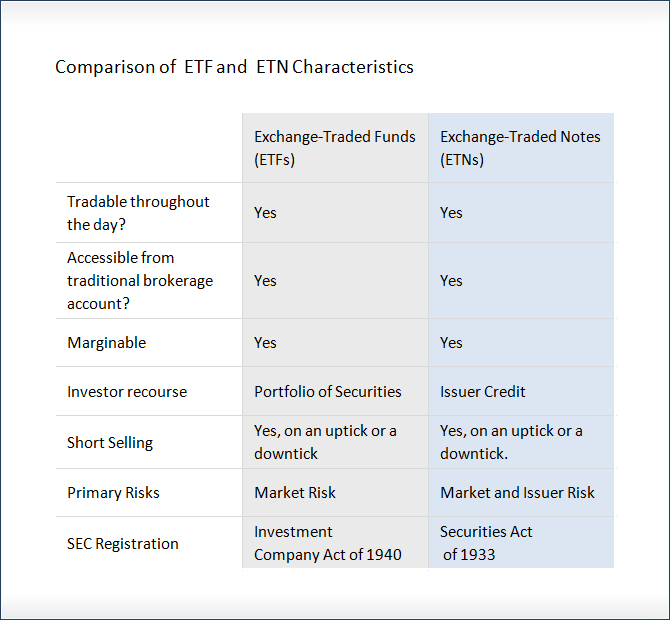

All exchange-traded funds (ETFs) are subject to trading risks similar to those of stocks. ETFs can entail market, sector, or industry risks similar to direct stock ownership. Generally, an ETF is a type of investment company whose investment objective is to achieve the same or similar return as a particular market index or stated objective.

Exchange-traded notes

Exchange-traded notes (ETNs) are senior, unsecured, unsubordinated debt securities issued by a bank or financial institution that have a maturity date and seek to mimic the return of certain equity, commodity, and currency indexes. ETNs offer returns linked to the performance of a particular market index, but they represent no ownership interest in a pool of securities, pay no periodic coupon interest, and offer no principal protection. The purchaser of an ETN is buying a debt instrument backed only by the creditworthiness of the issuer. Therefore, the performance of an ETN may be affected by both the performance of the particular index as well as the credit rating of the issuer. In addition, the tax treatment of ETNs is uncertain at this time.

Leveraged and inverse ETFs and ETNs

Leveraged and inverse products are unique and involve additional risks and considerations not present in traditional products. Leveraged products are often identified with a multiplier in their names, such as 2x or 3x, or may have a fund-specific description such as ultra. These funds are designed to double or triple the performance of a particular index over a stated period of time. Similarly, inverse or short products are designed to deliver the opposite return of an index, or, in the case of a leveraged inverse fund, a multiple of the opposite return of the index. Because the products reset over short periods of time, they are designed to deliver their stated returns only for the length of their reset periods. Most leveraged and inverse ETFs and ETNs currently reset on a daily or monthly basis and are therefore designed to deliver their stated returns for the reset period only (i.e. one day or month).

What does this mean? On any given day, an investor who uses a leveraged or inverse product can expect a return very similar to the stated objective. However, because of the structure of these products, their rebalancing methodologies, and the math of compounding, extended holdings beyond one day or month, depending on the investment objective, can lead to results very different from a simple doubling, tripling, or inverse of the benchmark’s average return over the same period of time. This difference in results can be magnified in volatile markets. As a result, these types of investments are generally not designed for a buy-and-hold strategy, even if the hold period covers only several days. Such funds are not intended to be used by investors who do not intend to actively monitor and manage their portfolios. These funds are riskier than alternatives that do not use leverage.

Examples: Assume you purchase a leveraged ETF that is designed to double the return of a particular index on a given day. You purchase the ETF for $100 per share, and the applicable index is at 10,000 that day. The next day, the index is up 10%. You could expect your ETF share to increase by 20% to $120. However, let’s say that on the following day, the index declines back down to 10,000. This decrease would constitute a daily decline in the index of 9.09% (from 11,000). The leveraged ETF would have a corresponding daily decline of 18.18%. The ETF share would be priced at $98.18 ($120.00$21.82). Thus, even though the index is flat over the two-day period, the leveraged ETF has suffered a loss over the same time period.

The following actual performances occurred between December 1, 2008, and April 30, 2009, and highlight the above hypothetical:

- The Dow Jones U.S. Oil & Gas Index gained 2%, while an ETF seeking to deliver twice the index’s daily return fell 6%. The related ETF seeking to deliver twice the inverse of the index’s daily return fell 26%.

- An ETF seeking to deliver three times the daily return of the Russell 1000 Financial Services Index fell 53%, while the index actually gained around 8%. The related ETF seeking to deliver three times the inverse of the index’s daily return declined by 90% over the same period.

Investors should understand the investment objectives of the funds they are purchasing. Before investing, you should read the prospectus carefully. Should you have any questions, please contact Vanguard Brokerage Services at 800-339-5024.

For additional information, please see this Investor Alert issued by the SEC and FINRA related to leveraged and inverse ETFs.

Risks of commodity ETFs and ETNs

Commodity exchange-traded products (ETPs) are investments that are traded on an exchange, similar to individual stocks. The price and value of the product may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity.

Commodity ETPs may be subject to greater volatility than securities ETPs and may not be appropriate for all investors. Unique risk factors of a commodity product may include, but are not limited to, the product’s use of aggressive investment techniques, which can include the use of options, futures, forwards, or other derivatives; correlation or inverse correlation; market price variance risk; and leverage.

Understanding commodity ETFs and ETNs

Investors who buy a commodity-linked product should know that its performance may deviate significantly from the performance of the actual referenced commodity. This is because many of these products do not physically hold commodities, but instead hold or track indexes based on futures or other derivative products.

A futures contract is an agreement to buy or sell a commodity at a certain date for a predetermined price, so its value generally moves along with spot prices of the commodity. However, this correlation is imperfect. In order to avoid taking physical possession of the underlying commodities, commodity products conduct a regular roll process, selling contracts nearing expiration and using the proceeds to purchase longer-dated futures contracts. This process of buying longer-dated futures contracts can sometimes be more expensive than simply buying and holding the underlying commodity due to changes in the spot price of the commodity and the amount of time value in the futures contracta situation known as contango. Therefore, if the market for a particular commodity is subject to contango, the performance of a commodity-linked product will deviate from the spot-price change of the commodity over the same period of time.

Before investing in a commodity ETPor any ETPinvestors should carefully read the prospectus and consider the product’s objectives, risks, charges, and expenses.

ETF Shares can be bought and sold only through a broker (who will charge a commission) and cannot be redeemed with the issuing fund. The market price of ETF Shares may be more or less than net asset value.