Vanguard Fund Ratings 10 Best Vanguard ETFs to Build a Portfolio

Post on: 29 Март, 2015 No Comment

6 Best Vanguard Portfolios for 2015 Included

At Remonsy ETF Network, we specialize in analyzing Vanguard Funds and building Vanguard portfolios. Here is our list of the 10 best Vanguard ETF and Index Funds to use for building a portfolio.

Following the list are the six best Vanguard portfolios for 2015.

10 Great Vanguard Funds to Build The Best Vanguard Portfolios

- Vanguard S&P 500 ETF (VOO) or (VFIAX) – This fund buys the 500 stocks selected by S&P to represent the U.S. large cap stock universe. It has the advantage of being an index that is recognized and purchased around the world. A limited number of stocks with growing global demand, and an incredibly low 0.05% expense ratio, make this a good core holding for your portfolio.

- Vanguard Extended Markets ETF (VXF) or (VEXAX) – This fund contains all of the U.S. common stocks regularly traded on the New York Stock Exchange and the Nasdaq over-the-counter market, except those stocks included in the S&P 500 Index. This fund fills in the blanks that are missing from the S&P 500 Index. It holds a total of 3,078 US stocks, mostly mid and small caps, which gives you fantastic coverage of the U.S. stock market.

- Vanguard Total Stock Market ETF (VTI) or (VTSAX) – When you want one fund to cover all of the stocks, except the micro-caps, from the Vanguard S&P 500 and the Vanguard Extended Markets funds listed above, you can use the Vanguard Total Stock Market fund. This ETF holds 3,772 different stocks. I prefer using the two above funds to cover the U.S. market to take advantage of the ability to fine tune the risk of the portfolio, but if the portfolio needs only a small exposure to U.S. stocks, then I prefer using this one broad based holding.

- Vanguard Total International Stock ETF (VXUS) or (VTIAX) – This fund tracks the market-cap weighted FTSE Global All Cap ex US Index, which covers 99% of the world’s global market capitalization outside the US. The ETF holds 5,512 stocks from 46 developed and emerging markets.

- Vanguard FTSE Emerging Markets ETF (VWO) or (VEMAX) – This fund offers investors a low-cost way to gain equity exposure to emerging markets. The fund invests in stocks of companies located in emerging markets around the world, such as Brazil, Russia, India, Taiwan, and China. The Vanguard Total International Stock fund listed above already includes these same Emerging Markets stocks, but because it is market-cap weighted they do not have nearly as much influence as the larger companies in the fund. Due to the high volatility, I only add this Emerging Markets fund to my higher risk portfolios.

- Vanguard Long Term Bond ETF (BLV) or (VBLTX) – This fund tracks the Barclays U.S. Long Government/Credit Float Adjusted Index. This Index includes all publicly issued medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities of greater than 10 years. This ETF uses a sampling method to replicate this index and currently holds 1,658 bonds.

- Vanguard Intermediate-Term ETF (BIV) or (VBILX) – This fund tracks the performance of the Barclays U.S. 5–10 Year Government/Credit Float Adjusted Index. This Index includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities between 5 and 10 years and are publicly issued. The Fund invests by sampling the Index and currently holds 1,522 bonds.

- Vanguard Short Term Bond ETF (BSV) or (VBIRX) – This fund tracks the Barclays U.S. 1-5 Year Government/Credit Float Adjusted Index. This Index includes all publicly issued medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities between one and five years. This ETF uses a sampling method to replicate this index and currently holds 1,796 bonds.

- Vanguard Total Bond Market ETF (BND) or (VBTLX) – This fund is designed to give a broad based exposure to most U.S. bonds with an amazing 6,979 different bonds. I use this fund when my efficient frontier allocation calls for mortgage backed assets as well as the three bonds funds listed above, which happens in two of my six portfolios. It is better to purchase one fund instead of four. However, I do not use it across all models because I want more short-term bonds in my conservative portfolios, and more long-term bonds to hedge my more aggressive portfolios.

- Vanguard Total International Bond ETF (BNDX) or (VTABX) – This fund tracks the Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). The Index includes government, government agency, corporate, and securitized non-U.S. investment-grade fixed income investments. They are all issued in currencies other than the U.S. dollar, with maturities of more than one year. To minimize the currency risk, the ETF will attempt to hedge its currency exposures. The ETF currently holds 2,246 bonds.

Using these 10 Vanguard Funds has several advantages for portfolio development:

- Incredible global diversification with 9,090 stocks and 7,222 bonds.

- Vanguard started the first index funds. This is helpful when designing portfolios because Vanguard has relatively long-term track records, which is important for researching proper asset allocation.

- Vanguard ETFs are exactly the same portfolio as the Index funds, with the only difference being the internal costs. This allows us to examine the index fund’s longer-term track record and use the ETF as needed. No other company has this.

- These 10 investments give me tremendous flexibility to design different portfolios from conservative to aggressive.

6 Best Vanguard Portfolios for 2015

Here are six portfolios that were made using the 10 Vanguard Funds listed above. They are listed in order of risk, with the most conservative portfolio first. See How to Make an Investment Portfolio: 6 Steps to Better Investing for a full explanation of how these portfolios were created. Also, download our free report on Vanguard Funds to see all of the return and risk data for each of these portfolios to find the portfolio that fits your needs.

Comments. This portfolio is designed to provide preservation of principle. It has the lowest historical drawdown of all the portfolios in this article. It has a good track record through these last two downturns. With the large short-term bond holding, it is also fairly well placed if we have higher inflation.

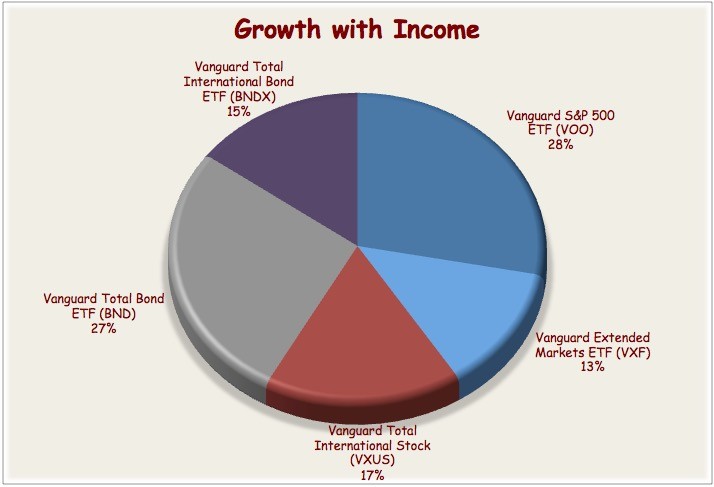

Comments. This was the second most popular portfolio with my clients. These clients were very interested in growth, but they did not want to give up some of the balance that bonds provide. If you can handle the potential drawdown, then this portfolio will probably be one of your favorites, too.

Comments. If you are looking for a high growth, globally balanced, aggressive portfolio with a long-term bond hedge, then this is your portfolio. The drawdown was as much as the S&P 500 Index, but the recovery time was much shorter, which shows the power of asset allocation.

If you enjoyed these portfolios, you will certainly like my 50-page Vanguard free report.

This report is full of critical information for the Vanguard investor. I disclose my Retirement Income Builder Program and I share my six risk-calibrated, easy-to-copy Vanguard ETF portfolios.

Click on the link below and I will email the report to you. You will also have the option of receiving my free email newsletter where you can see my best articles, delivered to your inbox, before anyone else.

Would you like a happy retirement? Download our FREE report Retirement Income Builder: 6 Easy to copy Vanguard Global Portfolios with time-tested retirement planning advice for every investor. Learn more.

Additionally, here are our top three Vanguard ETF portfolio articles, which provide more insight on building the best Vanguard ETF portfolio:

Updated on 1/20/15.

Remonsy ETF Network exists to enhance your life-long investing success by providing independent and authoritative investment advice you can trust. Landmark academic financial studies, proprietary in-depth research and over a quarter century of real world financial advisory experience during good times and bad provide the foundation for our time-tested, proven investing guidance. And most important, we work only for you: We dont hold or manage your money. We dont earn trading commissions. And we dont take money from investment companies.