Vanguard FTSE Europe ETF SPDR STOXX Europe 50 ETF Best European ETFs To Buy In An Uncertain Market

Post on: 16 Март, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

Also, growing tension in Russia and escalating violence in Iraq dampened the economic recovery and led to waning business confidence in the region. The recent Malaysian Airlines jet crash near the Russian/Ukrainian border has deepened the conflict between the two nations. This came on the back of fresh sanctions imposed by the U.S. against Russia.

The Good News

Though things might not be in good shape within the economy, they are however gradually improving. The corporate earnings picture in Europe is expected to be better than previously estimated.

Earnings for the S&P Europe 350 are projected to expand by 7.1% during the second quarter, which is a more than five percentage point improvement from the forecasts back in April, according to Wall Street Journal .

Companies in the S&P Europe 350 stock index are expected to report 10.2% growth in earnings this year as compared to 7.8% expected for U.S. companies .

Also, while profits for U.S. companies are at record levels, European earnings are still quite low as compared to before the financial crisis. This indicates that European earnings still have more room for upside, holding out hope for their equities.

Moreover, ECB’s easy monetary policies are likely to provide further boost to European equities. While the Fed is winding down its asset buying program, the ECB is implementing easy monetary policies and rumors are rife that it might even have to resort to quantitative easing to bring its economy back to health (read: Negative Interest Rates Put These European ETFs in Focus ).

Further, after a five-year bull run, most of the U.S. stocks look pretty expensive with stretched valuations. On the other hand, the European recovery is just one-year old and the European stocks are still trading significantly lower than their pre-crisis levels.

European stocks traded at a 23% discount to U.S. stocks at the end of the second quarter, as reported in an article by Paul J. Lim. This is quite higher than the historical average discount of 12%, suggesting that European stocks have much room for upside and might outperform U.S. stocks since they are relatively cheaply valued.

What Should Investors Do?

Admittedly Europe is showing a sluggish economic recovery amid heightening concerns of a geopolitical crisis not seen since the end of the Cold War. Despite this, the continent still provides investment opportunities and is relatively trading at cheaper valuations as compared to the U.S.

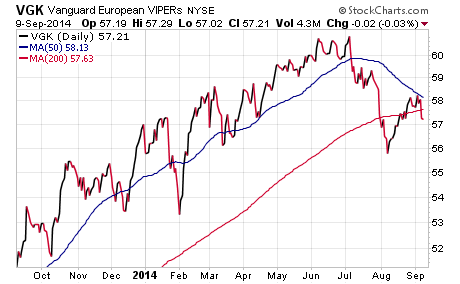

Many investors might be left wondering which ETFs to invest in given the difficult times. This is especially true as almost all the European ETFs have yielded negative returns in the past one month.

One way to narrow down the list is to utilize the Zacks ETF Rank. This system looks to find the best ETFs in a given market segment based on a number of factors including market outlook, expenses and tradability.