Vanguard Dividend Lineup

Post on: 27 Май, 2015 No Comment

If you have been following me for some time now, you know that I often suggest investors build up a core index portfolio before taking on dividend investing through individual dividend growth stocks. One way to look at that core portfolio is to consider Vanguard s extensive lineup of dividend orientated funds.[ad#tdg-embedded]

Vanguard is best known for their low cost indexing approach to investing. Personally, I hold Vanguard Emerging Markets Stock ETF, the Vanguard REIT Index ETF. the Vanguard Value VIPERs, and the Vanguard Small-Cap Value ETF. I have been furthering my research into their dividend focused funds and can offer the following summary of the funds that have available with a dividend based focus.

Vanguard Dividend Appreciation ETF (VIG)

Vanguard Dividend Appreciation ETF seeks to track the performance of a benchmark index that measures the investment return of common stocks of companies that have a record of increasing dividends over time. 0.24% MER.

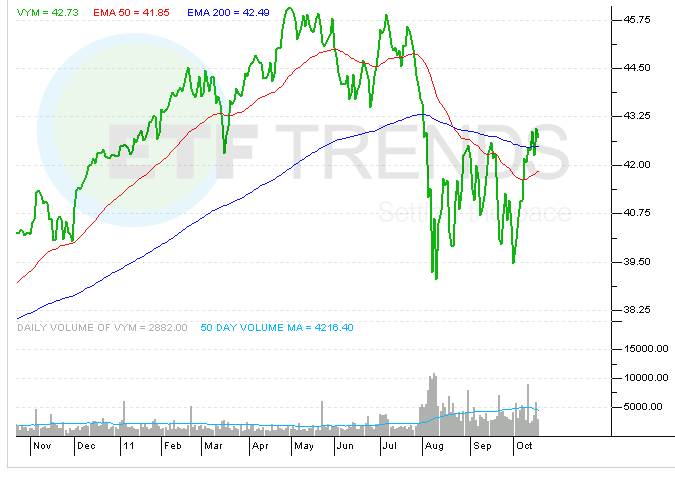

Vanguard High Dividend Yield ETF (VYM)

Vanguard High Dividend Yield ETF seeks to track the performance of a benchmark index that measures the investment return of common stocks of companies that are characterized by high dividend yields. 0.20% MER.

Vanguard Wellesley Income Fund Investor Shares (VWINX)

Balanced fund of roughly two-thirds high-quality bonds, one-third dividend-paying stocks. Has typically offered higher income than most other Vanguard balanced funds, with moderate movements in share value. 0.31% MER.

Vanguard Dividend Growth Fund (VDIGX)

Seeks a growing stream of income and long-term growth of capital. Invests primarily in large-capitalization stocks with a history of paying stable or increasing dividends from all industry sectors. Follows a value-oriented strategy in selecting stocks that the advisor believes to be undervalued. 0.38% MER.

Vanguard High Dividend Yield Index Fund Investor Shares (VHDYX)

Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high dividend yields. Provides a convenient way to track the performance of stocks with histories of above-average dividend yields. Follows a passively managed, full-replication approach. 0.35% MER.

Not all of these funds are going to be appropriate for everyone. Some require higher amounts to initiate a position. I tend to stick with the ETFs as I can buy without minimums when I have money to allocate to that specific asset class the fund represents.