Vanguard Brokerage Review Retirement Funds Investments

Post on: 5 Июль, 2015 No Comment

Vanguard is one of the most renowned online stock brokerages out there today. Founded by John C. Bogle, the creator of the first index fund, Vanguards investing philosophy is low-cost, long-term, and no-hassle.

Vanguard offers the full gauntlet of investing services including IRAs. 401k rollovers, 529 college savings plans. mutual fund accounts, brokerages services, options. and ETFs. However, they are most famous for their low-cost index funds, which are a type of mutual fund that invests broadly across a market with the goal of keeping costs low while maintaining diversification .

Heres a rundown of the funds and accounts Vanguard offers, the pros and cons of their services, and the type of investor Vanguard is best suited for.

What Are Vanguard Funds?

There are over 100 Vanguard-designed index funds, actively managed funds, and ETFs available through Vanguard. These funds are popular due to their industry-low expense ratios, performance, and diversification.

Vanguard has funds that specialize in retirement, short-term savings, college savings, and virtually every other investing situation imaginable. These funds are so renowned that Money Magazine recently chose 24 of Vanguards mutual funds for its Money 70 list of best mutual funds .

Types of Investment Accounts

Mutual Fund Accounts

This account is for investing in Vanguard mutual funds outside of retirement accounts. There are no tax advantages, but you can withdraw money at any time and there are no limits to how much you can invest.

The average expense ratio of these funds is just .21% while the industry average is over 5 times that at 1.15%. The account service fee is $20, but if you sign up for electronic statements they waive the fee.

IRAs & 401k Rollovers

These are tax-sheltered accounts for retirement. Among the most popular choices for IRA investing are the simple and cost-effective Target Retirement Funds. To invest in these funds, you choose how many years you have until retirement and Vanguard determines the appropriate fund for your age.

For example, a 25-year-old can invest in the Vanguard Target Retirement 2050 Fund. This fund starts off aggressively allocated at 90% stocks (made up of 2 other Vanguard funds) and 10% bonds. As time goes on, the fund becomes more conservative with a larger percentage allocated to bonds as retirement nears. Its all automatic and requires no effort on your part besides opening an account and depositing money each year.

If the Target Retirement Funds dont fit your investing needs, you can still choose from any of the over 100 Vanguard mutual funds for your IRA. These accounts have no service fees if you sign up for electronic statements and pay no commissions, which would otherwise increase their expense.

Also, if youve recently retired or lost your job and need to make a decision on your 401k plan, Vanguard can walk you through the 401k rollover process. Instead of facing unnecessary taxes for retirement accounts and penalties by withdrawing 401k funds, roll over your 401k to an IRA. Then, invest cheaply in one or more of the many Vanguard funds.

Brokerage Services

You can open a Vanguard Brokerage Services account and purchase individual stocks, mutual funds, bonds, and CDs from other companies. A Brokerage Services account costs $20 a year and offers you access to any stock or mutual fund.

With a Vanguard Brokerage Services account, each trade is $7 for the first 25 trades and $20 for each subsequent trade if your account has under $50,000. For accounts between $50,000 and $500,000, all trades are $7. Trades for accounts with $500,000 to $1,000,000 are just $2. Because of trade fees, Vanguard may not be suitable for active investors with modest portfolios.

If you already have a Brokerage Services account, you can also open an options account. Vanguard charges $30 plus $1.50 per options contract. If you have Flagship Services (accounts over $1,000,000) then options cost just $8 plus $1.50 per contract. Vanguard is most suitable for the infrequent options trader who may require or desire assistance with options trades.

Vanguard ETFs

Once you have a Brokerage Services account, you can invest in Vanguard ETFs. These funds are similar to mutual funds, but are traded throughout the day on an exchange, like stocks. Vanguard ETFs have no transaction costs and the average fund expense ratio is only .17%. The industry average is .53%.

529 College Savings Accounts

If youre thinking about your childs future school expenses, Vanguard offers a 529 Plan. 529 savings plans allow you to save for college expenses on a tax-advantaged basis. For more information, they provide a helpful 529 Plan page to guide you through the process.

Annuities

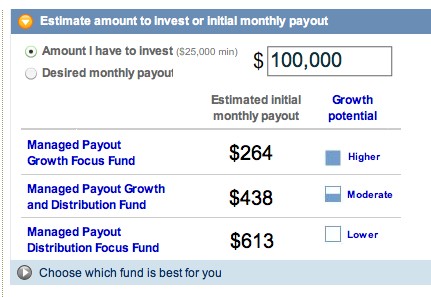

Annuities are an insurance product that help you save for retirement and can make your money last throughout your golden years. Vanguard offers both fixed annuities and variable annuities with annual costs that are significantly lower than the industry average. Check out Vanguards annuities overview for more information.

Advantages

1. Low Fees for Vanguard Funds

Keeping expenses at an industry low is what Vanguard prides itself on. Their average annual mutual fund expense is almost 1% lower than the industry average. While a single percentage point may seem insignificant to you, consider that it can save you tens of thousands of dollars in fees over the course of a long-term investment.

Vanguard also offers Admiral Shares. which have extra-low expense ratios of just 0.18% for over 60 funds when the investment amount reaches $10,000. Sticking with the no-hassle investing experience, Vanguard automatically promotes your shares to Admiral once you reach the $10,000 minimum.

Remember, Vanguard charges no account service fee as long as you sign up for electronic statements.

2. Clean User Interface

Unlike some investing and trading sites, Vanguard doesnt bombard you with stock tickers and overused screen space. Vanguard wants you to enjoy every aspect of your investing experience. This is one area where Vanguard has the edge over other stock brokerages like Schwab or E*TRADE .

Once youve purchased a fund or stock, its very easy to find performance tracking options to monitor your investments. With their tools you can track investments, performance, taxes, and asset allocation in seconds.

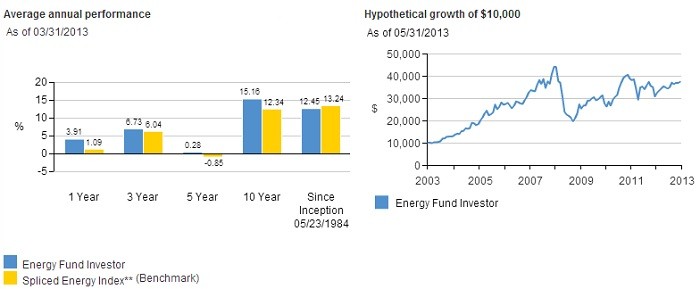

The individual fund pages are also well-organized. You can easily locate expense ratios, account minimums, holdings, dividends, risk, and past performance with barely a mouse scroll.

3. No-Hassle Investing Experience

My favorite aspect of working with Vanguard is the respect they show their customers. They wont sell you on their newest products or bombard you with worthless messages that clog your inbox. Only the most vital correspondence like trades or statements makes it to your email.

4. Noteworthy Blog & Learning Services

Vanguard offers its customers accessible educational information about saving, money management, and retirement. They also keep a thought-provoking blog to help customers increase their investing knowledge.

These two offerings promote the Vanguard culture of low-cost, long-term investing. They also host guest posts from noteworthy authors as well as guest lectures and videos.

Disadvantages

1. High Minimums

One problem new investors have with Vanguard is their high minimums. Their funds have a minimum initial investment of $3,000 or more and are non-negotiable. In comparison, Charles Schwab will waive their $1,000 minimum if you sign up for automatic transfers to your investment account. And Scottrade has a minimum of only $500.

However, if you find $3,000 too steep, Vanguard offers the STAR fund , which is an index fund made up of 11 other Vanguard funds. You can start investing in the STAR fund with only $1,000, and once your balance gets above $3,000, you can transfer your money to any other Vanguard fund.

2. Trading Costs for Brokerage Services

Most Vanguard accounts will incur $7 commissions for stock trades, which is an extremely competitive rate in the industry. However, if you want to trade actively, consider a discount broker that charges even lower fees.

For example, TradeKing charges a flat $4.95 for trading stocks, options, and ETFs. OptionsHouse is a very cheap brokerage that charges just $2.95 per stock trade, and INGs Sharebuilder charges $4 per trade and has great automatic investment options. Keep in mind that discount brokers will generally offer less service than a company like Vanguard, but they will offer the most competitive rates.

Note: If your Vanguard account is between $500,000 and $1,000,000, your brokerage commissions will only be $2.

Who Is Vanguard Best Suited For?

Much of Vanguard is crafted for the long-term, buy-and-hold investor (i.e. passive investing ). Their emphasis on index funds and low annual fees most benefits this style of investing and is the core of their company philosophy.

When you roam Vanguards site, you will see a lot of information speaking to investors who want to invest just once a year and check their investments progress every couple of months. If youre looking for a more active trading experience, however, consider other brokerages that charge lower commissions or offer better tools for active investing .

With that said, Vanguard does offer a wide selection of options and services, and competitive rates for active investors with large account balances. Active options traders and investors interested in trading less common instruments, such as futures, commodities, and other financial derivatives. will be better off going elsewhere.

Final Word

Vanguard is a great example of how simple investing on the Internet can be. When youre investing tens of thousands of dollars, you want your online brokerage to be on your side and not working against you. The fact that Vanguard wants your money to stay in your account and not funneled out via high annual expenses confirms this.

After three years with Vanguard, Ive recommended their services to countless friends and family members because they treat their customers like close friends, not just business partners. They dont want to gouge you with fees, but instead want to make sure your nest egg grows from year to year so you feel safe and secure.

Do you have any experience investing with Vanguard? What are your thoughts?