Value Stocks Versus Growth Stocks What Kind Of Investor Are You

Post on: 18 Июль, 2015 No Comment

Stay Connected

Investors are easily divided into two major camps: value and growth. However, it is easy to confuse the two or to think you are taking one approach when your portfolio contradicts that assumption.

Both value and growth investment theories have strong advocates and a case can be made for both. Some investors diversify their portfolios by combining the two into a unified strategy.

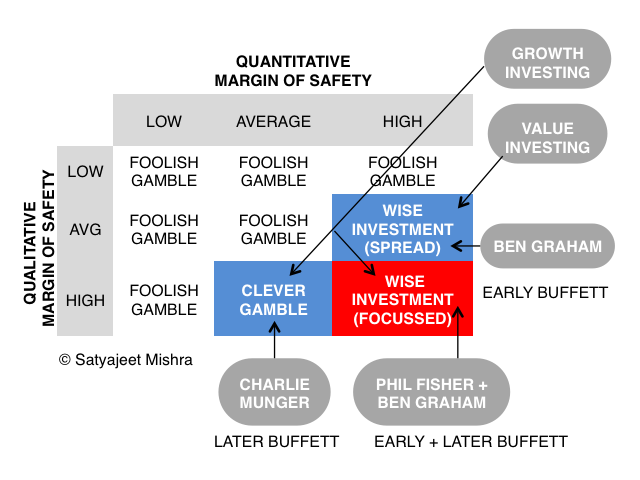

A value investor looks for bargain price levels on stocks of exceptionally well managed companies, have a long history of competitive strength in their sector, and have very strong financial positions. The typical value company has a low to moderate P/E ratio and a higher than average dividend yield.

A growth investor views value companies as taking too long to produce returns. This investor prefers a higher than average P/E, very strong and fast growth in revenues, and exceptional return on equity and profit margin. Growth companies are likely to pay very low dividends or no dividends at all.

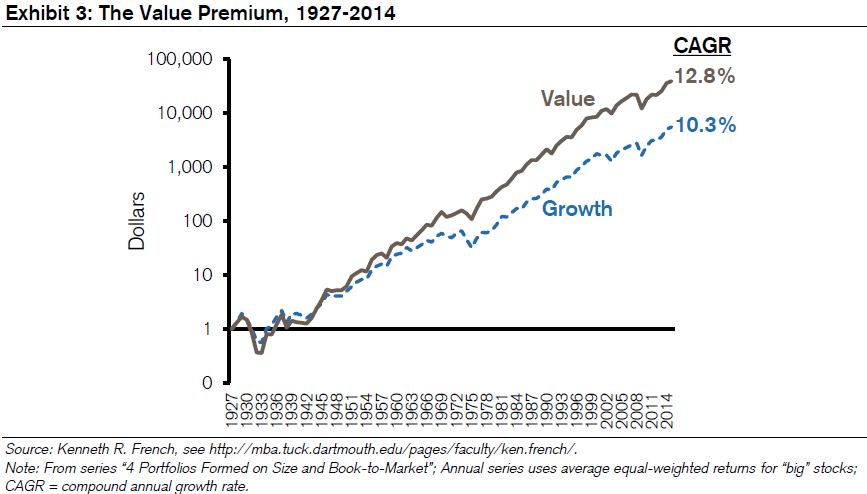

Which is better? In fact, value and growth stocks have both had their years of out-performing their rivals. But the reasons have to do with economic and market factors and not so much on which investment strategy is best. During times of economic expansion and a strong bull market, growth stocks are more likely to out-perform the more conservative value investments. However, good times invariably come to an end and often surprise even the most astute market watchers. When the market turns, growth stocks tend to lose value much more quickly than value stocks.

In other words, the distinction between the two sides is not just a matter of where profits are more likely to occur; it is, more significantly, a matter of risk. The degree of risk you are willing and able to take in a particular market defines what kind of investor you should be.

Problems arise when you invest contrary to your risk tolerance. For example, if you are more conservative than the average investor and you define yourself as seeking value over growth, does your portfolio reflect this goal? If it does not, then you may enjoy higher than typical profits, but your market risk exposure may be way too high, given your self-defined conservatism.

The prudent course is to constantly evaluate and reevaluate your portfolio to make sure the choices you make are consistent with your risk tolerance; to balance between value and growth accordingly; and to periodically review and question your own assumptions. As you gain experience in the market, as your earnings grow, and as your family situation changes (marriage, birth of a child, etc.) your risk tolerance evolves as well, and you are going to need to make adjustments.

The question of whether you are better off as a value or a growth investor relies on all of these dynamic factors. Even if you defined your risk tolerance a year ago, it deserves a new look today. You might discover that over even a single year, you have become a different kind of investor.