Value Investor Is the bad news priced in for iron ore

Post on: 12 Август, 2015 No Comment

Last week iron ore broke through the psychological price barrier of US$100 a tonne for the first time since September 2012. So far this year, the price of iron ore has plunged 27 per cent, taking it well into bear market territory, reaching $US95.70 yesterday.

The recent federal budget included a forecast decline in iron ore prices to US$90 per tonne by June 2016. Iron ore prices are crucial to both budget revenue forecasts and shareholder returns of Australian equity investors.

So what’s behind the price drop?

First, Chinese and global steel prices are softening and iron ore is selling off in sympathy, as it is an input to steel production.

Figure 1. Chinese and Global Steel prices

Sources: Thomson Reuters Datastream, Clime Asset Management

The poor sentiment on steel has not been helped by the softening Chinese property market.

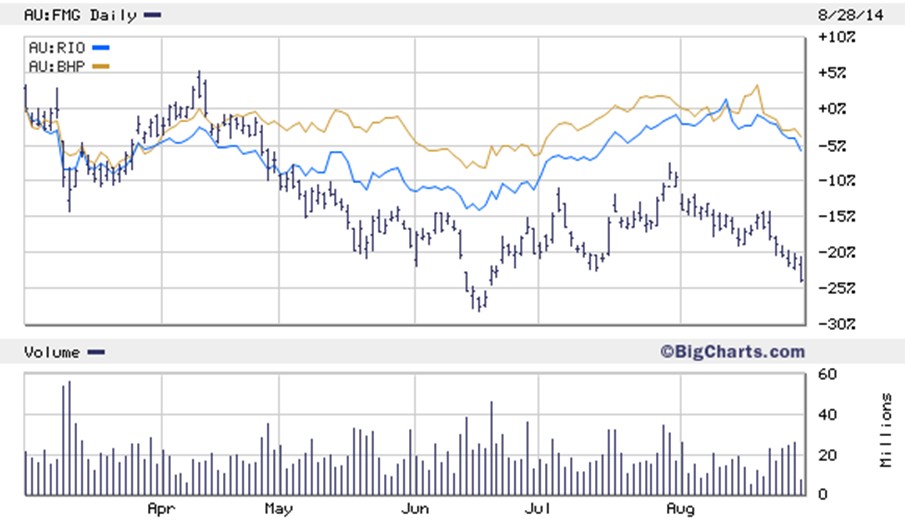

Meanwhile, global supply of iron ore is ramping up as diversified and single-metal miners add to supply. For example, BHP Billiton and Rio Tinto have both announced record production guidance.

There are unconfirmed suggestions the banks have cracked down on property developers and others using iron ore as collateral to obtain bank financing.

We don’t see the current sell-off in iron ore as a product of the earlier spike in Chinese iron ore port inventories, as that effect is now unwinding.

For domestic firms, given that iron ore is a dominant export for Australia (accounted for 22 per cent of exports in 2013), we might expect some currency depreciation, which would help miners to translate foreign earnings into Australian dollars. However, the currency has not provided much relief it is still high at over US92c.

Despite the recent downward trend, our view on the iron ore price is not deeply bearish, as a price around current levels will eventually see higher-cost producers which are uneconomic at current prices suspend production. However, we are not bullish either, as supply from low-cost miners is rising quickly.

Looking forward, the possible upside to the iron ore price is that the bad news could now be priced in and any unexpected good news would likely trigger a squeeze of short positions. This could happen, for example, if the Chinese authorities introduce fresh stimulus to meet their growth forecast of 7.5 per cent.

The downside is further weakness in iron ore, caused by bullish production guidance by miners, renewed softening in China’s property market and slippage in China’s economic growth.

A fall in iron ore prices would clearly affect iron ore producers; BHP Billiton, Rio Tinto, Fortescue Metals, Atlas Iron, BC Iron and Mount Gibson. The effect on each company depends on where each miner sits on the cost curve.

Figure 1 – Mining Industry Cost Curve

Source: Rio Tinto

We can see that BHP Billiton, Rio Tinto, Fortescue Metals and Brazil’s Vale are at the lower end of the global cost curve and are well-positioned, as they remain profitable down to $50-60/tonne.

Meanwhile, mid-cap mining companies such as Mt Gibson and Atlas, may face problems, should the iron ore prices fall further, given they are higher up the cost curve with a breakeven price of around $80/tonne. Generally, these companies came into existence due to the historically high iron ore prices over the last seven years. While they currently remain profitable, were the price to fall towards $80, they would struggle to break even.

Mid-cap miners also tend to mine lower-quality iron ore and cannot charge as much in the first place. Their cost base is higher due to their smaller size and they do not possess the same economies of scale as the larger miners.

It’s important to understand that none of the iron ore producers, with the exception of BHP Billiton due to its diversification, are suitable as long-term investments – unless you have a matching long-term bullish view on iron ore. Nearly all of them are cyclical trading stocks only, best bought during fear and pessimism and sold at premiums to value during optimistic times.

Analyst: Brian Soh and David Walker of StocksInValue , with insights from John Abernethy of Clime Asset Management .