Using Puts to Protect Your Portfolio

Post on: 16 Март, 2015 No Comment

At VectorVest workshops and webinars, we often talk about how to protect your profits. This can be driven by several different perspectives. Perhaps the VectorVest system suggests it’s an appropriate time to do so, or you hold some stocks that have reached significant gains or you want the upside of a stock and don’t want the downside. In any one of these situations, it may be a good idea to look at going long on a put option. Remember though, there won’t be a free lunch on offer!

In moving from the theory to the practical, you need to think about three things.

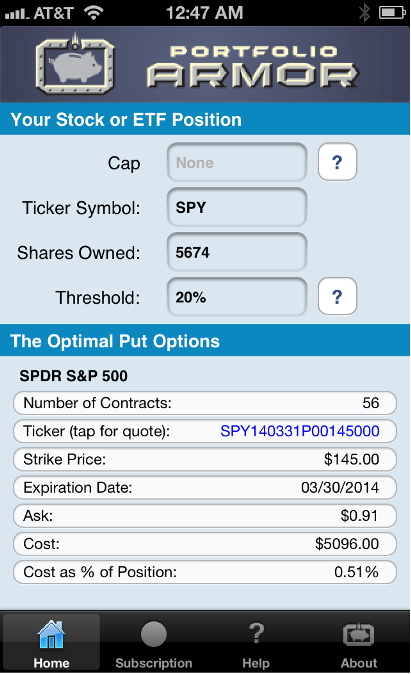

Firstly, what’s the trade off between gains and losses? Let’s walk through an example. Let’s say that you have bought a high VST stock three months ago and it’s delivered a 10% return. Are you willing to spend 3% of this on a premium which will ensure that you don’t have any of your initial investment? If this is too high, then you can spend less but this means you’re exposed to a little downside. After all, we make a return because we take a risk and hence, there is a payment involved in that risk is going to be hedged. In practical terms, you need to decide what price you want to lock in. i.e. what’s your strike price going to be? The higher this is, the greater the cost of premium. VectorVest has a very clear, distinct and proprietary way of setting stop loss; namely a 13-week moving average adjusted for risk. It’s much more difficult to create a defining system for choosing a protective put as the drivers of options pricing don’t allow for that given our friends (who are now going to turn into foes) called time decay and volatility .

Let’s start with the clock. While it’s great to have the downside protection on a position when you need it, the problem is that it disappears as soon as the option expires. This brings about another tradeoff; the longer the protection period, the higher the cost of the premium. If I’m an investor who tends to be buy-and-hold or perhaps I use the conservative indicator of the Confirmed Up and Down calls.

This leads you to your second question; for what period of time do you want to put these options in place. Unless you have a distinct myopic talent, you’re not going to know how long you’re going to hold your stock for and hence you need to choose between the short term and long term. In the short term, you could buy a rolling set of very short term options which will cost you little (but will aggregate quickly over time to a large amount), invoke lots of transaction costs but you will only ever buy what you need. In the long term, you can buy right out to almost two year long options (called LEAPS) which will cost you less on an overall basis, requires much less effort and transaction costs, but you may be left with an option on a stock that you no longer have. It’s like having insurance on a car you sold six months ago. Also, the further you go out in time, the more the upfront cost will be.

Finally, there is volatility. Naturally, the time that insurance is most valuable is when the thing being insured looks riskiest. Similarly, everybody wants to fly to safety when fear is swirling around the market. One clear way to measure this is by volatility and hence, the more volatile the price of the stock, the higher the cost of the premium. There is very little choice you have here except for will I buy the puts now (when I know the state of volatility irrespective of whether I like it or not) or later (when I don’t know what will happen either the stock’s price or that of the premium)? The market isn’t pricing in that you personally are taking this decision, so you may pick a good time or a bad time, but this really is a question of educated, opportunistic timing. Like all market decisions, if you buy them often enough over time, you will average out at the market average.

You can of course use them to generate growth from the downside or indeed to take a position on volatility so the above is far from exhaustive on the power of puts! In this piece, the focus is only from a protection point of view. This technique isn’t for everybody, but it’s good to know how to match a market motive with a way of doing so, if you want to make it a reality.