Using High Yield Bonds for Diversification

Post on: 13 Апрель, 2015 No Comment

High Yield Provides Diversification from Investment Grade Bonds, but not Stocks

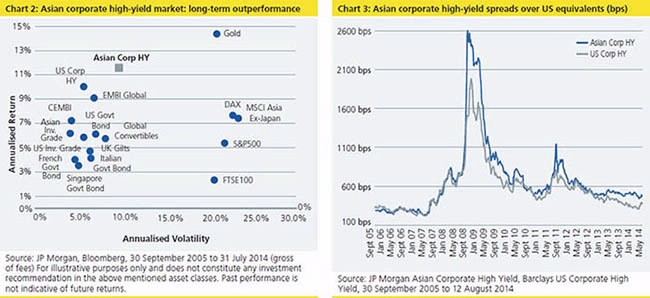

Investors who are looking to diversify their portfolios may find high-yield bonds to be very useful – but not necessarily in the way they may think. High yield is an effective diversifier for a portfolio that is heavily weighted in investment grade bonds, but not necessarily one that is tilted toward stocks. In other words, an investor who is stock-heavy and looking for a way to diversify his or her portfolio may find that high-yield bonds won’t help achieve the intended degree of diversification.

The Numbers

High yield bonds have had many attractive qualities over time, most notably their strong historical total return and their ability to provide higher income than most other types of investments. However, they also tend to track the performance of the stock market very closely. We know this by examining correlation data over time. Investors can compare the performance of two asset classes using correlation, a measure that runs on a scale from -1.0 to 1.0. A correlation of 1.0 signals perfect correlation (if asset A rises 10%, asset B rises 10%) while -1.0 indicates perfectly negative correlation (if asset A rises 10%, asset B falls 10%).

With that as the background, consider that from 1994 through February 2012, high yield bonds had a correlation of 0.64 with the Russell 1000 Index, a measure of the performance for the 1000 largest stocks in the U.S. market. The correlation has been even higher in more recent periods. In the five years ended May 2, 2013, the correlation between the largest high yield bond exchange-traded fund (ETF), the iShares High Yield Corporate Bond Fund (ticker:HYG), with the S&P 500 Index was 0.90 – indicating an extremely strong (and in fact, nearly perfect) relationship between the returns of high yield bonds and the stock market.

In contrast, high yield has a much lower correlation with investment-grade bonds: 0.38. In comparison to U.S. Treasuries, high yield has an even lower correlation. According to data compiled by Calvert Investments, high yield bonds had a negative correlation – -0.23 to be exact – during the ten years ended in 2011. Further, Peritus Asset Management – which operates the actively-managed AdvisorShares Peritus High Yield ETF (HYLD) – has calculated that in the 22 years through 2011, high yield bonds returned 14.1% on average during years in which yields on the five-year Treasury rose as its price fell. (Keep in mind, prices and yields move in opposite directions .)

What’s more, high yield bonds can perform well even when interest rates are rising. Financial advisor Sean Hanlon, writing for Forbes in May 2013, noted, (In) the period between June 2004 and July 2006, when the Fed raised rates 17 times. During this same period of time, high yield bonds rose 17%. Clearly rising rates did not spell doom for high yield bonds during those two years.

By looking at these numbers, we can conclude that high yield is a much more effective diversifier for a bond-heavy portfolio than one that is tilted toward stocks.

Why High Yield Tracks Stocks More Closely than Investment-Grade Bonds

The reason high yield moves in tandem with stocks has to do with the type of risks inherent in high yield bonds. While the primary driver of investment grade bonds is interest-rate risk, the most significant factor in high yield’s performance is credit risk. In other words, the performance of high yield bonds is more closely linked to the underlying results of the issuing companies than it is to interest rates – just as is the case with stocks.

The reason for this is that high yield companies are by their very nature more risky, perhaps with higher debt, shakier business models, or a more uncertain outlook than the typical investment-grade issuer. As a result, they are more sensitive to changes in business conditions. In this sense, they are much more like stocks than bonds.

At the same time, high yield bonds are less sensitive to interest rate movements than investment-grade bonds since their yields so high. In fact, high yield often outperforms the broader bond market during periods of rising rates .

High yield bonds are also similar to equities in the sense that they are considered a “high-risk asset.” When investors are feeling good about financial conditions, they tend to buy stocks and/or high yield bonds. When their risk appetites wane, both stocks and high yield bonds begin to seem less attractive. This dynamic doesn’t exist in the majority of investment-grade bond market. In fact, some areas of the market – most notably, U.S. Treasuries – can actually perform well when investors grow less optimistic due to a phenomenon known as the “flight to quality .”

The Bottom Line

Effectively diversifying a portfolio isn’t just about choosing a different asset class, but about choosing the right asset class. While high yield bonds offer a number of benefits, history has shown that they don’t provide true diversification relative to the stock market. However, investors with a heavy weighting in investment-grade bonds may find that high yield are an effective source of diversification, and one with less volatility than stocks.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Be sure to consult investment and tax professionals before you invest.