Using EDGAR Researching Public Companies

Post on: 16 Март, 2015 No Comment

The SECs EDGAR (Electronic Data Gathering, Analysis and Retrieval) database provides free public access to corporate information. The system allows you to research a companys activities, registration statements, prospectuses, and periodic reports, which include financial statements. EDGAR also provides access to correspondence about corporate filings reviewed by the SEC staff since August 1, 2004.

Searching EDGAR

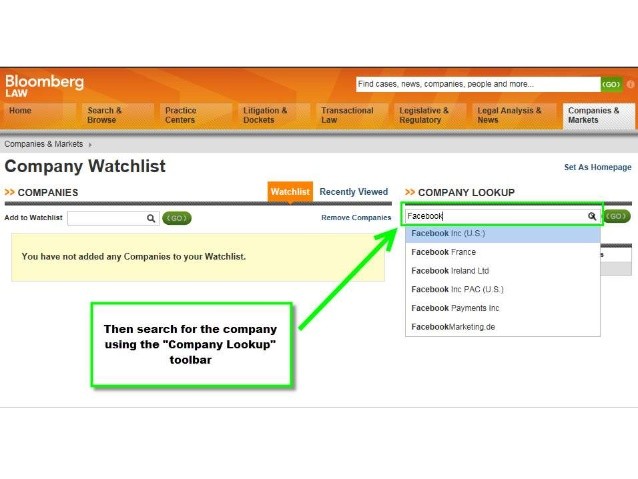

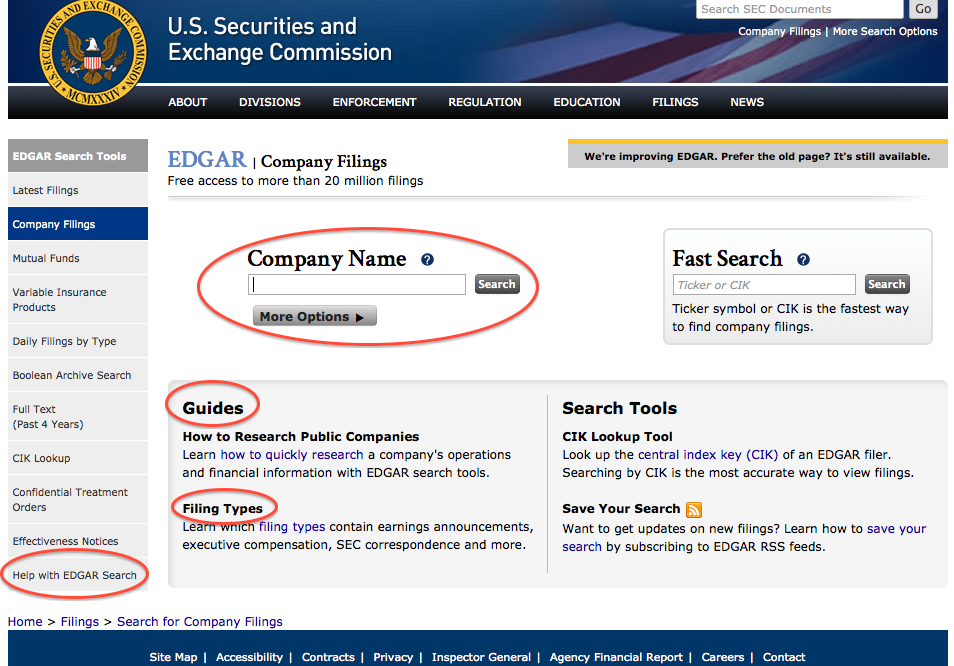

You can search the EDGAR database in several different ways. If you know the name of the company you want to research, or its ticker symbol, EDGARs Companies & Other Filers Search is a good place to start. The search results will be shown in a list, starting with the companys most recent filing. This is how the EDGAR search page looks:

Another option is to use the EDGAR Full-Text Search. which allows you to search the full text of EDGAR filings from the last four years based on keywords. Search results appear as a list of filings, beginning with the most recent. The type of filing is shown in the left-hand column.

Common Documents for Researching Investments

Here are the most common types of documents you will find on file with the SEC, which will help you research your investments:

Corporate Reports

Quarterly and annual corporate reports describe the business and include financial statements showing where the companys money came from and how it was spent. The required forms are:

- Annual Reports — Form 10-K . The annual report includes the companys history, audited financial statements, a discussion of products and services, a review of the organization and its operations, and a discussion of the companys major markets.

- Quarterly Reports — Form 10-Q. Each quarter, companies file unaudited financial statements and information about the companys operations in the previous three months. The 10-Q often compares the companys performance in the current quarter to the previous quarter, and to the same quarter in the prior year.

For additional information on how to read a companys financial statements, please read our Beginners Guide to Financial Statements .

There are four primary financial statements:

- Balance sheets show a companys assets and liabilities at a fixed point in time.

- Income statements show how much money a company made and spent over a period of time.

- Cash flow statements show the exchange of money between a company and the outside world over a period of time.

- Statement of shareholders equity shows changes in the value of owned stock in the company over time.

Other Reports

Other reports of interest to investors available on EDGAR include:

- Registration Statements. By law, public companies in the U.S. must disclose important financial information before they issue securities such as stocks and bonds for sale to the public. This includes a description of the security being offered; information about the companys properties, business, and management; and financial statements audited by independent auditors. The SEC may examine a companys registration statement to determine whether it complies with U.S. disclosure requirements but it does not evaluate the merits of offerings to determine if the securities are good investments.

- Form 8-K . Companies file this form with the SEC to announce major events that shareholders should know about, including bankruptcy proceedings, a change in corporate leadership (such as a new director or officer), and preliminary earnings announcements.

- Forms 3, 4, and 5. Corporate insiders — the companys officers and directors, and anyone owning more than 10% of its stock — must file a statement of ownership about those securities with the SEC.

- Form 3 is the initial ownership statement.

- Form 4 reports changes in ownership when the owners buy or sell some of their stock, and must be filed within two business days of the transaction.

- Form 5 is used to report any transactions that should have been reported earlier on a Form 4, or that were eligible for deferred reporting. If a Form 5 must be filed, it is due 45 days after the end of the companys fiscal year.

Helpful tips

Always check to see if a filing has been amended. When reviewing filings, especially registration statements and periodic reports filed on Form 10-K and Form 10-Q, check to see if the filing has been amended. Amended filings are designated by adding /A after the file name.

There are many different forms used in EDGAR. The SECs website includes a description of form types accepted by EDGAR.