Using DRIPs for faster compounding of dividends Dividend Growth Investor

Post on: 27 Март, 2016 No Comment

Wednesday, March 25, 2009

Using DRIPs for faster compounding of dividends

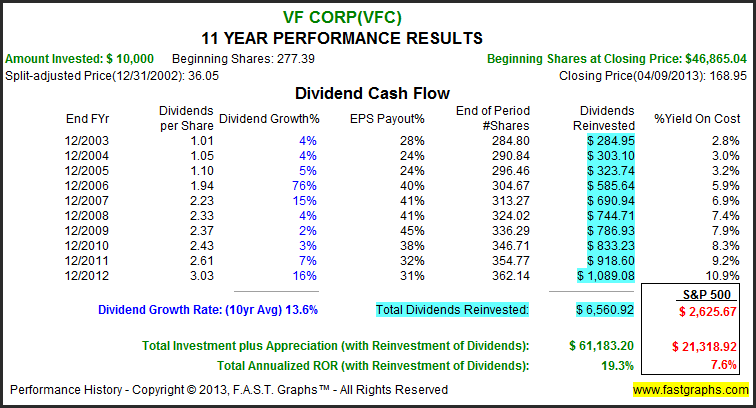

Dividends have historically contributed 35% — 40% of annual total returns over the past century. Re-invested dividends however are touted to have provided 97% of S&P 500 total returns between 1871 and 2008.

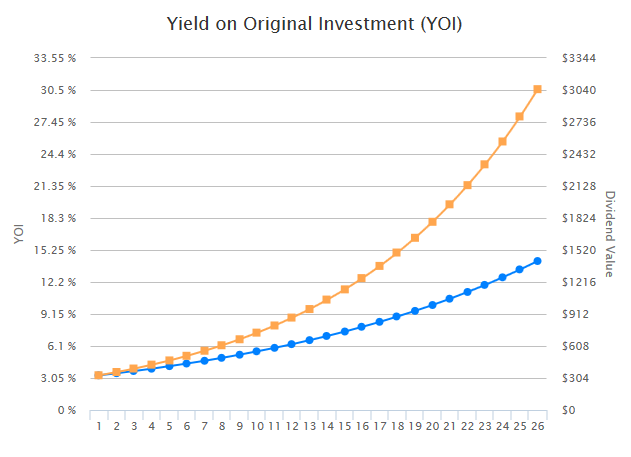

The main pro of dividend reinvestment is that you get the power of compounding in your favor. If you have also picked a solid stock that tends to increase the payments to stockholders every year you are essentially turbo charging your portfolio for the long run and should expect to receive even faster annual dividend raises.

There is another way to compound your dividends to the third degree using dividends reinvestment plans (DRIPs ) which allow participants to reinvest the cash dividends in additional shares of common stock at a discount. Drips are a nice low cost way to purchase dividend stocks and build a stock portfolio. These programs allow investors to purchase shares in two ways either through reinvesting dividends or with optional cash payments that can be sent to the companies you want to invest in. One benefit of drips is that they allow dividend reinvestment in partial shares. Check out my recent review of DRIPs .

The most valuable benefit of drips is that some allow reinvesting your dividends by purchasing shares at a discount to the market price. This is an inexpensive way for these companies to raise capital.

I have provided a sample list of dividend reinvestment plans. which allow participants to reinvest the cash dividends in additional shares of common stock at a discount. Its not a recommendation to purchase however:

If you are aware of any other drips offering a discount on dividend reinvestment, please add your comment below.

Its interesting to note that most major companies that offer discount on dividend reinvestment plans are Canadian. Major banks such as Bank of Montreal (BMO), Bank of Nova Scotia (BNS), Toronto-Dominion Bank (TD) and Royal Bank of Canada (RY) dominate the list. Canadian Income Trusts such as Pengrowth Energy Trust (PGH), Penn West Energy Trust (PWE) and Harvest Energy Trust (HTE) also reward shareholders with reinvesting their dividends by purchasing shares at 5% discount to the market price.

Few US companies are currently offering discounts on dividend reinvestment through their DRIPs. With the credit crunch I would expect companies to provide an additional incentive for shareholders to keep reinvesting their dividends through the companys plan in order to have an easy way to finance operations.

It is important to understand however that these discount prices could be determined differently in different drips. Thus always consult the plan documentation for further details concerning specific DRIPs. Buying stocks just for the dividend reinvestment discount shouldnt be the main reason behind the purchase. Always analyze each individual stock before investing in it.

Full Disclosure: Long TD