Using ClosedEnd Funds To Build Your Core At A Discount

Post on: 26 Апрель, 2015 No Comment

When State Street introduced its famous SPDR S&P 500 fund back in 1993, a huge growth industry was born. Exchange traded funds (ETFs) have become the go-to fund format for many investors looking to access new asset classes and strategies. More than $1 trillion worth of assets now sit in ETFs, and the industry continues to produce new and innovative fund types. However, investors should be aware of ETFs’ quirkier cousins.

Often wildly misunderstood, closed-end funds (CEFs) could be a great way to add many of the same strategies and assets available in ETFs, but at discount prices. At first glance, it may seem like ETFs and CEFs are quite similar. However, from an operational perspective, they are actually quite different. For investors willing to give the security type a go, exploiting these differences could lead to gaining access to many American and international blue chips at a fraction of the cost.

Juicy Discounts to NAV

According to the Closed-End Fund Association, closed-end funds have been available since 1893, more than 30 years prior to the formation of the first open-end fund in the U.S. Yet, the security type is often ignored when constructing portfolios. That’s a real shame, as its uniqueness can be used to an investor’s advantage.

Investors can think of closed-end funds as a cross between ETFs and traditional mutual funds. Unlike ETFs, which have a creation and redemption mechanism, CEFs are launched through an initial public offering (IPO), which raises a fixed amount of money by issuing a fixed number of shares.

The fund’s sponsor invests the IPO proceeds according to the CEF’s underlying mandate and then the shares trade on the equities markets. Because the shares of a closed-end fund are bought and sold on the open market, investor activity has no impact on underlying assets in the fund’s portfolio. Unlike a traditional mutual fund, which must hold cash for investor redemptions, CEFs can be fully invested in their assets.

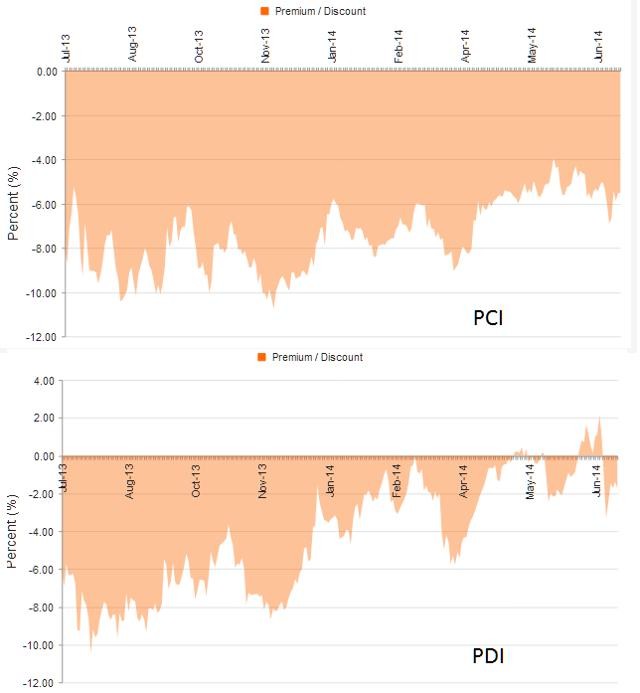

This fixed share nature also leads to one of the biggest benefits when it comes to CEFs — buying assets at a discount. After a CEF’s initial IPO, supply and demand take over. This allows CEFs to often trade for discounts to their net asset values (NAV) or the value of the funds’ underlying holdings (such as stocks, bonds or futures contracts). For example, if a CEF is trading at a 10% discount to its NAV, you effectively get one dollar’s worth of assets for 90 cents. By exploiting that discount, investors are able to pick up stocks for pennies on the dollar.

Building a CEF Core

While there can be some more complex issues when dealing with CEFs, such as return of capital distributions and leverage, the deep discounts available from many funds could make these eccentricities worthwhile, especially in the blue-chip stock space. Some of the largest discounts to NAV lie within funds that track bedrock companies such as 3M and Nestle. By using CEFs to gain access to these core stocks, investors can build their portfolios from the ground up and save some dough.

For investors looking for blue-chip American stocks, Adams Express could be a great portfolio answer. The fund was founded in 1840, originally as a courier service specializing in the transport of stock securities and other related documents.

However, Adams became more of a holding company for various investments and converted into a closed-end fund in 1929. Currently, the fund trades at an attractive 14.58% discount to its holdings. These include portfolio stalwarts Apple and McDonald’s. The fund also has a large position in energy-focused Petroleum & Resources, a closed-end fund currently trading at a 52-week average of 13.45% discount.

The eurozone crisis has already caused many leading European multinational firms to trade at historical lows. However, CEF investors can gain access to these leading companies for even cheaper. Deutsche Bank-sponsored European Equity Fund Inc. currently can be had for an additional average 9.6% discount to its NAV. The fund currently holds 48 different European multinationals, with the bulk of its holdings in the consumer and industrial sectors.

Add in a dose of heavily discounted funds in emerging markets — which can be had with the Morgan Stanley Emerging Markets Fund, or in real estate, through the Neuberger Berman Real Estate Securities Income Fund — and investors can assemble a strong core portfolio.

The Bottom Line

Exchange traded funds have taken the investment world by storm, offering exposure to a wide range of asset classes and strategies. However, some of the biggest values in the investment space could lie within their quirkier cousins. Closed-end funds offer portfolios that chance to buy assets at discounts to intrinsic values. Nowhere is that more apparent than in the blue-chip stock space.