Use the PricetoSales Ratio to Find Winning Stocks Like These 5

Post on: 10 Июнь, 2015 No Comment

The P/S ratio is a powerful weapon in the value-hunter's arsenal

Use the Price-to-Sales Ratio to Find Winning Stocks Like These 5

The price-to-sales ratio is a terrific valuation metric that helps you find great stocks at great values. And given the recent run-up in stocks, value is becoming more and more important.

In fact, aside from the Zacks Rank, if I could only use one item to screen and pick stocks with, price-to-sales would be the one.

Lets first start with a definition. The P/S ratio is simply price divided by sales.

If the P/S ratio is 1, that means youre paying $1 for every $1 of sales the company makes. A price-to-sales ratio of 0.5 means youre paying 50 cents for every $1 of sales the company makes. And so on.

As you might have guessed, the lower the price-to-sales ratio, the better.

One of the reasons I like the P/S ratio is because it looks at sales rather than earnings, as the P/E ratio does. Why? Because sales are harder to manipulate on an income statement than earnings.

Price-to-Sales Study

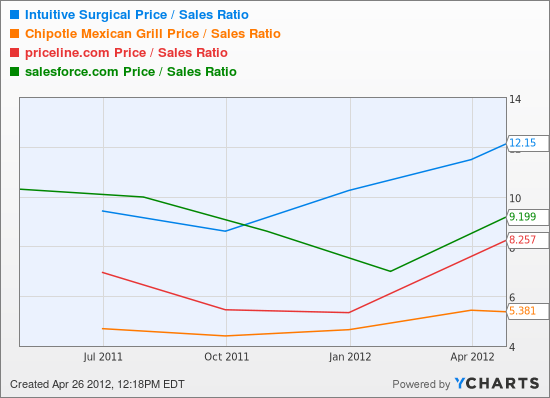

I prefer to look for stocks with a P/S ratio under 1. Although Im willing to go up to 4, depending on the industry.

But in my testing, as the illustration below shows, those with a price-to-sales ratio of 1 or less produced the best returns. Between 1 and 2 also outperformed pretty significantly. But once you got over 4, the odds were against you.

But the best way to use it, Ive found, is to find stocks with a price-to-sales ratio below the median for its industry. And thats what well be focusing on in this weeks screen.

Screen Parameters

- Projected growth rate greater than or equal to projected growth rate for the S&P 500 so above market growth rates.

- Last earnings surprise greater than 0 a positive EPS surprise

- Last sales surprise greater than 0 a positive sales surprise

- Zacks Rank less than or equal to 2 only stocks with a Zacks Rank of a Strong Buy or Buy get through.

- Price-to-sales ratio less than or equal to median P/S for its industry valuations that are lower than their industry.

- Price greater than or equal to $5

- Average 20-day volume greater than or equal to 100,000

Stock Selections

Here are 5 stocks from this weeks list:

Outerwall (OUTR ) P/S = 0.63

Arris Group (ARRS ) P/S = 0.98

Sanderson Farms (SAFM ) P/S = 0.74

Avis Budget Group (CAR ) P/S = 0.74

Rite Aid (RAD ) P/S = 0.03

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.