US vs Europe Which equities will win in 2014

Post on: 16 Март, 2015 No Comment

The outgoing year was certainly a remarkable one for equities – with markets in both the U.S. and Europe posting double-digit gains. But analysts have warned that 2014 is unlikely to prove so lucrative for stocks, although America is expected to outperform Europe yet again.

U.S. stocks ended 2013 at record highs, with the S&P 500 posting its largest annual jump in 16 years and the Dow its biggest gain in 18 years. While across the Atlantic, the pan-European benchmark STOXX 600 clocked gains of 17 percent, after a year in which faith in a euro zone recovery returned to the markets.

You’ve got to wonder how much of that we’re going to be able to keep into the next year, Daniel Morris, global strategist at TIAA-CREF Asset Management told CNBC on Thursday – the first trading day of the year for most major markets. So consequentially, (we have) pretty modest expectations for returns for equities in 2014.

That view is shared by Brenda Kelly, chief market strategist at IG.

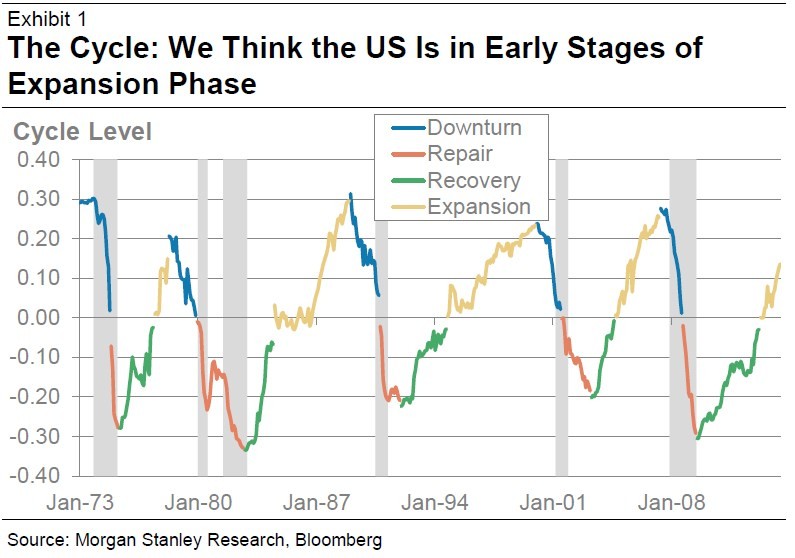

If you look where we are in the cycle at the moment, we have seen record levels for American stocks. You have to question whether we can see the same type of returns and I don’t think that is totally possible, Kelly told CNBC.

Although another blow-out year might not be on the cards, analysts expect strong economic growth – particular in the U.S. where gross domestic product (GDP) grew at a 4.1 percent annual rate in the third quarter – to continue to drive equities.

Morris, for instance, expects the U.S. economy to accelerate evenly throughout 2014, forecasting economic growth of between 2.5-3 percent for the U.S. although certainly less for Europe.

Jim McCaughan, CEO of Principal Global Investors, also expects U.S. GDP to continue to grow, which he said means the U.S. domestic economy should be quite a profitable place to be invested.

Markets could surprise to the upside when first-quarter earnings season kicks off in the U.S. later this month, he said. Europe’s another matter, but I’m pretty optimistic about how the U.S. economy can go, he added. I think the fourth-quarter could be quite positive in terms of U.S. results.

Growing concerns

One factor holding earnings expectations back in Europe is an ongoing concern about the strength of the region’s economic recovery. GDP across the 28 countries that make up the European Union rose by 0.2 percent during the third-quarter of 2013, compared with the previous quarter, and increased by just 0.1 percent in the euro zone.

I just don’t see where the growth is coming from in Europe. I’m skeptical of this ‘Europe is cheap argument’ argument – the valuations are low, but I don’t see the European markets as being competitive compared with U.S., McCaughan said.

The fortunes of European equities would be heavily dependent on the U.S. over the year, according to McCaughan. He forecast that in 2014,U.S. equities would rise by between 10 and 20 percent, while European equities could languish and post no growth at all.

(But) if it turns out to be another blow-out year like last year, European equities will be dragged up. If it turns out to be a break-even for the U.S. I would expect European to be down, he added.

Central bank boost?

One factor that could give European equities a boost is further stimulus measures by the European Central Bank. The bank surprised markets in November by cutting its main interest rate to a new low of 0.25 percent – and its President Mario Draghi has repeatedly stated the bank is prepared to do more if necessary.

There is an argument to be made for rotation into European equities. We could see monetary policy easing in the euro zone and possibly some degree of liquidity measures which should be bullish for European equities, but I would still question the growth prospect of the euro zone, Kelly said.

Mike Ingram, market analyst at BGC Partners expects the ECB to introduce further stimulus around Easter this year. OK — that’s a function of economic weakness, but the immediate reaction in the market, and the anticipation of that, is going to be positive.

There are, however, some European equities worth investing in, according to McCaughan.

What’s good in Europe are global companies, German car companies, aerospace, luxury goods – those are all things that don’t just depend on the European economies. Anything that’s dependent on the European economies – financials, retailers – be very wary, he warned.

—By CNBC’s Katrina Bishop. Follow her on Twitter @KatrinaBishop and Google