Updating my Dividend Aristocrat Perpetual Income Portfolio

Post on: 20 Апрель, 2015 No Comment

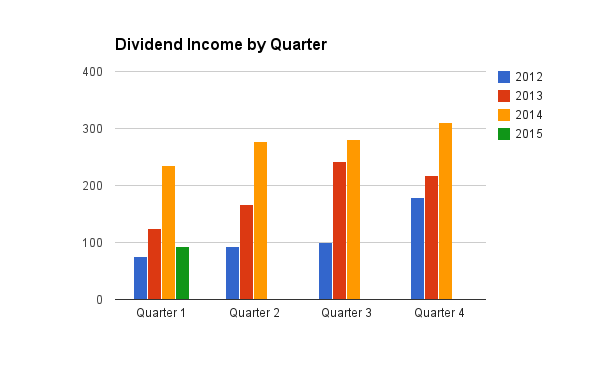

I started my perpetual income machine dividend portfolio at the beginning of last year and it has quickly become one of my favorite pieces of my financial world. It isn’t large (yet ) but it will be! The goal is simple to find undervalued stocks only within the Dividend Aristocrat Index. Last year I only updated the portfolio twice, however, this year I have been investing more and more money into the portfolio per month and thus think it should be updated every 60 days. Besides I find the research fun.

large cap, blue chip companies within the S&P 500 that have followed a policy of increasing dividends every year for at least 25 consecutive years.

Since I am first and foremost creating a future income stream (which is also why the portfolio is not in a qualified-retirement account) I want stable companies that have paid a consistent stream of income (i.e. a quarter century of increasing dividends will do it!). The criteria I used to build this particular portfolio:

- They have to actually be on the Aristocrat List

- The stock has to have a Price to Earning that is lower than or equal to their industry average

- Their Operating Margin has to be in line with the particular stock’s industry average

- Dividend Yield should be between 2% and 5%

- Price to Book Value Should be Reasonable

Some quick definitions

- Dividend Aristocrats are those dividend paying American companies that have increased their dividend for the past 25 years.

- P/E is Price is “a valuation ratio of a company’s current share price compared to its per-share Earnings.”

- Operating margin is “a measurement of what proportion of a company’s revenue is left over after paying for variable costs of production such as wages, raw materials, etc. A healthy operating margin is required for a company to be able to pay for its fixed costs, such as interest on debt.”

- Dividend Yield a “Financial ratio that shows how much a company pays out in dividends each year relative to its share price. In the absence of any capital gains, the dividend yield is the return on investment for a stock. Dividend yield is calculated by dividing Annual Dividends per Share by Price Per Share”

- Price to book is a ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

My Current Dividend Portfolio

While I am currently investing, in even amounts to the following Stocks,

- MMM 3M

- AFL – Aflac

- CTL – CenturyLink

- CB – Chubb

- LEG – Leggett & Platt

- SDY – Catch-all ETF of the index

After about 15 months or so of investing my portfolio looks like this:

CB, CTL, LEG are heavily invested because I have been putting money into them since they keep meeting the standards and criteria every update I do. I should mention that I don’t really do any research besides the numbers, nor do I have any loyalty to any company. The main criteria is that they are part of the Dividend Aristocrat list, so as long as they are in the index I won’t sell my position since I can come back to it if they become undervalued. I have only sold one position and that was LLY when they failed to increased their dividend last year.

Analyzing the Dividend Aristocrat Index for My Portfolio

First, I take out all those companies whose Price to Earnings is higher than their industry average

Second, I take out all those companies whose operating margins are not better than their industry average

Third, I remove all those companies whose dividend yield is not at least 2.0%.