Unsure About Retirement Account Contributions Consider Einstein’s Theory

Post on: 7 Май, 2015 No Comment

Compounding Compound Interest

Ive always admired Albert Einstein. After all, he was a fairly intelligent fellow. In science, he changed our understanding of light and of gravity, helped prove the existence of molecules, and explained the nature of space and time. In politics, he was influential as a promoter of peace and freedom. All in all, a very strong resume. But for our purposes, his most impressive contribution was in the field of finance.

Einstein was reportedly asked what he thought the most powerful force in the universe was, and he replied, Compound interest. Another Einstein quote on this topic: Compound interest is the eighth wonder of the world. He who understands it, earns ithe who doesnt, pays it. (1)

The Einstein connection with a compound interest theory was his association with the Rule of 72, a simple formula for calculating how long it takes to double your money. All you need to do is divide 72 by the annual rate of return. For example, if you invest $1,000 in an account that earns 12%, divide 12% into 72. The result is 6, which is the number of years it will take to double your money. So there it is, Compound Interest, not E=MC2, is the greatest mathematical discovery of our time.

Well maybe not, but at a certain threshold of savings the impact of compound interest is considerable. And if you also make regular supplemental deposits to that savings (or investment) account you can essentially compound the compound interest effect.

Einstein was reportedly asked what he thought

the most powerful force in the universe was,

and he replied, Compound interest.

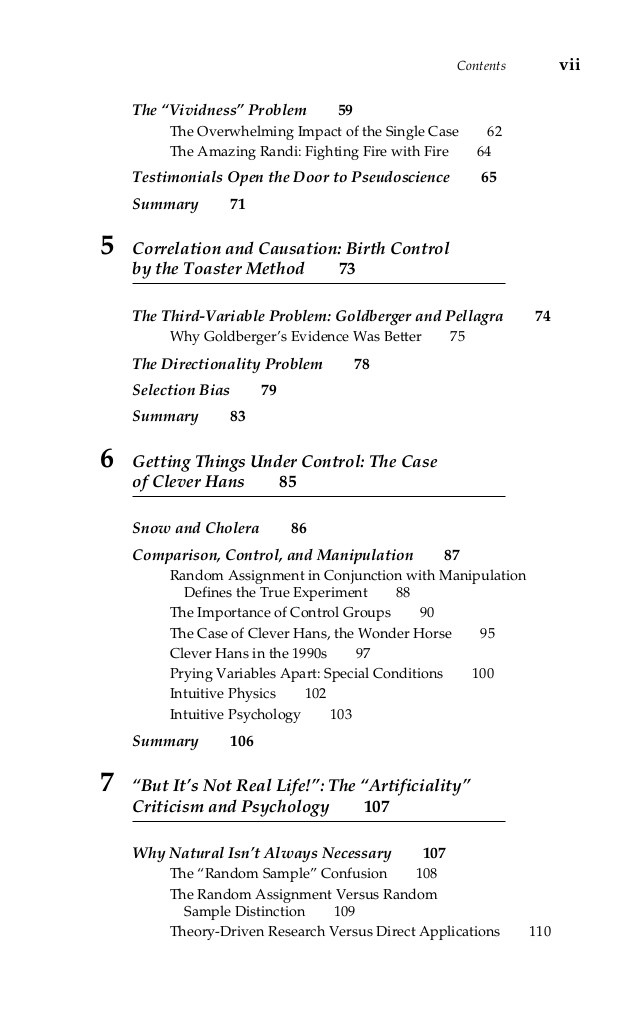

Lets take a look at three scenarios to illustrate the point. The first is a simple savings account. If you put $1,200 into savings at a bank at, say, age 22 and let it sit there at 3% APR compounded annually it would grow to $4,406 after 45 years when youre ready to retire at age 67. In our e-booklet, Wealth is Good, Cash Flow is Better, we would consider a basic savings account like this a 2nd Best asset, which means it EITHER appreciates (grows in value) OR generates positive cash flow but not both.

But doesnt it do both? Well, it does generate cash flow in the form of interest earned but note that the basic investment amount, the principal, doesnt grow. Thats why its second best.

At least it is better than the Worst asset type, which depreciates (loses value) AND also generates negative cash flow. A car or a boat would be good examples of Worst assets.

The second scenario is an investment account such as a mutual fund comprised of stocks. Lets assume this account, on average, grows at a compound annual rate of 6%. The growth comes from stock price increases and also dividends. Because the principal (the stock price) grows AND it also generates Cash Flow (from dividends), we classify this as a Best asset type. From an initial amount of $1,200 this investment grows to $15,583, or more than three times the value of the bank savings account. Thats a nice improvement, but it still wouldnt cover many retirement expenses.

If on the other hand you make regular $100-per-month supplemental contributions to that same investment account, at a 6% compounded rate it would grow to over $255,000. Now thats betteractually its an enhanced version of Best. As illustrated in the graph, making regular contributions to investment accounts such as 401-Ks or IRAs creates a whole new dynamic. And with the help of compounding, the impact is particularly dramatic in the latter years.

So if you ever have doubts about whether to continue making regular contributions to your retirement account, remember Albert Einstein physicist, humanitarian, and champion of compound interest. Count yourself among those who understand it, and earn it.