Undervalued Stocks To Buy on Investing News Show

Post on: 9 Июль, 2015 No Comment

November 23, 2014

Money Info Investing News Show

Live CEO Interview :

The November 25 show will feature a live interview with

Ryan Schadel, Chairman, Chief Executive Officer of Labor Smart, Inc.

Over the past couple of years we have been able to grow our business from $7 million revenue in 2012 to $16 million revenue in 2013 to $18 million revenue in the first nine months of 2014,

stated Ryan Schadel, Labor SMART Chairman and Chief Executive Officer.

In fact, we have doubled our branches to 30 locations in the past year and reached positive EBITDA.

Every Tuesday

Use this Link To Watch The Show:

Be On The Air With Us

Call In Your Questions

About Labor SMART, Inc.

Labor SMART, Inc. provides On-Demand temporary labor to a variety of industries. The Companys clients range from small businesses to Fortune 100 companies.

Labor SMART was founded to provide reliable, dependable and flexible resources for on-demand personnel to small and large businesses in areas that include construction, manufacturing, hospitality, event-staffing, restoration, warehousing, retailing, disaster relief and cleanup, demolition and landscaping.

Labor SMART believes it can make a positive contribution each and every day for the benefit of its clients and temporary employees. The Companys mission is to be the provider of choice to its growing portfolio of customers with a service-focused approach that enables Labor SMART to be seen as a resource and partner to its clients.

Undervalued Stocks To Buy News:

Labor SMART, Inc. Provides Update on Its Balance Sheet and Capital Initiatives See News

Since we now have our business generating $2 million revenue per month and EBITDA positive, it is now a major focus of ours to minimize the equity dilution going forward.

We are taking a 3-pronged approach to address the current capital structure

WORLD SERIES and MONDAY NIGHT FOOTBALL Staffing Company Specializes in On Demand” Labor Providing Workers FAST. Where and When They Are Needed.

Labor SMART, Inc. Reports Record Third Quarter 2014 Financial Results See News

Third Quarter 2014 Highlights:

- Revenues up 28% to $6.8 million vs. $5.3 million a year ago

Same branch revenue up 12.5% year-over-year

Gross profit margins improve to 25% vs. 17% a year ago

Added 315 new customers

EBITDA* of $121,577

Adjusted EBITDA* of $344,731

30 branches, up from 15 at year end 2013

During the remainder of 2014, Labor SMART does not expect to open any new branches, however, it is aggressively pursuing acquisitions that fit well with its culture and will continue to seek more acquisition opportunities than in prior years. This major shift in focus is directly related to the new large deductible workers compensation policy. The industry is very fragmented. The Company has invested heavily in its corporate infrastructure in the last two years and believes it can execute acquisitions to immediately recognize economies of scale.

Labor SMART believes it can successfully execute and close acquisitions totaling $20-$40 million in revenue in 2015.

Labor SMART, Inc Reports Largest Monthly Revenue in Its History

Announced record October revenues of $2,704,432, the most revenue achieved by the company in its history during a single monthly period. This also continues a 23-month streak of year-over-year increases for the Company. The Company also announced that Year-to-Date revenue for 2014 has exceeded $20 million.

Company-wide revenue for the five week month ended October 31, 2014 was $2,704,432, compared to October 2013 revenue of $1,642,319, which represented a four week month. Among the 15 branches open one year or more at October 31, 2014, revenue for the first four weeks of October was up 15.40% at $1,895,038 in a year over year comparison.

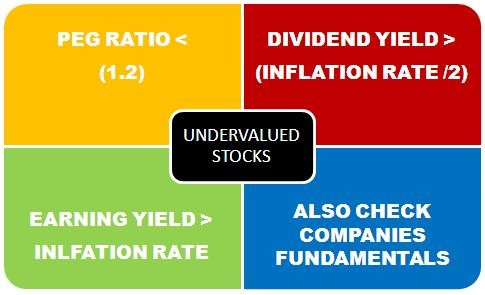

Undervalued Stocks To Buy December 2014

Money Info

The Princeton Research Money Info show features where to invest now, stock market, business, economy and financial investment news.

Money Info is hosted by Mike King and Charles Moskowitz.