Undervalued Dividend Growth Stock of the Week Exxon Mobil (XOM)

Post on: 24 Март, 2016 No Comment

March 8, 2015

Buying quality merchandise on sale.

Thats generally a smart decision, be it a new computer or anything else.

But its particularly true when were talking about stocks. Specifically dividend growth stocks.

Valuing stocks is an incredible skill to possess that can literally change your life, which is why you should check out Dave Van Knapps guide on the subject .

Once you get the hang of valuing companies, you realize that stock prices are far from necessarily representative of fair value or what you should pay.

Price is simply what a stock is offered at today.

And that price may or may not be a good deal.

But how would you know?

If you always pay what someones asking for anything and everything in life, where do you think that will get you?

That used car? Its $20,000.

That pair of pants? $150.

Without having some gauge of value, youll never know if youre paying too much and thus wasting money.

Same goes for stocks.

Ive spent five years of my life valuing companies and buying stocks only when I thought they were priced fairly or better, which is partly how I was able to accumulate a six-figure portfolio in a relatively short period of time on a modest salary.

And almost every single stock Ive ever purchased can be found on David Fishs Dividend Champions, Contenders, and Challengers list, which tracks and documents more than 600 US-listed stocks with at least five consecutive years of dividend growth.

Now, I was able to build my portfolio through prudent purchases, but also regular purchases. I dont bother timing the market, but I do focus on individual company valuation.

As such, Im always on the lookout for a good opportunity to add a cheap stock. And I may just have found one.

Exxon Mobil Corporation (XOM) is an integrated energy company engaged in the exploration for, and production of, crude oil and natural gas, the manufacturing of petroleum products, and the transportation of oil, natural gas, and petroleum products.

This might not be a popular pick right now due to the falling prices of crude oil, but Exxon Mobil has been there and done that. Its a $367 billion company thats survived many cycles and there doesnt appear to be any reason on the horizon as to why they wont once again.

In fact, its times like now that keep the big fish in the pond dominant, as theyre in a more defensive position, and makes other companies more attractive potential acquisition targets.

Nonetheless, Exxon Mobil has managed to rack up 32 consecutive years of dividend raises, which is a feat that very few energy companies in the world can claim.

And over the last decade alone, the dividend has grown at an annual rate of 9.8% .

Combine that with a current yield of 3.17% and you can see theres an attractive total return proposition here.

Its hard to go wrong with a high-quality stock that yields north of 3% and is growing the dividend near double digits.

The payout ratio is low, at 36.4%. However, because XOMs earnings can be volatile, that margin of safety probably isnt as large as it might seem on the surface, especially with the way oil is priced lately. But I also see no reason why the dividend would be in danger.

So the dividend metrics are pretty top notch here. Yield above 3%? Check. Low payout ratio? Check. More than three decades of dividend growth? Check.

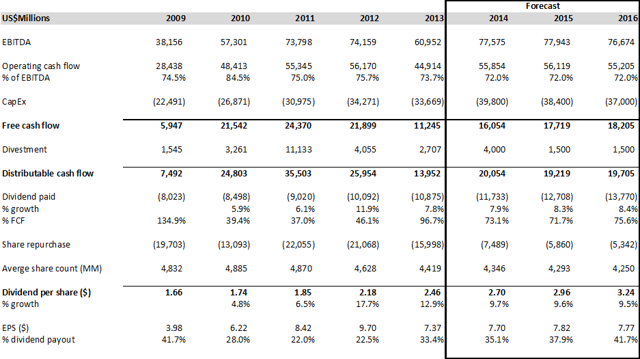

Well take a look at Exxons growth over the last decade, which may give us some idea as to where theyre going. Itll also help us value the company. However, we need to keep in mind that, due to the cyclical nature of oil as a commodity, the growth isnt as secular as some other companies out there. The long-term demand for oil appears to be there, but the ride along the way can be a bit bumpy.

Revenue was $370.680 billion in fiscal year 2005. That grew to $411.939 billion in FY 2014. So were looking at a compound annual growth rate of 1.18% over the last decade. Not particularly impressive, but we are talking about over $400 billion in annual revenue .

Earnings per share improved from $5.71 to $7.60 over this period. The CAGR for EPS then is 3.23%. Again, Exxon Mobil is no growth stock, but it is a defensive play as an investment in a company that is providing the world a required commodity. But their financial results do oscillate a bit, due to the volatile nature of oil pricing. And the growth rate depends on which period you use, as earnings didnt accelerate in FY 2014 due to oils rather substantial drop over the second half of the year.

S&P Capital IQ predicts EPS will compound at a -11% rate over the next three years, citing production volume growth concerns and low oil prices. Of course, XOMs results will largely depend on the price of oil over this time frame.

One extremely bright spot for the company is the balance sheet. One of only three US companies with a AAA rated balance sheet from S&P, the long-term debt is negligible.

Profitability metrics compare well to peers, though Exxon Mobil is really operating at another level. The company has posted net margin thats averaged 8.33% over the last five years and return on equity of 23.37% .

Exxon Mobil is the worlds largest publicly owned energy company. So in terms of defensiveness in a volatile industry, XOM is tough to beat. For instance, crude oil is down over 40% over the last six months, while XOM is down less than 13% over the same stretch.

As a dividend growth stock, XOM is about as good as they come. Its a blue-chip harbor of safety in energy. But is the stock a good deal right now?

The stocks P/E ratio is 11.44 right now, which is almost exactly in line with its five-year historical average. That would seem to indicate the stock is pegged at pretty close to fair value. However, its interesting to note that the current yield is about 60 basis points higher than its five-year average.

But whats the stock worth? What should we pay?

I valued shares using a dividend discount model analysis with a 10% discount rate and a 7% long-term growth rate. That growth rate would appear aggressive based on more recent results, but over the very long term, thats about the rate at which Exxon has grown.

Factoring in a comfortable payout ratio and Exxons penchant for raising the dividend in the high single digits, I think a 7% long-term growth rate for the dividend is fairly reasonable. Of course, if oil stays this low for a decade or more, that could cause issues for the dividend and its ability to grow. The DDM analysis gives me a fair value of $98.44.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide. The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today. I find it to be a fairly accurate way to value dividend growth stocks.

It would seem that XOM is moderately undervalued from where Im standing, but Im not the only opinion around. Well compare my valuation with what some of the professional analysts have come up with to see if they jive.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system. 1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates XOM as a 4-star stock, with a fair value estimate of $108.00.

S&P Capital IQ is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line. They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

S&P Capital IQ rates XOM as a 3-star hold, with a 12-month target price of $95.00.

Looks like Im not alone here, falling somewhere in the middle. Averaging out the three numbers gives one final number to work off of, which is $100.48. That valuation would indicate that the stock is potentially 15% undervalued right now, which would be a rare opportunity to pick up a blue-chip stock at a sizable discount. However, keep in mind that volatility could continue for the foreseeable future due to supply and demand concerns with oil.

Bottom line: Exxon Mobil Corporation (XOM) is the worlds largest publicly traded integrated oil and gas company. The odds of it failing are extremely small, which gives one peace of mind while also being exposed to energy. Its increased dividends for more than three consecutive decades, which also includes lengthy periods of very low oil prices.

Exxon has been there and done that in regards to volatile/low oil prices, and I see no reason they wont do it again. Shares appear undervalued right now, offering their highest yield in more than five years. I would take a strong look at this bastion of safety in the energy sector for value and yield.

Jason Fieber, Dividend Mantra

Turn $5K into a Million-Dollar Retirement in Just 5 Years [sponsor]

It all starts by banking one double-digit winner and then stringing 12 of those double-digit winners together in a year. In just 5 years. you could grow a mere $5,000 into $1,522,408! Click here for complete details, plus: 3 Stocks to Kick-Start Your Million-Dollar Retirement Portfolio.