Understanding Volatility and How to Trade the VIX

Post on: 16 Март, 2015 No Comment

What Is the Volatility Index (VIX)?

The CBOE Volatility Index was introduced in 1993. VIX futures began trading in 2004 and VIX options became available in 2006.

Escalating volatility, at least the downside volatility that scares investors, is often a sign of market turmoil, unrest in the markets, falling stock prices and/or lack of investor confidence. The VIX reflects this; when stock prices fall the VIX rises, acting as a fear gauge. It gives a reading of how much uneasiness there is in the market.

When stock prices are rising, fear is low and investor confidence relatively high, so the VIX will usually be at low levels or declining.

The VIX is based on real-time options prices. Options prices. which have a volatility aspect included in their price, tend to increase during periods of market declines. As option prices rise, so does the VIX. When there is little to worry about in terms of volatility (stock prices are rising), option prices on the whole tend to decline, and so will the VIX.

Trading the VIX with Options

Aside from the trading the VIX directly with a VIX futures contract. traders can also trade options on the underlying VIX futures. VIX options (and futures) are offered by the CBOE and can be traded by anyone with a brokerage account approved for options trading.

VIX options expire on the third Wednesday of each month. Quotes (delayed) are available on the CBOE website:

Figure 1. VIX Call Options — Source: CBOE

The quotes table lists what the option is called, as well as last sale, current pricing and volume information.

There are options available with expiries up to six months out from the current date. This gives traders some flexibility in choosing a maturity.

VIX1416G10-E (top of the list) means it is based on the VIX futures, expiry in 2014, on the 16th of the month, in month G and has a strike price of $10. Month G is equal to July. H is equal to August and so on. Names for Puts are structured in the same way, except that different letters are used for the expiry, for example S is for July, and T for August.

Strategies

Strategies with VIX options range from the very simple to the complex. If you believe that stocks may see a significant decline over the next couple months, buy a VIX call option with an expiry a few months out. If stocks do in fact decline, the VIX will rise, hopefully by enough to make your VIX call worth some money. This approach can also be used as a short-term hedge against market declines when holding a portfolio of stocks.

If your view is the oppositeyou believe stocks will rise and the VIX will fall purchasing a VIX put option will give you the potential to profit if this scenario plays out.

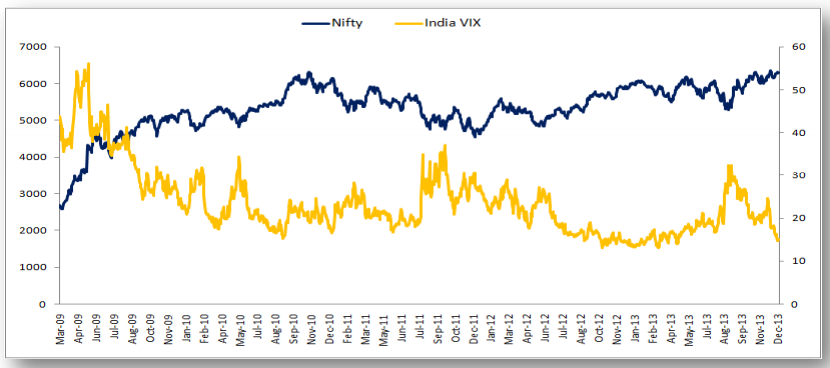

Another approach it to look for historical extremes in the VIX index, and attempt to profit when these extremes occur. In Figure 2, between 2007 and 2014 a reading above 40 marked an extreme high in the VIX. Buying puts on the VIX when the price began to decline from these extremes could have been one way to potentially profit as the VIX returned to more normal levels. The downside is that these extremes can last longer, or extend further, than we think, as seen in 2008.

Figure 2. Volatility Index — Source: Finance.Yahoo.com

Options expire, so VIX options traders not only need to pick the right direction, but also make their trade at the right times. CBOE VIX options are also typically European style, meaning they can only be exercised on the expiration date, unlike equity options, which can typically be exercised at any time before expiry.

The S&P 500 and the VIX also dont move in a perfect inverse relationship. From 2000 to 2012 the two indexes moved opposite each other about 80% of the time, according to the CBOE. Therefore, a decline in the S&P 500 doesnt always equate to the rise in VIX, or vice versa. Although sustained rises or falls in the S&P 500 will cause an overall inverse move in the VIX.

Trading the VIX with ETFs

Trading the VIX is relatively straightforward for stock traders with the advent of exchange traded products (ETPs). These are instruments that are offered on NYSEARCA stock exchange, trade in a similar fashion to stocks and can be bought and sold actively.

Top VIX-Related ETPs Based on Average Daily Volume as of July 9, 2014: