Understanding Trend Lines

Post on: 14 Июль, 2015 No Comment

Introduction

Trend lines can reveal profit opportunities that an inexperienced trader may not see. How is a trendline different from a trend? I’ll cover these subjects and more on this web page.

Trendlines identify levels on a stock chart beyond which the price of a stock will have difficulty moving. From this definition we see that a trendline is not about determining the direction of the trend, but rather about looking for investor behavior related to the price of a stock.

Benefits of a Trendline

- This line makes it easier to see a trend.

- This line helps in the prediction of future price behavior for a stock.

- It helps the trader to see a level beyond which the stock price is not likely to move, a line from which the stock price is likely to bounce.

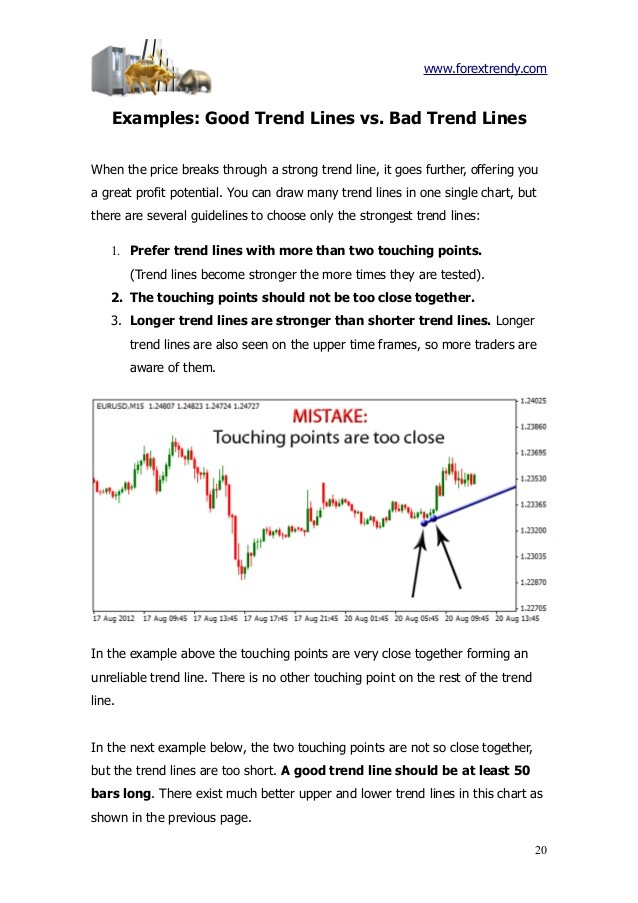

Traders make frequent use of technical analysis in looking at the price action of a stock. When the trader sees the price of a stock approaching a trendline. Two outcomes are possible.

- The stock price will bounce off this line changing the direction of the current trend, or

- The stock price will move through this line toward higher highs or lower lows.

Upward Sloping Trendline

- Upward sloping trendlines are a signal that the demand for the stock is greater than the supply causing a rise in the price of the stock.

- These lines are drawn below the price and connect a series of closing prices (lows).

- On the graph below, note the successively higher bottoms in an upward sloping trendline. If this is truly a trend, the trader will be able to draw a line through a minimum of 3 lows.

Downward Sloping Trendlines

- Downward sloping trendlines are a signal that investors are more inclined to sell the stock than to buy it and there is likely more supply of stock to sell than investors wanting to buy it at the current price.

- These lines are drawn above the price and connect a series of closing prices (highs).

- On the graph below, note the successively lower tops in a downward sloping trendline. How many points can you see that touch this trendline? (I count more than 6).

What Makes These Trendlines Significant?

Look at the upward sloping trendline graph above. The graph does not provide you with a name for the stock, prices, and trading volume. But what do we know from this chart?

- We know that this is a trending stock because the slope of the trendline is upward as time progresses across the graph left to right.

- We also know that this is a trending stock because the prices are above the trendline.

- If we were watching this stock and we knew that there was no bad news being reported about this stock, about the industry group, or about the market in general, this stock price is likely going to bounce off the trendline every time it approaches or touches the trendline.

- As soon as the stock price bounces off the trendline, that may be a good time to buy that stock because the stock price is likely going to increase after we buy it.

Trend lines are a significant factor in technical analysis. If a stock trader can look at a stock chart and quickly see the trendline, then that trader can quickly determine whether or not that stock is one to consider for further analysis in finding quality stocks to purchase.