Understanding the Stock Market How to Buy Stocks and other Stock Market Basics

Post on: 7 Июнь, 2015 No Comment

Sign up for your FREE report today!

Investing is an important aspect of anyones financial life. Its a way to grow your savings for retirement, finance your children’s college education, and earn extra income once youre already retired.

But to many new investors, learning stock market basics and how to buy stocks is a daunting task. There are numerous questions that need answering. Our latest report will delve into the various aspects of investing, from defining your investment goals and determining your risk tolerance to detailing the various types of investments in the stock and bond markets.

Stock Market Basics

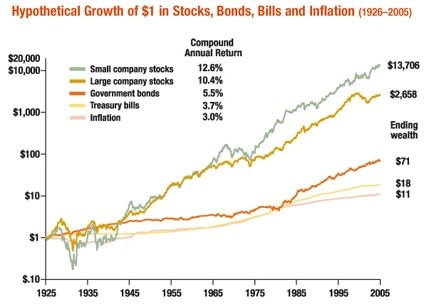

The first question is what types of investments are right for you. The answer depends upon your age and risk tolerance. One thing is for sure, however: with long-term inflation likely to average 3% or more per year, stashing your savings in taxable CDs paying 1% to 2% will not achieve your retirement goals. The only way to preserve the purchasing power of your savings and sufficiently grow your wealth is to take some additional risk and invest in the stock market.

Understanding the Stock Market

Over the very long term (30 years or more), we are confident that stocks will outperform fixed income by a wide margin. The fact remains, however, that stocks are much riskier than fixed income over the short term. Consequently, a 100% stock portfolio is inappropriate for all but the most aggressive investors, and even then should be limited to those who are still in their 20s.

For the rest of us, it makes sense to smooth out volatility with an allocation to fixed income of at least 20% of the investment portfolio. As one gets closer to retirement and beyond, the fixed-income allocation should be gradually increased and the stock allocation reduced.

Since a person can live well into one’s 80s or beyond, however, a majority allocation to stocks of at least 50% remains necessary even after retirement. You must keep in mind that one’s golden years can last for decades. Especially during a time when a regular employee paycheck is not forthcoming, stock investments are the only way to ensure that one is able to earn an average annual return large enough to overcome the ravaging effects of inflation to investor wealth over time.

Defining Your Investment Goals

Investors, from the beginner to the seasoned pro, shouldnt enter into any investment without a particular purpose in mind. That purpose can range from retirement planning to saving for a childs education to preserving existing assets or earning extra income. Often, you may have two or more goals to consider; in that case, you may choose a different investment for each of your goals.

Before you make your choice, ask yourself these two important questions:

- When do you plan to use the money youre investing?

- Whats your risk tolerance?

By answering these questions, you can identify the correct investment to match your financial needs, time frame, and personal approach to investing.