Understanding the Morningstar Style Box _1

Post on: 16 Март, 2015 No Comment

Understanding the Morningstar Style Box

Page 2 of 2

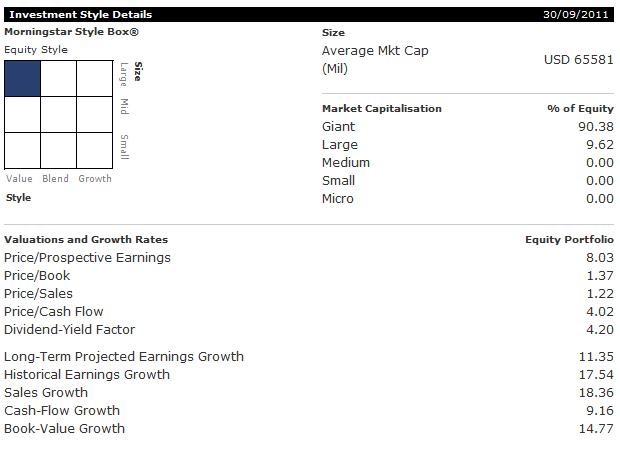

Within each size grouping (large-cap, mid-cap, and small-cap), we then divide stocks into broadly equal groups according to their value or growth style scores. The most value-like group gets classified as value; the middle group as blend; and the most growth-like group gets classified as growth.

Plotting market-cap and style

The next stage is plotting the stockholdings’ market-cap and investment style characteristics on the Style Box. A fund’s position is based on the asset-weighted underlying stockholdings’ market-caps (for the vertical axis), and value/growth scores (for the horizontal axis).

This provides an intuitive representation of the underlying stockholdings’ market-cap and style qualities. A fund which holds mostly large-cap growth stocks will fall into the large-growth square. If the fund holds stocks which lie across the value/growth spectrum, the fund will land in the blend square. And if the fund owns mainly small-cap value stocks, the fund will appear in the bottom left-hand square.

Moving around the Style Box

From time to time, funds will move around Style Box locations. There are several reasons for this.

Firstly, both stocks and funds sometimes land right on the borders between Style Box squares: for example, on the border between value and blend styles, or between mid- and small-cap sizes. Small shifts in the underlying portfolio can bump these funds between squares.

Funds can also shift Style Box locations if the fund manager changes the way they pick stocks, either in terms of the market-caps of the stocks selected, or the stocks’ style characteristics. For example, a strong growth fund manager may move towards a more growth at a reasonable price style. This would alter the kinds of companies they invest in, and have a corresponding impact on their fund’s Style Box location. The fund might move from being firmly in the top right-hand square (large-cap growth), to being in the top middle square (large-cap blend). Or in market-cap terms, a fund could move from being most heavily-invested in small-cap stocks, and therefore appearing in the bottom row of the Style Box, to investing more in a mixture of small- and mid-cap stocks, which could move the fund up into the middle row.

A stock can also shift if its business and valuations change, if the stock’s market-cap goes up or down, and for other reasons (such as takeovers and mergers). The dividing points between value, blend, and growth classifications for stocks will also move over time, as the distribution of stock styles in the sharemarket changes. One-third of the universe is always assigned as value, one-third growth, and one-third blend.

We update a fund’s Style Box whenever we get a new portfolio, often as regularly as monthly, and we’re working actively to persuade fund managers to provide us with portfolios as frequently and as accurately as possible. This ensures that Style Boxes are based on the most recently-available portfolio holdings information.

We don’t claim that the Style Box is an instant panacea for portfolio construction, or for fund and investment strategy assessment — we continue to undertake qualitative research on fund managers’ investment strategies, integrating our analysts’ top-down views on the basis of interviews, visits, and analysis with bottom-up holdings-based assessments and fundamental portfolio data. The great thing about the Style Box is that it provides a sound basis for comparing and evaluating the universe of share funds available, and a fundamental building block to help investors and advisers build more diversified portfolios.