Understanding The Dividend Yield On A Stock

Post on: 16 Март, 2015 No Comment

Dividends Can Be Cut and Yields Can Change Rapidly

You can opt-out at any time.

Please refer to our privacy policy for contact information.

A dividend yield tells you how much income you receive in relation to the price of the stock. Buying stocks with a high dividend yield can provide a good source of income, but if you are not careful, it can also get you in trouble.

Companies do not have to pay dividends. Trouble comes about when a company lowers their dividend. The market will often anticipate this move, and the stock price will drop before the company announces its plans to lower the dividend.

Since the share price has dropped, when you look at the dividend yield based on the last dividend the company paid, it will look high. If you buy the stock based on that high dividend yield. you could be in for a big surprise if the company lowers or eliminates the dividend.

To be successful at investing in dividend paying stocks, it is important that you understand this relationship between the share price and the dividend yield. The first step is knowing how to calculate a dividend yield .

Calculating The Dividend Yield On A Stock

- Let’s say you buy a stock for $10.00 a share.

- The stock pays a dividend of $.10 per quarter, which means for every share you own you will receive 40 cents a year.

- This stock has a 4.0% dividend yield ($.40 divided by $10).

Companies do not have to pay dividends. During recessions companies may lower the dividend they pay on their stocks, or stop paying a dividend all together. In that case, the dividend yield could rapidly go to zero.

Stock Prices React Quickly To Changes in Dividend Payouts

In uncertain times dividend paying stocks. or dividend paying stock funds, can rapidly go down in value because there is a risk that future dividends will be reduced. If a company announces that they are lowering their dividend, the stock price will react immediately.

As the economy improves, the stock price might rise in anticipation that the company will once again increase its dividend. If the economy gets worse, the stock price might fall even further in anticipation that the company will completely stop paying the dividend .

Don’t Buy Dividend Stocks Based Solely on Yield

If the price of a dividend paying stock rapidly drops, there is a reason. It means there is a very real chance the company may reduce or stop paying the dividend in the near future. The market will often anticipate these changes, and that anticipation is reflected in the stock price.

You see a stock that has a dividend yield of 10%. (The stock price is $10.00 a share. Last year the stock paid a dividend of $.25 per quarter, or $1 a year.) You are excited to find a stock that pays such a high level of income. You buy the stock. A few days later the company announces that they are going to cut their dividend to $.10 per quarter (40 cents per year). The stock price rapidly drops to $5.00 a share.

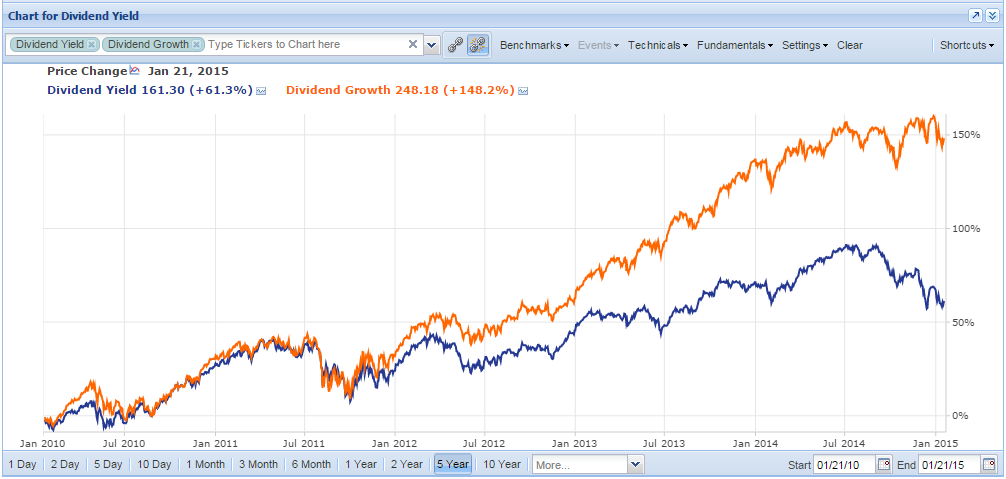

Before Buying Individual Stocks, Look At Dividend Income Funds

Dividend income funds own a portfolio of dividend paying stocks. These funds use the term “distribution rate” rather than “dividend yield ”, to describe the amount of income they pay out.

If you don’t know how to analyze individual stocks than don’t buy them. Use a dividend income fund instead. They have analysts that do the work for you, and although you pay an expense ratio inside the fund, it may save you from making a bad investment.

How Does A Dividend Yield Compare To A Bond Yield

Bond yields are calculated in a similar way as dividend yields. However, a company must pay the stated amount of interest to its bondholders whereas paying a dividend to stockholders is optional, so during uncertain times, your future investment income is more secure if you own an interest paying bond instead of a dividend paying stock.