Understanding the Balance Sheet

Post on: 3 Июнь, 2015 No Comment

Jan 20, 2009

This second entry in the Understanding Financial Statements series looks at the balance sheet, the second of the 3 primary financial statements that all public companies must report to the SEC. In the first article, we covered the income statement.

The purpose of the balance sheet. The balance sheets purpose is to provide a detailed listing of the companys assets and liabilities. It is not unlike a personal credit report. If you think about your own financial net worth, you probably have a number of assets such as a home, a vehicle, a stock portfolio, cash in a savings account, and so forth. You also likely have a list of liabilities or debts, such as a mortgage, a car loan, electric or telephone bills that have not yet been paid, etc. This concept is directly analogous to a company, and the balance sheet lists out all of these.

Like the income statement, an investor needs to be aware of the potential accounting assumptions made for the balance sheet. Obviously, some line items are unambiguous. For example, the worth of cash in the bank is a pretty straightforward value. However, the worth of a 5 year old computer, or an undeveloped piece of land, are less concrete. For most of these kinds of items, a company will book their value at whatever was paid for it. While items that depreciate, like computers, are usually de-valued over a period of time, that piece of land will likely appreciate over time, and the current value may not be reflected on the balance sheet. This can make the company more valuable than it appears (some value investors refer to these as asset plays).

For financial companies, a ton of assumptions are made on the balance sheet. The actual value of a loan is very difficult to calculate due to variable interest rates, risk of default, risk of early payment, etc. Take that reality and multiply it by the millions of loans a large bank has outstanding, and you begin to see why investing in banks is such a difficult and risky endeavor. However, since the Magic Formula throws out financial stocks, we wont discuss that in much detail here.

One other thing to be generally aware of is that both assets and liabilities are categorized as either current or long-term. The line items falling into the current category are assets that the company expects to be converted into cash within the next 12 months, or liabilities that are expected to be paid off over the next 12 months. Long-term assets and liabilities have a longer time horizon for being liquidated or covered, respectively.

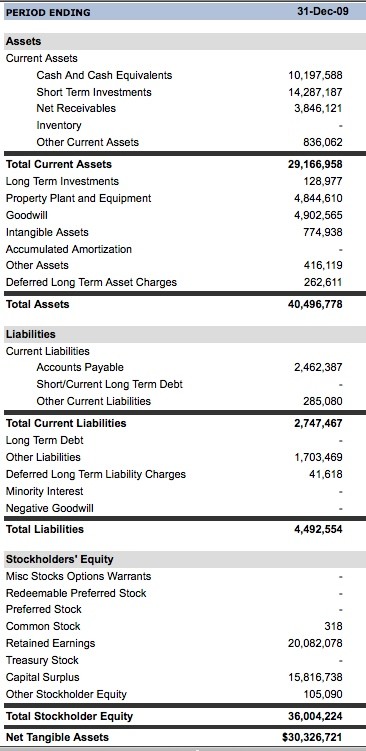

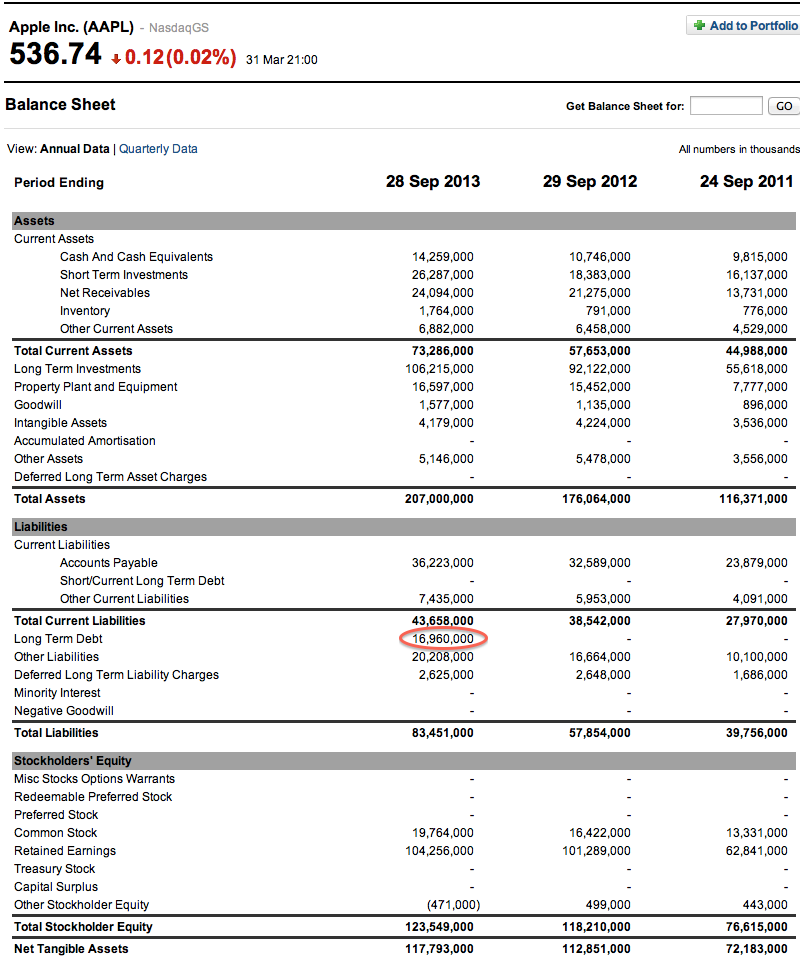

To understand the balance sheet, will continue with our previous example, Intel (INTC). Here is its year end 2007 balance sheet. Again, gray columns are calculated values, and light blue columns are calculated metrics. All values are in millions of dollars, and items in parenthesis represent liabilities. The balance sheet often has line items that are specific to a line of business or a company, so some of these you wont generally see, while others are pretty common.