Understanding Standard Deviation as a Measure of Risk

Post on: 3 Апрель, 2015 No Comment

The Simple Way to Plan, Manage, and Organize Your Money

April 13, 2010

Understanding Standard Deviation as a Measure of Risk

In the investing world, two of the most important concepts are risk and return.  Most people understand the return part, which is the amount of gain or profit produced by an investment, but the risk part is much less clear.  The reason for this is that risk is often quantified by a measurement known as standard deviation — a not so appealing term.  However, understanding this measure will help you a great deal in putting together your investment portfolio.

Standard Deviation Defined

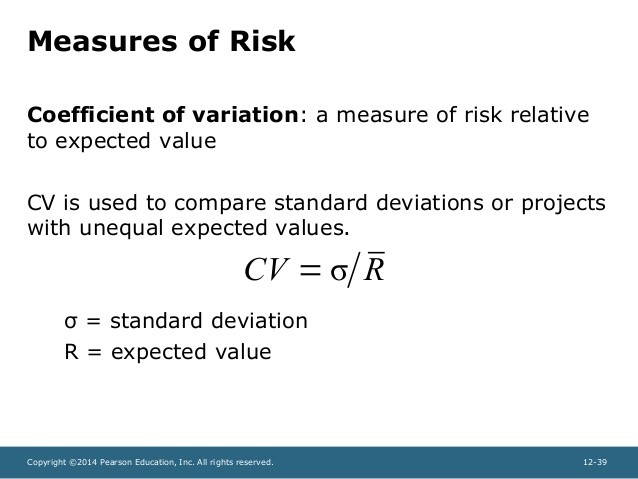

According to Dictionary.com. standard deviation can be defined as a measure of the dispersion of a set of data from its mean.  The more spread apart the data is, the higher the deviation.  Dont you love dictionaries?  To put it in slightly more useful terms, standard deviation measures the volatility of investment returns (a.k.a. risk) relative to the average return.  Still clear as mud?  No worries.  Well explain this in more detail later in an example.

1-2-3 Standard Deviations

While standard deviation measures volatility, there are also varying degrees by which this measure is considered accurate.  For each standard deviation, there is an increasing level of reliability as shown here:

- 1 Standard Deviation = 68.27% reliability

- 2 Standard Deviations = 95.45% reliability

- 3 Standard Deviations = 99.73% reliability

Bringing It Together

At this point, we know that standard deviation is a measure of risk (or volatility) and that the number of standard deviations determines the reliability.  So heres how it works in the investing world.  Lets say you own a mutual fund that has a standard deviation of 21% and an average annual return of 8%.  What this really means is that over the long-term, you can expect the investment to produce around an 8% return, and that in any given year, the one-year return could be anywhere from a gain of 28% (8% + 21% = 28%) to a loss of 13% (8% — 21% = -13%).

Also, since its only one standard deviation, you know that over the next year, there is a 68.27% chance that the one-year return will fall between a loss of 13% and a gain of 28%.  (In case you were wondering, the other 31.73% of the time, the returns are outside of the range)  Just looking at these numbers, this particular mutual fund likely invests in stocks and has a pretty good amount of volatility.

Real Life Application:  Morningstar.com

If you want a better idea of how risky your investments are, you can go to Morningstar.com and punch in your investments symbol.  Follow the steps below to find a funds risk and return characteristics.

Step #2:  Enter the Investments Symbol

Step #4:  Find the 3-year Standard Deviation

Step #5:  Find the 3-year Average Annual Total Return

Step #6:  Determine the Risk of the Investment

In this final step, you can see how risky your particular investment has been by doing the same calculation above.  Here is the formula for finding the expected return range at one standard deviation:

Average Annual Total Return  +/-  Standard Deviation  =  Return Range

In this example with the Fidelity Contrafund, we know that 68.27% of the time, the funds range of returns over the last three years was:

-0.24%  -  19.01%  =  -19.25% Bottom of Range

Final Thoughts

While understanding standard deviation as a measure of risk is helpful, it is by no means the final answer.  The reason weve taken you through this exercise is because when you go about selecting your investments to fill in your asset allocation model, many funds will have similar return numbers without much in the way of a risk assessment.  When faced with several investment options with each having similar returns, it is generally best to pick the one with the lowest amount of risk.  Understanding standard deviation will help you find a better trade-off between risk and return.

NOTE:  Morningstar uses one standard deviation measuring the last three years of data.