Understanding Order Types Part II

Post on: 16 Март, 2015 No Comment

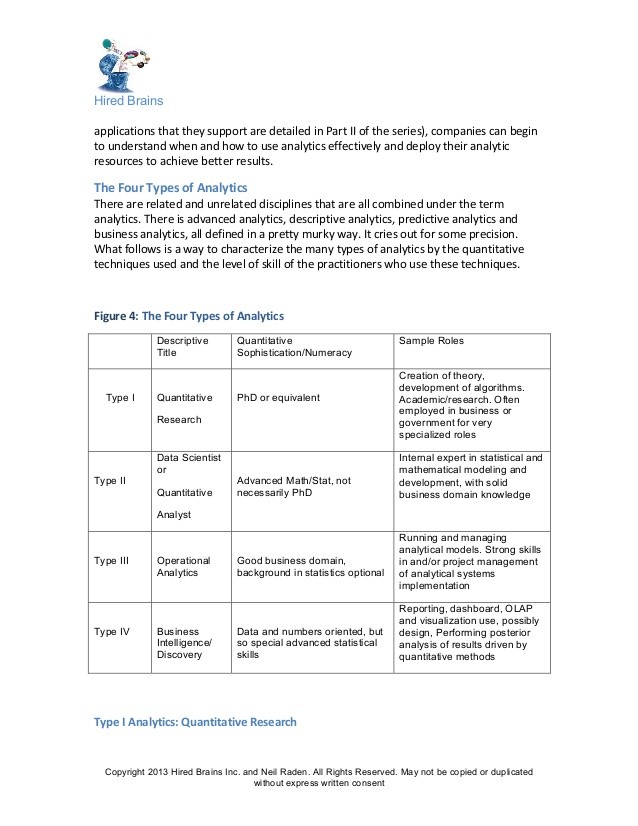

Key Points

- Stop-limit and trailing stop orders are two useful specialty tools for traders. Stop-limit orders combine features of stop and limit orders. Traders have more control over price; however, the trade may not be executed at all if the stop is triggered but the limit can’t be met. Trailing stop orders automatically adjust a sell stop higher, as a stock moves higher, based on points (dollars) or a percentage. It can be helpful for letting profits run or limiting losses.

Which order type will you use to place your next trade? An important—yet overlooked—part of trading is selecting the appropriate order type.

With this mind, we’ve been looking at the main order types and when to use them. In part one of this series, we covered market, limit and stop orders. Now, we’ll examine stop-limit and trailing stop orders.

Before we begin, let’s do a quick review of market, limit and stop orders:

Order types: The big three

A market order is an order to buy or sell a stock at the best available price. Keep in mind that a market order generally guarantees execution but does not guarantee a particular price. Traders should consider using a market order only when their primary concern is getting the trade done as soon as possible.

A limit order is an order to buy or sell a stock at a specified price or better. It generally guarantees a price but doesn’t guarantee execution. A limit order might make sense if:

- You’re buying and want a lower price, because a limit order allows you to specify a price below the current market price.

- You’re selling and want a higher price, because a limit order allows you to specify a price above the current market price.

A stop order is an order to buy or sell once the price of a stock reaches a specified price. It’s often referred to as a stop-loss order. In this context, the stop order to sell is triggered when the specified price is reached and becomes a market order executed on the next trade.

However, a stop order may be used as a buy order as well. In this case, the trader identifies a specific price that will trigger a purchase of the stock, in essence stopping the stock from getting away. This type of order may be useful to a trader who’s identified a point at which he or she believes a stock’s price trend changes from down to up.

Which tool should I use?

As I mentioned before, each order type can be thought of as a different type of tool. Just as a hammer, screwdriver or wrench has a particular function, so do order types. To continue that analogy, think of stop-limit and trailing stop orders as specialty tools which are best used in certain situations.

There are two basic questions that can help you select the best tool to place a trade:

- Am I trying to buy or to sell ?

- What price do I want? (Is it the current price? A higher price? A lower price?)

Sell stop-limit orders and gaps in price: Danger in disguise?

Traders often run into trouble with stop orders due to the second question: What price do I want? I’ve often heard: I don’t use stop orders—they don’t work because my stop was executed at a much lower price. These traders were likely affected by a gap in price. where the stock closed one day at a certain price and then opened the next day significantly lower.

Traders who feel they’ve been burned by stop orders and a gap lower in price may view a stop-limit order as a way to avoid taking a larger loss than anticipated. A stop-limit order combines features of both a stop order and a limit order. The stock is sold only if it drops below a given price and the limit price is still marketable.

Take a look at the chart below. It shows both a sell stop order and limit order for a given stock.

Sell Stop Limit Order

Source: StreetSmart Edge®

In this example, the trader uses a $22.50 sell stop order and combines it with a $22.00 limit order. In other words, sell the stock if it drops below $22.50 but execute the trade at $22.00 or higher. In the example above, the stock didn’t trade between those prices and as a result, the stock is not sold.

This brings us back to our two basic questions that can help us decide which order type to use. When using a sell stop-limit order, traders want to sell the stock if it moves lower, but there’s an added twist—they want to limit the price they’re willing to accept.

When traders first learn about stop-limit orders, some have an ‘ah-ha’ moment and think they’ve found a way to avoid the pain of a gap lower in price. However, this thinking may be danger in disguise.

In the example above, the stock has gapped lower. Traders must recognize this, as well as the fact that they may now have losses. The only question remaining is whether those losses are realized if the stock is actually sold, or unrealized if the stock is held.

Holding onto the stock after the trend in price has changed from up to down may be a costly mistake. I’ve previously explored the dangers of holding onto a losing stock trade. I recommend against using a stop-limit order as a sell order, for it might fail to execute at a very important time (as in the example above). Remember the Wall Street adage, Your first loss may be your best loss!

Buy stop-limit orders and gaps in price: A useful tool

Traders using a trend-following methodology may look to buy a stock with solid fundamentals on a change in trend from down to up, or what’s called a breakout. A buy stop order can catch a breakout yet exposes traders to gap up risk —the possibility that a gap higher may take out much of the potential profit and subject traders to higher risk levels than planned.

In the example below, a given stock gaps higher from about $21.50 to about $23.50. Here’s where a buy stop limit order becomes quite useful. By combining a $22.00 buy stop price with a $22.50 limit, traders avoid automatically buying the stock when it gaps up significantly.

Remember the two basic questions. When using a buy stop limit order, a trader wants to buy the stock if it moves higher yet wants to limit the price they are willing to pay.

The key point is that traders retain the power of choice. By not automatically buying the stock (because it did not trade between $22.00 and $22.50), traders can evaluate whether they still want to buy the stock, given the higher price, or pass on the trade.

Buy Stop Limit Order

Source: StreetSmart Edge

Trailing stop orders

Traders trying to let profits run often find it far easier to say than to actually do. One common reason traders exit trades too early is fear of profits slipping away. It takes discipline to remember that an uptrend is marked by a series of higher lows. These higher lows can only occur following a pullback in price, often referred to as a correction .

A trailing stop order automatically adjusts a sell stop order higher as the stock moves higher. When a stock pulls back, the trailing sell stop remains at the same price and does not pull back with the stock. Trailing stops have also been referred to as chandelier stops, in that they hang from the highest price since entering a trade just as a chandelier hangs from the ceiling. Trailing stops can be based on points (dollars) or a percentage because the stop price is set in reference to the highest price since entering the trade.

One caution with using a trailing stop is to set the hanging distance far enough to sustain a normal correction in a given stock. If a trailing stop is set too tightly, the trade may be stopped out before a probable trend change has occurred.

Trailing Stop Order

Source: StreetSmart Edge

In the example above, we observe a textbook uptrend of higher lows as the stock moves from $110 to a high of $210. During a sustained uptrend as in this example, using a percentage trailing stop may be more advantageous. Even as the number of points of a given pullback increases from 20 to 35 points, the percentage pullback only increases from 15.4% to 16.7%.

Another key point is that when using trailing stop orders, the hanging distance must be enough to absorb a normal pullback. A trailing stop set too tightly—10% in the example above—would have caused the stock to be sold (before the trend changes) in a 5 to 10% pullback, which may be quite normal.

Reviewing our two basic questions, a trailing stop is a sell order below the current price, but with the twist that it is adjusted higher as the stock moves higher and then holds that level when the stock pulls back.

Bottom line

Now traders have two specialty tools: stop-limit and trailing stop orders, which can be useful in certain situations. Combined with the three basic order types reviewed in part one of this series, traders have a variety of tools with which to execute their desire to buy or sell stocks.

To use an analogy, almost every kitchen has a microwave oven. It’s one of many tools in the kitchen and best used in certain circumstances—but just not for cooking the Thanksgiving turkey!

Learn to use the different types of orders and you’ll add to your ability to execute trades. Until next time, good luck and good trading!