Understanding Earnings Yield Financial Web

Post on: 26 Апрель, 2015 No Comment

One of the fundamental metrics for starting fundamental analysis in investing is earnings yield. This figure essentially gives the investor a basic understanding of how wealthy the company is for the investor. Given, the goal of the investor is to profit from his or her investment, when all is said and done the earnings minus any dividend or interest liens is due to the equity investor.

Earnings yield is simply calculated by taking the earnings per share (EPS) for the company and dividing that by the price of the stock for the company, resulting in a percentage much like the dividend yield. Granted, the earnings yield will be a trailing fact or figure, the investor can calculate it a number of different ways to factor in the future expectations.

How to Calculate Earnings Yield ?

Calculating EPS0 /Price is simple but is not the most effective for the sake of measurement. A better calculation is to calculate forward (EPS), we can call it EPS1 and divide that by an average price. In other words, instead of EPS0 /Price; our formula would be EPS1 /Price MA(50). Where, Price MA(50) is the 50 day moving average of the stock price. Keep in mind that one could use a different parameter for the moving average, most likely a 200 day moving average would be most suitable.

Forward Earnings

Now that we have our denominator figured out, how about the numerator which is the forward earnings per share figure. If one has trusty analyst estimates readily available, one could simply plug in the future estimate for earnings per share given by the analyst as EPS1 .

Another way to calculate forward earnings is to add the two recent quarters earnings per share looking back and add in the 2 quarters earning per share looking forward, the estimates given by the trusty analysts. This will even out the skew from the future expectations; and on a comparative basis will make a good figure for comparing other earnings yields in industry groups or other stocks.

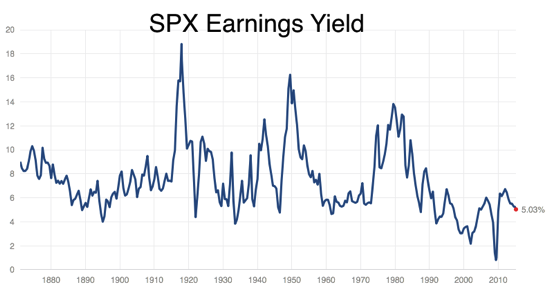

Why is this important to investors? The goal, essentially, is to create a parameter that is comparable. If one is using proprietary analytical software, the earnings yields for the industries covered will most likely be already calculated. Taken into perspective, the earnings yield and its expectations will be a reasonable measure for how profitable and/or well evenly priced a company or an industry is.

Because so-called global metrics like these are widely compared by top analysts, they are vital in understanding where the company or industry is placed in rank or order within the broader scheme of things. For instance, if the aerospace and defense industry is showing a great earnings yield compared to other industries and this is shown to be historically great based on recent history, we can conclude that this industry is a benefactor to an exogenous or non-cyclical trend. Therefore, analysts can conclude that any high stock prices are not overly inflated and there is reason to expect bumper earnings so long as the root of this cause is in effect.

$7 Online Trading. Fast executions. Only at Scottrade