Understanding Dividend yield Earnings yield

Post on: 26 Апрель, 2015 No Comment

Understanding Dividend yield & Earnings yield.

by J Victor on August 8th, 2010

DIVIDEND YIELD.

Hi there,

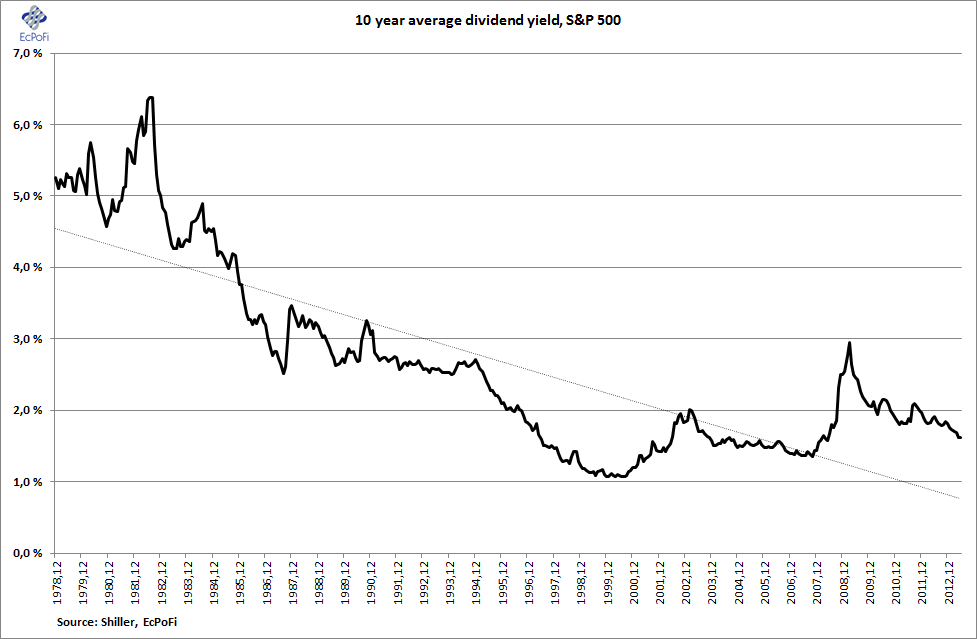

Dividend yield is another ratio that’s connected with dividend payments. The yield ratio is particularly useful for investors who are looking to cash in on the dividends paid by a company.

Dividend yield and dividend pay out ratios are different. If dividend payout ratio was the percentage of profit that was paid out as dividends, dividend yield ratio shows how much divided you received for the money you spend on your investment. Yield is a measure to calculate the percentage of return on an investment. With dividend yield, it becomes easier for you to compare between companies that pay high dividends.

The formula for calculating the Dividend Yield is by taking the annual dividend per share and divide by the stock’s price. So, the equation is-

- Annual dividend per share / the stock’s price.

For example: Two companies- A and B pay an annual dividend of Rs 15 per share. The share price of company A is Rs 100 and the price of company B is 150. Which stock gives better return?

- Company A. because it gives an yield of 15% for every Rs 100 invested in it whereas company B gives an yield of just 10% ( 15/150)

The Dividend Yield Trap

We talked about dividend yield ‘s positive factors. However, Dividend yield can lead you into a trap if you’re not careful.

The trap is the denominator figure. The dividend payout is divided by the share’s price. Since the share price keeps changing, the ratio will keep changing accordingly. So, if there is a sudden fall in a stock’s price, the dividend yield ratio will show a higher figure. That’s one pint to be careful.

EARNINGS YIELD.

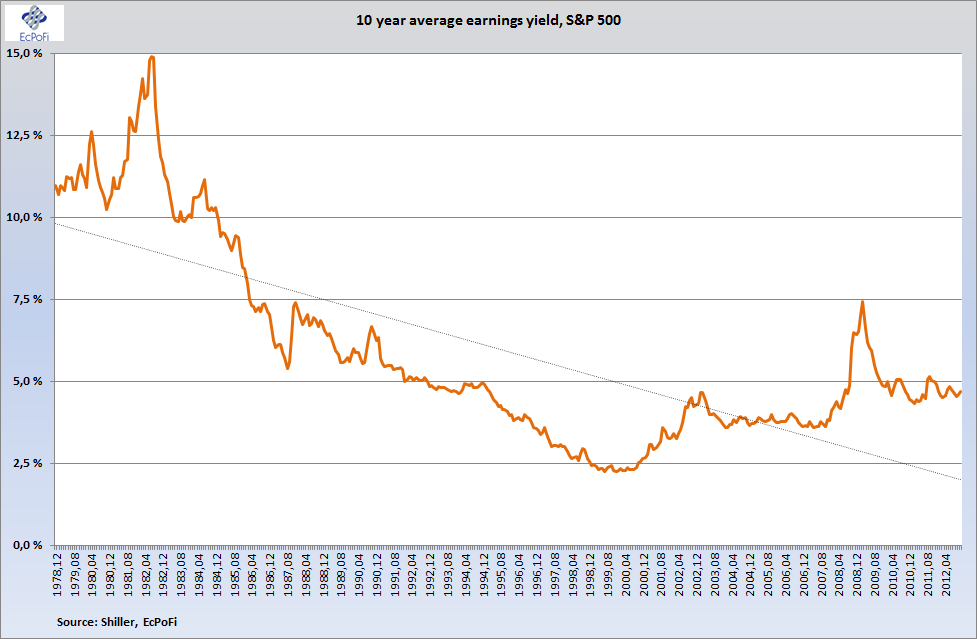

As I said before, yield is a measure to calculate the percentage of return on an investment. Earnings yield is another ratio that’s similar to dividend yield. Earnings yield ratio shows how much earnings you received for the money you spend on your investment.

This ratio becomes useful where the dividend payments are low.

Earnings yield is calculated as follows:

- Earnings per share / market price per share or E/P

That means, earnings yield is the exact opposite of P/E ratio. The convenience of earnings yield is that since it measures the return you received for the money you spend on your investment, it’s makes it easier for you to compare the company’s return against alternative investment options such as bonds or fixed deposits. So, practically it’s more useful than a P/E.

The only problem for E/P is that ‘earnings’ are not properly defined.

Benjamin Graham, the father of value investing, has recommended investors to buy a stock that has a P/E ratio equal or lower than the sum of the earnings yield plus the growth rate. That is. an investor should buy a share only id it’s P/E is less than the earnings yield + growth rate.

- P/E Ratio < Earnings Yield + Growth Rate

For example, let’s say you want to invest in shares of a company that has 7% earnings yield and was growing at 7%. You check he balance sheet and find that the company’s fundamentals are good. Considering the history of the company, quality of the management and order book for the future, you expected the company to accelerate it’s growth from now on. In this case, if you could buy the shares at a price-to-earnings ratio of 14 or less, you would have a reasonable chance for very satisfactory returns (7% earnings yield + 7% growth rate = 14 P/E ratio maximum).

However, it would be very difficult to get such investing opportunities where the P/E equals the earnings yield plus growth rate. It’s a very conservative filter. I am sure that 95% of the stocks you scan would get rejected on this basis alone. (And, that’s why it’s such a safe measure to valuate investments)

Bye for now

. have a nice time.

You may like these posts: